Back to News

Back to News

Weekly recap: investors awaiting for crypto winter

Ethereum is losing ground to Solana in the NFT market. Fidelity Digital Assets analysts predict bitcoin bull run amid expected massive adoption of BTC by countries, while UBS Investment Bank is getting ready for a “crypto winter” due to the interest rate increase by the Fed. Read the Weekly recap to find out more about the main events of the crypto market that happened between 12th and 19th January 2022.

Crypto market in numbers

The crypto market cap remained above the $2 trillion mark for most of the week, according to CoinMarketCap. Since 18th January, the indicator began to decline. Over the week, it fell by 1.9% to $1.9 trillion as of Wednesday morning. The average market cap value for the previous 30 days stands at $2.2 trillion.

Trading activity remains relatively low. Over the past seven days, average daily trading volumes stood at $81 billion, 21.4% down from the previous week.

The Crypto Fear & Greed Index has remained in the “Extreme Fear” zone for more than two weeks since 4th January. On 19th January, its value was 24 points. Considering the index values, the market sentiment is almost the same as it was in June last year, but then the index rose above 25 points more often.

By the end of the week, bitcoin’s dominance levels barely changed and on 19th January stood at 40.25%. However, during the past seven days, the indicator was predominantly below 40%, having dropped to 39.24% on 16th January, according to CoinMarketCap.

Ether’s market share decreased from 19.2% to 18.76% during the same time. Some part of the market was taken over by Cardano, with its dominance increasing from 2.01% to 2.37%. On 18th January, when the biggest increase in the ADA price was recorded, Cardano’s dominance rose to 2.69%.

The 30-day bitcoin volatility index has maintained a downward trend since mid-December. Since 16th January, its value has stood at 2.45%, according to CryptoCompare. Over the past week, the indicator fell by 0.33%.

Gainers of the week (13th – 19th January 2022)

| Coin | Opening price 13.01, $ |

Opening price 19.01, $ |

Change |

| WXT | 0.0036 | 0.0043 | 20.7% |

| DCR | 60.18 | 68.22 | 13.4% |

| ADA | 1.33 | 1.48 | 11.7% |

| ETC | 31.58 | 33.29 | 5.4% |

| GAS | 5.25 | 5.50 | 4.8% |

Losers of the week (13th – 19th January 2022)

| Coin | Opening price 13.01, $ |

Opening price 19.01, $ |

Change |

| BTT | 0.0027 | 0.0017 | -35.5% |

| HAI | 0.12 | 0.10 | -16.3% |

| VLX | 0.38 | 0.32 | -15.3% |

| ROOBEE | 0.0040 | 0.0034 | -14.1% |

| CRON | 1.41 | 1.24 | -11.7% |

Easily track gainers and losers within the Simple trade section on EXMO. Check real-time updates in the last 24 hours, week and month.

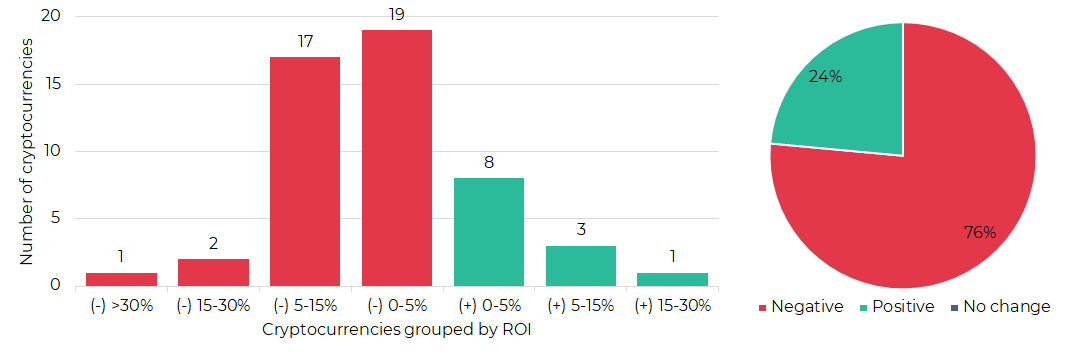

Segmentation of cryptocurrencies based on trading results (13th – 19th January 2022)

Most traded coins (12th – 18th January 2022)

| Coin | Trading volumes, $ |

| BTC | 23,425,230 |

| ETH | 16,997,961 |

| TONCOIN | 3,672,028 |

| XRP | 3,177,528 |

| IQN | 2,611,207 |

| ROOBEE | 2,152,337 |

| DOGE | 1,771,848 |

| LTC | 1,696,379 |

| ADA | 1,559,328 |

| GMT | 1,205,082 |

Top crypto market driving factors

Overall crypto market

▲ 12.01.2022 – The U.S. Department of Labour: the consumer price index rose by 7% in December 2021 from a year earlier. Inflation plowed ahead at its fastest 12-month pace in nearly 40 years. The Fed plans to start raising rates in March to combat inflation.

