Back to News

Back to News

Weekly recap: BTC hits April’s ATH amid Bitcoin ETF debut in the U.S.

The first-ever bitcoin-based ETF has started trading in the U.S. Amid this news, BTC broke beyond April’s ATH on EXMO, reaching $67 359 on 20th October. Read the Weekly recap to find out more about the main events of the crypto market that happened between 22nd and 29th October 2021.

Crypto market in numbers

The cryptocurrency market cap grew by 11% over the week exceeding $2.5 trillion, as reported by CoinMarketCap. This is almost equal to India’s GDP for 2020, which is about $2.6 trillion, according to the World Bank.

During the same period, the daily trading volumes decreased by 19.6% – to $88.3 billion. According to CoinMarketCap, there was no significant recovery in terms of trading volumes throughout the week, despite the growth of Bitcoin and most altcoins. The maximum trading volume level of $134.7 billion was recorded on Saturday, 16th October. However in early September, during a sharp market fall, daily trading volumes were almost twice as high – up to $244.8 billion.

Since 6th October, the cryptocurrency index of fear and greed has remained in the “Greed” zone at above 70 points, which has not been observed since 7th September.

For the past three week, bitcoin’s closing price has been higher than its opening price. Its capitalisation reached $1.2 trillion, which is almost equal to the GDP of Spain in 2020 ($1.28 trillion) and exceeds the GDP of countries such as Mexico ($1.08 trillion), Switzerland ($0.75 trillion) and Turkey ($0.72 trillion). On EXMO, the first crypto reached a new all-time high of $64,944 on 19th October, and then hit $67,359 the next day.

Bitcoin’s dominance of the crypto market increased by 2% over the week reaching 47.5% and by almost 5% over the month.

Bitcoin’s 30-day volatility index remained at above 4% since the beginning of October, according to CryptoCompare. But on 20th October, it sharply dropped from 4.17% to 3.71%. Exactly 30 days ago, a confident upward movement of the rate began to be observed.

According to Viewbase, over the week, BTC balances on crypto exchanges decreased by 1%, ETH – by 2.2%, and USDT – by 6.5%.

All Time High

| Coin | Date | ATH on EXMO, $ |

| BTC | 20.10.2021 | 67 359 |

| DOT | 16.10.2021 | 43.95 |

Gainers of the week (14th – 20th October 2021)

| Coin | Opening price 14.10, $ |

Opening price 20.10, $ |

Change |

| PRQ | 0.51 | 0.71 | 38.4% |

| HAI | 0.09 | 0.11 | 26.5% |

| ROOBEE | 0.0058 | 0.0071 | 23.2% |

| ZEC | 120.33 | 145.53 | 20.9% |

| BTT | 0.0035 | 0.0039 | 12.0% |

Losers of the week (14th – 20th October 2021)

| Coin | Opening price 14.10, $ |

Opening price 20.10, $ |

Change |

| CHZ | 0.35 | 0.30 | -16.6% |

| GAS | 9.48 | 8.35 | -11.9% |

| VLX | 0.16 | 0.14 | -11.7% |

| WAVES | 32.65 | 28.95 | -11.3% |

| QTUM | 13.44 | 12.40 | -7.7% |

Easily track gainers and losers within the Simple trade section on EXMO. Check real-time updates in the last 24 hours, week and month.

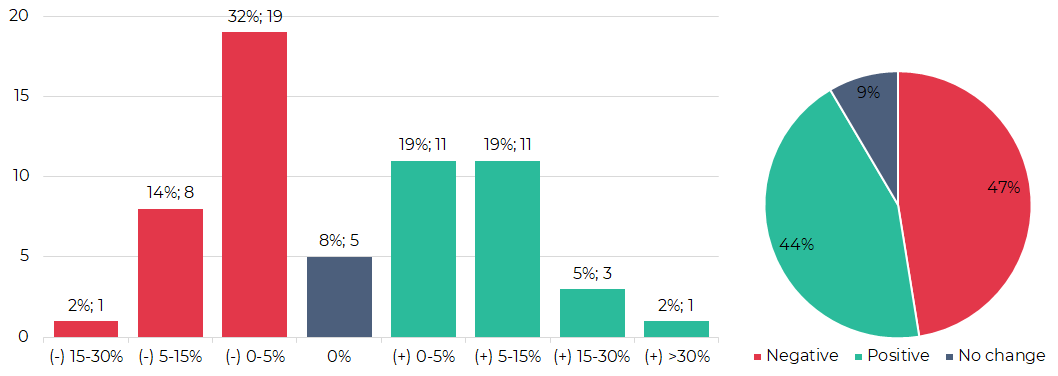

Segmentation of cryptocurrencies based on trading results (14th – 20th October 2021)

