Back to News

Back to News

Weekly recap: hope for a crypto market bounce

The Central Bank plans to ban crypto transactions in Russia, the U.S. is preparing a strategy to regulate digital assets, Google is going to issue cards for storing cryptocurrencies, and one EU country is considering the use of crypto payments. Read the Weekly recap to find out more about the main events of the crypto market that happened between 19th and 26th January 2022.

Crypto market in numbers

The capitalisation of the crypto market could not stay at the level of $2 trillion over the week and since 21st January, it has fallen below this mark, reaching $1.5 trillion on 24th January – the minimum value for the last six months. Over the past seven days, the indicator has decreased by 13.3% to $1.7 trillion, according to CoinMarketCap. The median value for the previous 30 days is $2.05 trillion.

Trading volumes between 19th and 25th January were about $662 billion, up 17% from the previous week. Trading activity was particularly observed to increase on 22nd and 24th January. According to CoinMarketCap, trading volumes amounted to $148 billion and $132 billion, which is higher than the average daily value over the past 30 days by 62% and 45%, respectively. At the same time, trading volumes fell to $53 billion and $51 billion on 20th and 25th January, respectively, or 42% and 79% below the daily average ($91 billion).

The Crypto Fear & Greed Index continues to be in the “Extreme Fear” zone. The median value of the index for the week was 13 points. Such consistently low values of the indicator were not observed even last summer, during the period of drawdown in the market. However, amid a slight recovery in the market on 25th January, the index rose to 23 points, approaching to leave the “Extreme Fear” zone.

Bitcoin’s market share rose by nearly 2% to 42.18% over the week. This level of dominance of the first cryptocurrency has not been observed since the end of November 2021. At the same time, the positions of many altcoins declined. The share of ether fell from 18.74% to 17.52%, cardano – from 2.38% to 2.09%, solana – from 2.16% to 1.79%.

The 30-day bitcoin volatility index hit 2.32% on 20th January, the lowest level since November 2020. But amid a sharp drop in the BTC rate below $34,000 and the subsequent recovery to almost $38,000, bitcoin’s price rose to 2.99% by 26th January, returning to the level seen at the beginning of the year. Overall, volatility remains low compared to the first half of 2021.

Gainers of the week (20th – 26th January 2022)

| Coin | Opening price 20.01, $ | Opening price 26.01, $ | Change |

| IQN | 2.68 | 3.15 | 17.8% |

Losers of the week (20th – 26th January 2022)

| Coin | Opening price 20.01, $ | Opening price 26.01, $ | Change |

| WAVES | 13.37 | 8.62 | -35.5% |

| SOL | 143.56 | 98.55 | -31.4% |

| UNI | 15.58 | 10.92 | -29.9% |

| CHZ | 0.25 | 0.18 | -29.6% |

| LINK | 22.53 | 15.97 | -29.1% |

Easily track gainers and losers within the Simple trade section on EXMO. Check real-time updates in the last 24 hours, week and month.

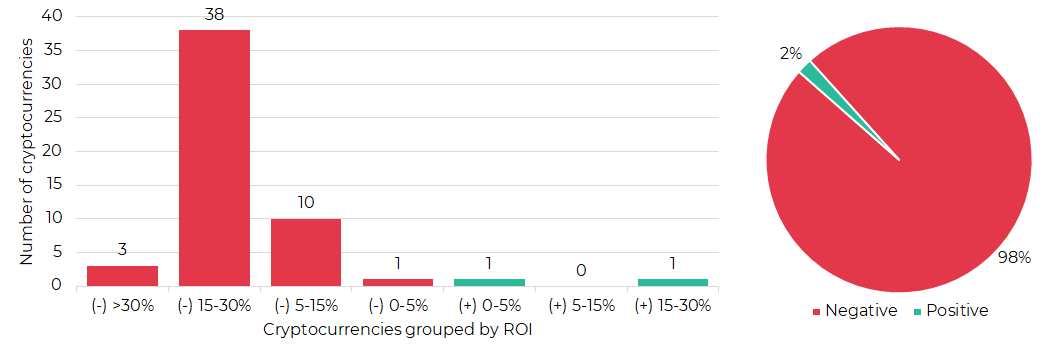

Segmentation of cryptocurrencies based on trading results (20th – 26th January 2022)

