Back to News

Back to News

Weekly recap: the growing tension on the crypto market

While China prevents a global crisis and liquidates the crypto business in the country, the threat of default looms over the United States. Read the Weekly recap to find out more about the main events of the crypto market that happened between 22nd and 29th September 2021.

Crypto market in numbers

Crypto market capitalisation has continued to remain below $2 trillion since 20th September 2021, as reported by CoinMarketCap. Over the last 7 days, the indicator practically did not change and amounted to $1.88 trillion.

The trading volumes on the market have significantly decreased. Daily trading volumes fell 31% over the week and now stands at $90.4 billion, according to CoinMarketCap. The largest volumes of the month up to $245 billion were observed on 7th and 8th September.

The Crypto Fear & Greed Index remains in the “Fear” zone for 9 days in a row. During the last two days, it indicates “Extreme fear” on the market.

Bitcoin dominance has hardly changed in 7 days and is currently at 42.3%. The share of ether on the market is also practically unchanged which is 18.3%.

Bitcoin’s 30-day volatility index renewed its maximum value in the last 2 months at 3.98% on 24th September, according to CryptoCompare. By 29th September, it dropped slightly to 3.84%. Bitcoin itself has been holding above $40,000 for almost two months, since 5th August.

Bitcoin exchange balances have barely changed. Over the past 7 days, they have risen by 0.4%, according to ViewBase. A minimal outflow of 1.3% was seen by ether. At the same time, an inflow of USDT stablecoin to exchanges was 13.5%.

Gainers of the week (23rd – 29th September 2021)

| Coin | Opening price 23.09, $ |

Opening price 29.09, $ |

Change |

| TONCOIN | 0.63 | 0.74 | 17.7% |

| EXM | 0.07 | 0.08 | 15.5% |

| ONE | 0.14 | 0.15 | 11.1% |

| UNI | 21.77 | 23.82 | 9.4% |

| ROOBEE | 0.003999 | 0.004231 | 5.8% |

Losers of the week (23rd – 29th September 2021)

| Coin | Opening price 23.09, $ |

Opening price 29.09, $ |

Change |

| HP | 0.0013 | 0.0008 | -36.5% |

| HB | 0.0040 | 0.0025 | -36.5% |

| VLX | 0.18 | 0.13 | -31.5% |

| QTUM | 11.00 | 8.90 | -19.1% |

| WXT | 0.0062 | 0.0051 | -18.4% |

Easily track gainers and losers within the Simple trade section on EXMO. Check real-time updates in the last 24 hours, week and month.

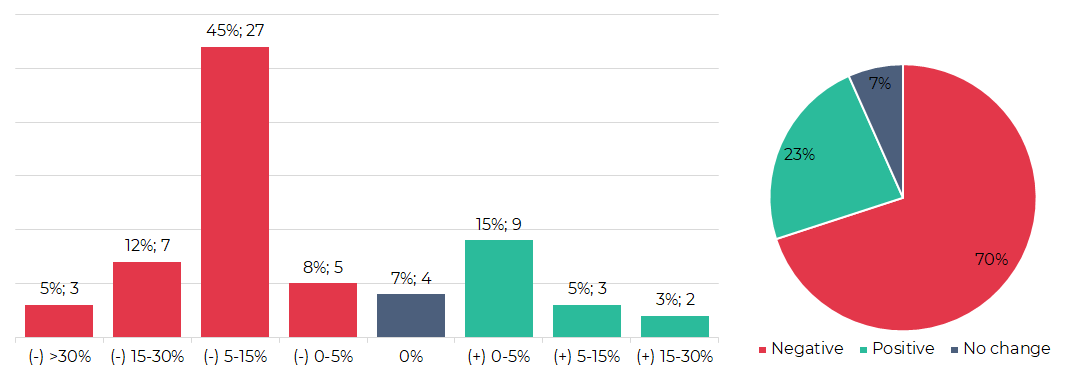

Segmentation of cryptocurrencies based on trading results (23rd – 29th September 2021)

Most traded coins (22nd – 29th September 2021)

| Coin | Trading volumes, $ |

| BTC | 35,022,905 |

| ETH | 33,713,551 |

| XRP | 5,633,728 |

| CRON | 2,354,139 |

| ADA | 2,323,912 |

| EXM | 1,755,074 |

| LTC | 1,257,548 |

| DASH | 1,236,820 |

| WAVES | 963,479 |

| DOGE | 905,159 |

Top crypto market driving factors

The overall crypto market

▲ 22.09.2021 – The Federal Reserve funds target rate range has been left at 0-0.25%. The Fed is expected to shutter its pandemic-era bond-buying program by mid-2022.