Most traded coins (13th – 19th October 2021)

| Coin | Trading volumes, $ |

| BTC | 56,566,759 |

| ETH | 32,431,645 |

| XRP | 7,580,693 |

| CRON | 2,172,542 |

| LTC | 2,041,627 |

| ADA | 1,897,179 |

| DOGE | 1,587,180 |

| WAVES | 1,132,267 |

| DASH | 1,101,883 |

| ROOBEE | 1,064,201 |

Top crypto market driving factors

The overall crypto market

▲ 13.10.2021 – The annual inflation rate in the US reached 5.4%. The Fed estimates that it will steadily exceed 3% until mid-2022. Despite inflation risks, the Fed will attempt to mitigate monetary tightening.

▲ 15.10.2021 – The CFTC settled charges against Tether and Bitfinex, ordering the companies to pay civil fines totalling $42.5 million.

▼ 18.10.2021 – Coin Shares: between 11th and 15th October, digital asset investment products saw inflows totalling $80 million. Total assets under management now exceed $72 billion, their highest level on record.

Bitcoin (BTC)

▲▼ 13.10.2021 – Whale Alert: on 12th October 2021, a leading Bitcoin address transferred 3,600 BTC to a crypto exchange. In a separate transfer, a BTC millionaire moved 2,600 coins to an unknown wallet.

▼ 14.10.2021 – Glassnode: the outflow of BTC from exchanges has slowed down. From the beginning of October, the balance of bitcoin on all exchanges remains unchanged.

▲▼ 14.10.2021 – СryptoQuant: bitcoin “whale” activity is on the rise. On 14th October alone, whales moved $186 billion worth BTC. The whale moving trend has been observed since September.

▲ 14.10.2021 – The U.S. SEC has recommended understanding the potential risks before investing in a fund that holds Bitcoin futures contracts, therefore hinting that it is set to allow the first U.S. bitcoin futures exchange-traded funds to start trading.

▲ 14.10.2021 – Valkyrie has updated their Bitcoin futures ETF prospectus, adding the ticker BTF.

▲ 14.10.2021 – Ark Invest is creating a bitcoin ETF under the symbol ‘ARKB’, according to the SEC filing.

▲ 15.10.2021 – Bloomberg: the SEC is poised to allow the first U.S. Bitcoin futures exchange-traded fund to begin trading.

▲ 15.10.2021 – Bloomberg’s data team added the ProShares Bitcoin Strategy ETF (BITO) to the terminal. The Bloomberg feed shows a trading start date of 19th October.

▲ 15.10.2021 – The U.S. SEC has approved the ProShares Bitcoin Strategy ETF.

▲ 15.10.2021 – According to Nasdaq, Valkyrie Investment has received regulatory permission to launch the Bitcoin Strategy ETF.

▲ 18.10.2021 – The New York Times: ProShares will launch a long-awaited exchange traded fund on the New York Stock Exchange (NYSE) on 19th October.

▲ 18.10.2021 – Valkyrie Investments Bitcoin ETF has also been added to the Bloomberg terminal.

▲ 18.10.2021 – Glassnode: as bitcoin topped $60,000, long-term holders wanted to take profits but short-term holders’ buying demand completely neutralised the negative impact on BTC’s price.

▲18.10.2021 – CoinShares: bitcoin saw the largest inflows, totalling $70 million, marking the 5th consecutive week of inflows.

▲ 19.10.2021 – The ProShares Bitcoin Strategy ETF (BITO), the first U.S. Bitcoin ETF, started trading on the New York Stock Exchange (NYSE). It debuted as the second-highest traded fund ever, with a turnover of almost $1 billion.

▲ 19.10.2021 – Grayscale Investments, has filed with the U.S. SEC to convert its Grayscale Bitcoin Trust (GBTC) into a bitcoin ETF.

Ethereum (ETH)

▼ 17.10.2021 – Roadmap update: Ethereum will begin public tests on the merger with ETH 2.0, no earlier than in the first quarter of 2022.

▲ 18.10.2021 – Glassnode: the number of ETH addresses holding more than one coin reached an ATH of 1,341,789. Since the beginning of the year, about 300,000 new ETH addresses have been created, which is 22% of all existing ETH addresses.

▼ 18.10.2021 – CoinShares: Between 11th and 15th October, Ethereum saw minor outflows totalling $0.9 million. A major ETH outflow of $ 13.6 million was observed a week earlier.