Most traded coins (19th – 25th January 2022)

| Coin | Trading volumes, $ |

| BTC | 41,511,841 |

| ETH | 33,688,515 |

| XRP | 6,256,782 |

| TONCOIN | 2,949,687 |

| ADA | 2,331,047 |

| IQN | 2,217,669 |

| LTC | 2,035,604 |

| ROOBEE | 1,590,230 |

| DASH | 1,502,577 |

| DOGE | 1,069,543 |

Top crypto market driving factors

Overall crypto market

▼ 19.01.2022 – Kommersant: at the end of 2021, for the first time, the Central Bank of the Russian Federation sent requests to banks regarding cooperation with crypto exchangers in terms of P2P payments.

▼ 19.01.2022 – EU financial regulator called for a ban on Proof-of-Work bitcoin mining to save renewable energy.

▲ 19.01.2022 – Google is set to allow its customers to store cryptocurrency assets on their digital cards. According to Bloomberg journalists, the company plans to fully immerse itself in the crypto industry, which includes the development and launch of the blockchain, Google token, NFT marketplaces and the metaverse.

▼ 19.01.2022 – Chairman of the U.S. SEC Gary Gensler: the SEC will turn more attention to crypto exchanges this year.

▼ 20.01.2022 – UK financial watchdog (FCA) proposes to strengthen rules for crypto adverts.

▼ 20.01.2022 – Bloomberg: FSB and the Central Bank of the Russian Federation agreed on a complete ban on cryptocurrencies.

▼ 20.01.2022 – Russia’s central bank proposed banning the use and mining of cryptocurrencies on the territory of the Russian Federation.

▲ 20.01.2022 – Representative of the Bank of Russia Elizaveta Danilova: the regulator does not plan to offer a ban on holding cryptocurrencies by citizens.

▼ 20.01.2022 – Indonesia’s oldest religious organisation has banned Muslims from owning cryptocurrencies.

▼ 20.01.2022 – US Congress held an oversight hearing on crypto mining. Congressmen expressed concerns about the fact that old coal-fired power plants in New York and Pennsylvania started focusing on crypto mining.

▲ 20.01.2022 – Venture capital firm Andreessen Horowitz is seeking $4.5 billion of funds to invest in two new projects in the crypto industry.

▼ 21.01.2022 – CEO of the U.S. Financial Industry Regulatory Authority (FINRA), Robert Cook: the regulator will consider the potential tightening of rules for cryptocurrency sales.

▼ 21.01.2022 – Bloomberg: the Biden administration is preparing to release an initial government-wide strategy for digital assets in February.

▲ 22.01.2022 – Head of the State Duma Committee on the financial market, Anatoly Aksakov: a bill to regulate cryptocurrencies in Russia will appear no earlier than autumn this year.

▲ 22.01.2022 – The Bulgarian government is exploring options to deploy a crypto payment mechanism.

▲ 24.01.2022 – ETF provider iShares, part of investment firm BlackRock, has filed an application with the US Securities and Exchange Commission (SEC) to launch an ETF, which will include companies related to mining, its infrastructure and the trading of digital assets.

▼ 24.01.2022 – Business Insider: a crypto “ice age” might be coming as the Fed abruptly tightens monetary policy and the arguments in favor of bitcoin as a currency and an inflationary hedge keep weakening.

▼ 24.01.2022 – Myanmar’s military government is planning to outlaw the use of virtual private networks (VPN) under a proposed new cybersecurity law.

▲ 24.01.2022 – CoinShares: between 15th to 21st January, digital asset investment products saw inflows totaling $14.4 million, for the first time since a five week run of outflows. The inflows came later in the week during a period of significant price weakness, analysts noted.

▼ 24.01.2022 – CoinShares: total assets under management (AuM) dropped to $51 billion, the lowest level since early August 2021. From a record $86 billion recorded in November, the indicator fell by 41%.