▼ 12.01.2022 – The U.S. Congress will hold a hearing on the energy use and environmental impact of bitcoin mining on 20th January 2022.

▲ 12.01.2022 – The Wall Street Journal: while the Turkish lira unraveled against the dollar in the last quarter of 2021, cryptocurrency trading volumes using the lira rose to an average of $1.8 billion a day across three exchanges. Such volumes are more than any of the preceding five quarters.

▲ 13.01.2022 – Visa survey: 24% of small businesses are ready to accept payments in cryptocurrencies.

▼ 14.01.2022 – Bloomberg: the IRS believes that NFT investors owe billions in taxes.

▼ 16.01.2022 – Pakistan’s authorities plan to block websites dealing with cryptocurrencies.

▼ 17.01.2022 – The Monetary Authority of Singapore has advised local crypto companies to avoid advertising their services to the public to minimise the risk of speculation.

▼ 17.01.2022 – Spain’s National Securities Market Commission has imposed restrictions on crypto promotions.

▼ 17.01.2022 – The Australian Securities and Investments Commission (ASIC) has urged citizens to refrain from investing their pension savings into crypto assets.

▼ 17.01.2022 – UBS Investment Bank: crypto market slump could be the start of a “crypto winter”. Negative factors that can result in a “crypto winter” include interest rate increase by the Fed, regulation tightening and technological flaws.

▼ 17.01.2022 – CoinShares: digital asset investment products saw the fifth consecutive week of outflows, with this run totaling $532 million. A record of $73 million outflows was recorded over the past week. Multi-asset products saw the largest inflows of $6 million.

Bitcoin (BTC)

▲ 12.01.2022 – Former Twitter CEO, Jack Dorsey, recently announced that he is working on setting up a legal defense fund exclusively protecting Bitcoin developers.

▲ ▼ 12.01.2022 – skew: bitcoin 90-day realised volatility hit a one-year low.

▲ 13.01.2022 – Fidelity Digital Assets: bitcoin bull run is likely to continue. Miners are making long-term investments. In 2022, countries will start to adopt BTC on a massive scale.

▲ 13.01.2022 – Mayor of Rio de Janeiro, Eduardo Paez, announced that the prefecture intends to invest 1% of the city’s reserves in digital assets. Initially, the data provider specified that the prefecture would invest in bitcoin but then changed the wording to a more general one.

▼ 13.01.2022 – Santiment: the topics of inflation and the Fed’s impact on the market are increasingly discussed in social media as bitcoin keeps falling. Analysts believe that something being actively discussed indicates that something significant can happen with the market, oftentimes in the opposite direction to the crowd expectations.

▲ 13.01.2022 – Strategist at Bloomberg Intelligence, Mike McGlone: amid fast bitcoin growth, the raw material market has a low potential of generating superior returns for its investors. The expert also notes that bitcoin is becoming more stable than copper.

▲ 14.01.2022 – Glassnode: on 14th December 2021, bitcoin’s hashrate reached a new ATH of 215 Eh/s.

▼ 16.01.2022 – The Bitpay crypto processing service: in 2021, Bitcoin’s use at merchants that use BitPay dropped to about 65% of processed payments, down from 92% in 2020. Among the possible reasons were the increase in bitcoin’s price, as well as the desire of companies to store BTC for the long term.

▲ 16.01.2022 – Glassnode: the percentage of BTC transfer volume in profit is less than 40% now. Such low levels were earlier recorded in March 2020 and July 2021. This historically occurs in market downtrends and especially capitulation events.

▼ 17.01.2022 – CoinShares: bitcoin saw outflows totaling $55 million over the past week. Total AUM in Bitcoin reached a three-month low of $35 billion mid-week.

▼ 18.01.2022 – The Invesco investment company: bitcoin’s price can fall below $30,000. The drop from highs to as low as $42,000 in early January is exactly in line with the bubble pattern.

Ethereum (ETH)

▼ 12.01.2022 – Bank of America analyst, Alkesh Shah: scalability, low transaction fees and ease of use make Solana a worthy competitor to Ethereum.