▼ 24.09.2021 – Chinese property developer, Evergrande, has missed its bond interest payment deadline. If the company does not fulfill its obligations within a month, it will declare its default.

▼ 24.09.2021 – If Congress does not raise the debt limit, the United States would default on debts for the first time in history.

▼ 24.09.2021 – The Chinese government reportedly declared all crypto transactions illegal. The document was published on 15th September, while the announcement was made on 3rd September.

▲▼ 26.09.2021 – Discussions on the infrastructure bill in the US House of Representatives have resumed.

▼ 27.09.2021 – Republicans of the U.S. Senate have blocked the adoption of the law on raising the government debt limit, in order to provide funding for the work of government agencies from 1st October 2021 – the beginning of the new fiscal year. Already, this Friday, the shutdown (the temporary closure of the government) may begin. The U.S. default is possible from mid-October. Discussions on the bill are ongoing.

▼ 27.09.2021 – Chinese e-commerce giant, Alibaba, will block sales of crypto mining equipment beginning 8th October.

▼ 27.09.2021 – The F2Pool mining pool “will not provide services to China” and may close or block accounts.

▲ 27.09.2021 – Coinshares: Amid declining markets, the digital asset investment products saw inflows totalling $95 million last week – a 126% growth compared to the preceding week. BTC and ETH inflows account for 83% of all inflows. Crypto investment products keep seeing inflows for the sixth consecutive week, bringing the total run of inflows to $320 million.

▼ 29.09.2021 – The jump in yields on long-term U.S. government bonds to June values led to a new round of sales in the stock markets and the strengthening of the dollar.

▲ 29.09.2021 – Reuters: the Chinese authorities have developed a plan to ward off or at least mitigate any social unrest that could occur in case of the country’s largest developer, China Evergrande Group, “messy collapse”. Beijing is prodding government-owned firms and state-backed property developers to purchase some of embattled Evergrande assets, people with knowledge of the matter said.

Bitcoin (BTC)

▲ 22.09.2021 – Kaiko: BTC/USD trading volume now accounts only for 44% of the total volume – a decrease from 77% in September.

▲ 23.09.2021 – Twitter has officially added support for Bitcoin transactions through its Lightning Network scaling solution.

▲ 27.09.2021 – Glassnode:The number of addresses holding 1,000 or more bitcoins has grown considerably over the past days.

▲ 27.09.2021 – Glassnode: Long-term holders now hold an all-time-high of 80.5% of BTC circulating supply.

▼ 27.09.2021 – Glassnode: The number of transactions on the Bitcoin network has been declining since May, and now the network settles around 175-200 thousand transactions per day, which is similar to levels seen during the 2018 bear market.

Ethereum (ETH)

▼ 22.09.2021 – Kaiko: Ethereum gains popularity among crypto exchange users. At the same time, BTC/USD trading volume now accounts only for 44% of the total trading volume – a decrease from 77% in September.

▲ 22.09.2021 – Kaiko: the share of Ether in the total trading volume of first-level cryptocurrencies (ETH, ADA, SOL, LUNA, AVAX and FTM) in pairs with USDT decreased from 86% to 34% over the year.

▲ 23.09.2021 – JPMorgan: investors are more interested in ETH futures than BTC, which demonstrates the growing interest in Ethereum among institutions.

▲ 27.09.2021 – Ethereum developers plan to launch the Alair hardfork on 27th October. Altair is described as the first mainnet upgrade to the Beacon Chain that represents the zero phase of Ethereum 2.0. At the same time, it is assumed that the merge of Ethereum 1.0 and Ethereum 2.0 could be delayed.

▼ 27.09.2021 – The second-largest Ethereum mining pool, SparkPool, announced that it will suspend all operations in China and abroad.

▼ 28.09.2021 – BeePool, the fourth largest Ethereum mining pool, will shut down operations on 15th October, in response to the latest regulatory policies.