▲ 24.01.2022 – CoinShares: investors continue to add multi-asset investment products to positions, with inflows totaling $8 million between 15th to 21st January.

▲ 24.01.2022 –Rothschild Investment Corp has increased its exposure to Bitcoin since the beginning of 2022.

▲ 25.01.2022 – Santiment: On 24th January, the largest surge in “buy the dip” sentiment over the past month was recorded among investors.

▲ 25.01.2022 – Ministry of Finance of the Russian Federation: the cryptocurrency market needs to be regulated, not banned because this is the only way to ensure its transparency and protect Russian investors.

▲ 25.01.2022 – Anatoly Aksakov, head of the State Duma Committee on the Financial Market, proposed test legalisation of bitcoin.

▼ 25.01.2022 – Indonesia’s Financial Services Authority (OJK) has banned financial service providers from trading cryptocurrencies.

Bitcoin (BTC)

▼ 19.01.2022 – Arcane Research: bitcoin’s correlation with the S&P 500 has reached a record since April 2020.

▲ 19.01.2022 – Santiment: bitcoin’s ratio of coins on exchanges has fallen to its lowest since November 2018. Traders moving BTC to cold wallets continues, and this milestone points to less risk of continued major selloffs.

▲ 19.01.2022 – Glassnode: the total coin volume older than one year has been on a remarkable ascent since October, increasing by 5.8% to 58.9%. These coins reflect those last moved on-chain between October 2020 and January 2021 during the early and more exciting phase of the bull cycle.

▲ 20.01.2022 – Bloomberg’s strategist Mike McGlone: bitcoin’s transition to digital gold will propel it to a new all-time of $100,000 in 2022.

▲ 20.01.2022 – El Salvador is exploring the possibility of providing loans to small and micro businesses secured by bitcoin.

▼ 20.01.2022 – According to comment letters released by the U.S. SEC on 3rd December 2021, the regulator rejected MicroStrategy’s bitcoin accounting strategy.

▼ 21.01.2022 – MicroStrategy shares fell 18% amid the SEC claims.

▲ 21.01.2022 – El Salvador President Nayib Bukele: the government purchased an additional 410 BTC for $15 million at an average price of $36,585.

▲ 21.01.2022 – BitInfoCharts: bitcoin mining difficulty has grown by 9.3%, reaching a new record of 217 ECH/s as a result of another recalculation – the largest increase since August last year.

▲ 21.01.2022 – Bloomberg: bitcoin’s correction is coming to an end as the Relative Strength Index (RSI) drops to its lowest (less than 40) – a level at which trend reversal usually occurs.

▲ 21.01.2022 – CryptoQuant: the amount of BTC owned by holders for 12-18 months is at its two-year high now.

▲ 24.01.2022 – CoinShares: bitcoin saw inflows totaling $14 million last week. Over the past five weeks, it suffered outflows of $317 million, which represents 1% of AuM.

▲ 25.01.2022 – MicroStrategy CFO, Phong Le: “Our strategy with bitcoin has been to buy and hold, so to the extent we have excess cash flows or we find other ways to raise money, we continue to put it into bitcoin”.

▲ 25.01.2022 – Wealth-focused investment firm, Kingfisher Capital, acquired 93,463 shares of Bitcoin Trust (GBTC) from Grayscale Investments during the fourth quarter.

Ethereum (ETH)

▲▼ 24.01.2022 – Santiment: Ethereum’s top 10 non-exchange whale addresses have pushed to an all-time high of 26.22 million ETH held, as weak hands are releasing their coins on this dip. Meanwhile, the top 10 ETH exchange addresses have slumped to 3.52 million ETH, the lowest amount since August 2015.

▼ 24.01.2022 – CoinShares: Ethereum saw outflows totaling $16 million last week. The current seven-week run of outflows now totals $245 million, or 2% of AuM.

Cardano (ADA)

▲ 20.01.2022 – Cardano mainnet launched the decentralised SundaeSwap exchange, which was publicly supported by IOHK and by Charles Hoskinson, personally. Users complained about transaction processing errors.

▲ 24.01.2022 – CoinShares: Cardano saw inflows totaling $1.5 million between 15th to 21st January.