▲ 15.01.2022 – The total amount of ether (ETH) burned since the EIP-1559 launch exceeded 1.5 million tokens.

▲ 16.01.2022 –The Bitpay crypto processing service: ether purchases accounted for 15% of the total crypto payments.

▼ 17.01.2022 – CoinShares: over the past week, ether saw outflows of $30 million, entering its 6th week of outflows totaling $230 million.

▼ 18.01.2022 – JPMorgan: Ethereum is losing ground to rivals in the NFT market due to high gas fees. Solana is one of the main competitors of Ethereum, analysts say.

Cardano (ADA)

▲ 14.01.2022 – Between 13th December 2021 and 13th January 2022, the number of smart contracts based on the Cardano-based smart contracts platform grew by 8% to 969.

▲ 14.01.2022 – Cardano development company IOHK has unveiled its scaling plans for 2022.

▲ 15.01.2022 – Pavia.io announced that it has become the first metaverse project to launch on the Cardano blockchain.

▲ 16.01.2022 – Developers announced that the launch of SundaeSwap, a Cardano-based decentralized exchange (DEX), is scheduled for 20th January 2022.

▲ 17.01.2022 – Emurgo and the Cardano Foundation launch a project where they will combine efforts to foster the development of a tool stack that supports the Cardano ecosystem and accelerates dApps creation.

Solana (SOL)

▲ 12.01.2022 – Bank of America analyst Alkesh Shah: scalability, low transaction fees and ease of use make Solana a worthy competitor to Ethereum. Solana “could become the Visa of the digital asset ecosystem,” the analyst highlights.

▲ 17.01.2022 – CoinShares: amid the general outflows recorded last week, Solana remained an investor favourite with inflows of $5.4 million.

▲ 15.01.2022 – Former professional boxer, Mike Tyson, asked his Twitter followers how high solana would rise.

▼ 18.01.2022 – JPMorgan: Ethereum is losing ground to rivals in the NFT market due to high gas fees. Solana is one of the main competitors of Ethereum, analysts say.

XRP (XRP)

▲ 13.01.2022 – The court ordered the U.S. SEC to give Ripple internal documents requested by the latter as a part of a legal battle.

Dogecoin (DOGE)

▲ 12.01.2022 – Twitter users drew attention to the fact that Tesla was testing payments in DOGE a few days earlier.

▲ 14.01.2022 – Elon Musk announced the start of sales of Tesla merchandise for Dogecoin. Some products on the website of the manufacturer of electric cars can only be purchased for DOGE.

▲ 16.01.2022 – Dogecoin Foundation announced that the AMA session is scheduled for 23rd January 2022.

Litecoin (LTC)

▲ 12.01.2022 – Santiment: wallets, holding from 10,000 to 1 million LTC, keep accumulating litecoin for the 15th consecutive week, increasing their holdings by 10%, which is 5% of the total coin circulating supply. This is the longest accumulative period in a four-year period.

Algorand (ALGO)

▲ 16.01.2022 – SkyBridge Capital founder, Anthony Scaramucci, predicted that Algorand will be a huge success comparable to Google.

TON (TONCOIN)

▲ 13.01.2022 – Rapper and video blogger, Morgenstern, supported the developers of The Open Network (TON) and bought Toncoin for 10 million rubles.

▲ 14.01.2022 – Morgenstern has released a video that mentions the TON project.

Velas (VLX)

▲ 13.01.2022 – Singapore-based SpaceChain announced the successful launch mission of its blockchain-enabled payload, integrated with the space node created for Velas Network AG.

EXMO news

We struck a partnership with Gambit Esports, one of the world’s leading esports organisations. EXMO has become a general partner of Gambit Esports CS:GO, Dota 2 and Apex Legends rosters, as well as AS Monaco Gambit Dota 2 & Fortnite rosters.

Solana (SOL) has been listed on EXMO. SOL is now available for deposits and trading in pairs with BTC and USDT.

EXMO Coin (EXM) quarterly burn has been completed. On 4th January 2022, we burned 599,300 EXM. Following this, the total supply of EXMO Coins decreased to 221.4 million tokens.

EXMO supports December’s report by CryptoCompare. The Exchange Review of December 2021 sheds light on market performance over the past month and outlines key development vectors.

That’s all for this week! Follow EXMO on YouTube, Twitter and Telegram to stay tuned to the main events and trends in the crypto market.