▼ 27.09.2021 – Ethereum developer, Virgil Griffith, has pleaded guilty to conspiracy charge in the North Korea sanctions case.

▲ 27.09.2021 – Santiment: ETH’s exchange supply ratio has dropped from 24% to 16% within the last 12 months, which is an almost three-year low.

Cardano (ADA)

▲ 22.09.2021 – Kaiko: the share of Ether in the total trading volume of first-level cryptocurrencies (ETH, ADA, SOL, LUNA, AVAX and FTM) in pairs with USDT, decreased from 86% to 34% over the year.

▲ 25.09.2021 – Cardano is set to integrate Chainlink’s oracles to add additional support for developers building smart contracts.

▲26.09.2021 – COTI to issue “Djed,” the first algorithmic stablecoin on Cardano.

▲27.09.2021 – Emurgo, the official commercial and venture arm of the Cardano project, launched a $100 million investment fund to power the development of DeFi and NFT projects on Cardano.

XRP (XRP)

▲ 23.09.2021 – The Central Bank of Bhutan will test their digital currency through a partnership with Ripple.

▼ 24.09.2021 – The U.S. SEC has obtained an extension on the deadline for petitioning in the Ripple case. The regulator may file its motion to seal no later than 24th September.

Dogecoin (DOGE)

▼ 23.09.2021 – BitInfoCharts: Dogecoin transactions have dropped to lowest levels since 2017.

Uniswap (UNI)

▲ 26.09.2021 – Amid China’s crypto ban, the prices of DEX tokens, including UNI, have grown considerably. At the same time, the Uniswap on-chain data has not kept up with the price increase.

Chainlink (LINK)

▲ 28.09.2021 – Santiment: Chainlink whales with 1 million to 10 million LINK accumulated 62 million coins worth $1.45 billion last week. This accounts for 3.4% of the total LINK supply.

Stellar (XLM)

▲ 28.09.2021 – Anclap has created a stablecoin pegged to the Peruvian currency on the Stellar blockchain.

Crypto market trends

Tightening of cryptocurrency crackdown in China

📊 China’s central bank reportedly declared all financial transactions involving cryptocurrencies, crypto services and derivatives illegal. All businesses providing services for the circulation of cryptocurrencies in China are banned. The published document classifies mining as a “liquidated industry” and bans investment in the sector.

📊 A number of cryptocurrency exchanges announced that they will stop offering their services to Chinese mainland users. The CEO and founder of BTCC, the oldest and second largest Chinese Bitcoin mining company, Bobby Lee says China’s OTC desks that operate from big exchanges are next to close down.

📊 Crypto market data sites, CoinGecko and CoinMarketCap, have now become inaccessible for users based in mainland China, according to the Block.

📊 Key developed Chinese provinces face an acute shortage of electricity, which results in the shutdown of large power-consuming companies.

This situation has also provoked a forced mining farm shutdown in the country. Authorities in China’s Inner Mongolia province have seized 10,100 crypto mining rigs from a government-operated tech park and closed 45 mining projects.

📊 Chinese e-commerce giant Alibaba will block sales of crypto mining equipment beginning 8th October. Bitmain, one of the world’s largest manufacturers of bitcoin mining machines, is planning to suspend sales of its machines to miners based in mainland China.

📊 Largest Ethereum mining pools, SparkPool and BeePool, suspend all operations. F2Pool shuts down services in China.

Regulation

📊 Commissioner at the U.S. Commodity Futures Trading Commission (CFTC) Dan Berkovitz said that the agency has the “capability and the expertise” to further regulate crypto assets but is currently unable to do so due to a “resource issue.”

📊 Dan Berkowitz will reportedly be the chief legal adviser to the U.S. SEC from 1st November.

📊 The U.S. House of Representatives has included a crypto provision in this year’s version of the annual defense budget bill. According to the bill, the SEC and the CFTC should clearly define which agency has oversight of which aspects of the crypto market.

📊 The Kentucky Department of Financial Institutions has barred crypto lender, Celsius Network, from providing its services in the state, arguing that Celsius has been selling unregistered securities.

📊 The Central Bank of Russia has listed another 105 companies that show “signs of illegal activities in the financial market.” Several crypto companies have been added to the list.

📊 Igor Krasnov, Prosecutor General of the Russian Federation, called on strengthening international coordination in the fight against illegal virtual asset usage.