XRP (XRP)

▲ 25.01.2022 – Ripple bought back shares from Series C investors, which increased its value to $15 billion. The company also called 2021 the most successful year in terms of business growth.

Solana (SOL)

▲ 19.01.2022 – CryptoSlam: in January, Solana NFT’s total sales volume crossed $1 billion for the first time.

▲ 19.01.2022 – Metaplex Foundation, the developer of the Solana-based NFT protocol Metaplex, has raised $46 million in a funding round.

▼ 23.01.2022 – Representatives of the crypto group reported on Twitter in regards to the unavailability of the Solana (SOL) community for 48 hours.

▲ 23.01.2022 – Solana blockchain was updated to version 1.8.14 on the weekend to solve degraded performance and congestion issues.

▼ 24.01.2022 – Solana developers explained that the latest Solana outage was caused by bots spamming the network. Users were promised compensation.

▲ 24.01.2022 – Pantera Capital: Solana and Near smart contract platforms will eat away the market share of Ethereum in 2022.

▲ 24.01.2022 – CoinShares: Solana saw inflows totaling $1.4 million between 15th to 21st January.

Polkadot (DOT)

▲ 24.01.2022 – CoinShares: Polkadot saw inflows totaling $1.5 million between 15th to 21st January.

Dogecoin (DOGE)

▼ 21.01.2022 – CNBC’s host Jim Cramer: Dogecoin will be supervised by watchdogs in the future because it is unregistered security.

▲ 25.01.2022 – Elon Musk: “I will eat a happy meal on TV if McDonald’s accepts Dogecoin”.

▼ 25.01.2022 – McDonald’s in response to Musk: “Only if Tesla accepts grimacecoin”.

Shiba Inu (SHIB)

▲ 19.01.2022 – SHIB lead developer Shytoshi Kusama announced that he passed a big idea to the Shiba Inu Core Team that might shake the crypto space and do a good deed if agreed upon.

▲ 24.01.2022 – The Shiba Inu development team announced their plans to create the Shiberse Metaverse in 2022.

Cosmos (ATOM)

▲ 20.01.2022 – 21Shares, the world’s largest issuer of cryptocurrency ETPs, announced the listing of the world’s first Cosmos crypto ETP on SIX Swiss Exchange.

▲ 24.01.2022 – Grayscale has included an additional 25 digital assets in the list of possible contenders for the launch of new investment products. Algorand (ALGO), Cosmos (ATOM) and Decred (DCR) are mentioned among them.

Litecoin (LTC)

▼ 24.01.2022 – CoinShares: Litecoin recorded no inflows and outflows between 15th to 21st January.

Algorand (ALGO)

▲ 24.01.2022 – Grayscale has included an additional 25 digital assets in the list of possible contenders for the launch of new investment products. Algorand (ALGO), Cosmos (ATOM) and Decred (DCR) are mentioned among them.

Tron (TRX)

▼ 24.01.2022 – CoinShares: Tron recorded no inflows and outflows between 15th to 21st January.

EOS (EOS)

▲ 21.01.2022 – EOS blockchain platform founder Dan Larimer’s company, ClarionOS, will prepare the codebase for Mandel hardfork, designed to give the community control over the protocol.

Decred (DCR)

▲ 24.01.2022 – Grayscale has included an additional 25 digital assets in the list of possible contenders for the launch of new investment products. Algorand (ALGO), Cosmos (ATOM) and Decred (DCR) are mentioned among them.

Toncoin (TONCOIN)

▲ 19.01.2022 – Forbes: Andrew Rogozov, a vice president at VK, will join the TON Foundation in the near future. Telegram does not rule out integrating the TON Wallet down the line.

EXMO news

Crypto market snapshot for Q4 2021 has been published. The analytical report presents 2021’s fourth quarter in review: capitalisation, trading volumes, gainers and losers, as well as the correlation of cryptocurrency rates by month and for the entire quarter.

The EXMO merch design contest is now over. We are pleased to announce the name of the participant whose merch design has been considered best.

That’s all for this week! Follow EXMO on YouTube, Twitter and Telegram to stay tuned to the main events and trends in the crypto market.