📊 Ukraine has prepared draft amendments to the tax code. This is intended to regulate the taxation of transactions related to cryptocurrencies. The authorities plan to introduce a five-year period, during which individuals will only pay 6.5% tax on profit received from the sale of virtual assets.

Acceptance of cryptocurrencies

📊 Twitter has added support for Bitcoin transactions through its Lightning Network scaling solution.

📊 Amid Twitter’s Bitcoin tipping and El Salvador’s Bitcoin adoption, analysts at Glassnode report a considerable growth of the Lightning network metrics. Total BTC capacity in LN channels has grown by 170% to reach 2,904 BTC (~$127M). 514 of these coins (22%) were added to LN channels in September alone.

📊 El Salvador’s president, Nayib Bukele, has said that 2.1 million or 33% people in the country are actively using the bitcoin wallet, Chivo. He noted that the wallet now has more users than any single bank in El Salvador.

📊 According to research conducted by the Sherlock Communications agency, 54% of Salvadorans are not familiar with Bitcoin, while 40% of respondents have heard something about bitcoin.

📊 The UAE’s financial regulator has approved a regulatory framework for trading crypto assets in one of Dubai’s free trading zones.

📊 Verifone has joined forces with BitPay to introduce digital asset payment options to its clients in the USA.

📊 Miami’s mayor, Francis Suarez, announced that Miami residents could soon be able to pay their taxes with BTC. Miami is also working on allowing municipal workers to be paid in bitcoin.

CBDC and stablecoins

📊 The Bank for International Settlements (BIS) has published a report stating that blockchain-based CBDCs can reduce the transaction throughput of cross-border payments from 3-5 business days to only a few seconds.

📊 The National Bank of Ukraine plans to pilot e-hryvnia salary payments for government workers as early as this year.

📊 Fed Chairman, Jerome Powell, is preparing an update of the Fed’s work on central bank digital currency (CBDC).

📊 Federal Reserve chairman, Jerome Powell, called on Congress to work with the U.S. central bank on creating a digital dollar and developing an appropriate regulatory framework for it.

📊 Anclap aims to create a digital ecosystem for Latin America based on Stellar stablecoins pegged to local currencies. Therefore, last year, the company launched a stablecoin pegged to the Argentine peso and now plans to launch a new stablecoin in Peru by the end of September 2021. It is also working on digital Colombian and Chilean pesos that are expected to launch in October and November 2021, respectively.

Big business

📊 Invesco, the investment giant with over $1.3 trillion in assets under management, plans to launch a series of crypto ETFs in the USA.

📊 JPMorgan, Deutsche Bank and other financial institutions oppose strict Basel rules for banks holding bitcoin. They believe that new rules requiring them to set aside a dollar in capital for every dollar of bitcoin they own, will keep them away from participating in the sector.

📊 Anthony Scaramucci, CEO of Skybridge Capital, says that most institutions are still not interested in cryptocurrency as an investment. At the same time, he predicted that one of the big banks, frustrated by the growing footprint of decentralised finance, will “end up buying something crypto-related to make that transformation” more quickly.

📊 Major U.S. investment bank, Morgan Stanley, has more than doubled its shares of Grayscale Bitcoin Trust since April. By the end of July, the company owned 58,116 Grayscale shares worth $2.018 million by the end of July.

Mining

📊 Econometrics analysts point out that bitcoin ROI is much lower than the ROI for stocks of mining companies. As a result, shares of Marathon Digital Holdings plunged by more than 2000% over the year, Riot Blockchain – by 1000%, and Bitcoin – only 300%. Researchers believe that American investors are investing in mining companies because they do not have access to physical BTC through a Bitcoin ETF.

📊 On the eve of the listing of shares of the British mining company, Argo Blockchain, on NASDAQ, the value of its shares on the London Stock Exchange fell by 25%.

📊 El Salvador President, Nayib Bukele, shared on Twitter a video footage of the preparation process for bitcoin mining using volcanic energy.

EXMO news

The quarterly burn of EXMO Coin – the most profitable exchange token according to Cryptorank – will take place on 1st October.

Buy Cardano and get a unique achievement, ADA party animal, to celebrate the cryptocurrency’s fourth anniversary.

That’s all for this week! Follow EXMO on YouTube, Twitter and Telegram to stay tuned to the main events and trends in the crypto market.