Cardano (ADA)

▲ 18.10.2021 – CoinShares: between 11th and 15th October, Cardano saw continued inflows totalling $2.7 million. The asset ranked third in terms of institutional inflows after bitcoin and Polkadot.

▲ 19.10.2021 – Santiment: cardano traders and investors are starting to open longer positions. Analysts expect an increase in the asset’s price volatility.

XRP (XRP)

▲ 14.10.2021 – Ripple has joined the UK CBDC study initiative.

Polkadot (DOT)

▲ 13.10.2021 – Polkadot developers have announced their readiness to deploy parachains on the platform. This will mark the final phase of a multi-stage mainnet launch process. The first batch of auctions for parachain slots is scheduled for 11th November and the second one for 23rd December.

▲ 17.10.2021 – Polkadot founder, Gavin Wood, stated that the Polkadot treasury currently has 18.9 million DOT in it and is ready to spend on ideas for building and improving Polkadot’s ecosystem.

▲ 18.10.2021 – CoinShares: between 11th and 15th October, Cardano saw continued inflows totalling $3.6 million. The asset ranked second, in terms of institutional inflows after bitcoin.

Dogecoin (DOGE)

▲ 18.10.2021 – Elon Musk reacts with a face with tongue emoji to Billy Markus tweet in which he calls to “keep dogecoin absurd”.

Uniswap (UNI)

▲ 15.10.2021 – Former President Barack Obama’s senior spokesperson, Hari Sevugan, has joined the Uniswap Labs team as a new communications chief.

Litecoin (LTC)

▲ 13.10.2021 – Santiment: Litecoin surpasses Ethereum in terms of network activity with 600,000 active addresses per day. The number of LTC-receiving wallets has surged to a new historic peak.

Chainlink (LINK)

▲ 19.10.2021 – Whales have increased their investments in Chainlink by 15% in four months. At the moment, 167.7 million tokens worth $4.3 billion are stored on addresses holding between 1 million to 10 million Chainlink.

Stellar (XLM)

▲ 13.10.2021 – On 14th October, Stellar developers announced a presentation of the progress they made in Q3 2021.

▲ 18.10.2021 – Grayscale: Grayscale Stellar Lumens Trust has started trading on OTCQX under the symbol “GXLM”.

Cosmos (ATOM)

▲ 19.10.2021 – The Cosmos team is developing the Sagan blockchain designed to test new protocols before launching them on the mainnet.

▲ 19.10.2021 – Cosmos announced a partnership with gaming company, Forte, that will entail an undisclosed investment in the company.

Tron (TRX)

▲ 15.10.2021 – Sony Interactive Entertainment decided to partner with the Tron Foundation to use their blockchain ecosystem for further gaming development.

Waves (WAVES)

▲ 15.10.2021 – The VIRES token generation event (“TGE”) will take on 19th October on the Waves blockchain. The first distribution of tokens is scheduled for 21st October.

Zcash (ZEC)

▲ 18.10.2021 – Grayscale: Grayscale Zcash Trust has started trading on OTCQX under the symbol “ZCSH”.

PARSIQ (PRQ)

▲ 18.10.2021 – PARSIQ has become an Amazon AWS technology partner.

Crypto market trends

Regulation

📊 The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) is publishing an industry-specific brochure that provides an overview of OFAC sanctions requirements and procedures. Exchanges, wallet operators, mining pools and companies dealing with crypto should use geolocation tools to identify and prevent IP addresses that originate in sanctioned jurisdictions from accessing their website and services for activities that are prohibited by OFAC’s regulations.

📊 The US Treasury said that the use of digital assets reduces the efficacy of American sanctions. It also stated that OFAC will start pursuing crypto companies that violate the sanctions regime.

📊 On Monday, the New York Attorney General’s Office ordered two cryptocurrency lending platforms to shut down their operations in the state. It also forced three other companies to answer questions on their activities and products. The agency argues that virtual currency lending products are considered securities, which requires companies offering such financial services to register with the attorney general’s office.

📊 Russian authorities do not intend to impose restrictions on the purchase of cryptocurrency on digital asset exchanges based abroad, according to Russia’s deputy minister of finance, Alexey Moiseev. He also pointed out that regulators’ main position is “to ban operations with cryptocurrencies on the territory of the Russian Federation”.

📊 The Bank of Russia is set to find out how many Russians are investing in crypto. The regulator estimates investment in digital assets as “a potentially very significant problem”. At the same time, the head of the bank’s financial stability department, Elizaveta Danilova, stated that even if regulators ban crypto investing in Russia, Russians will be able to buy financial instruments from foreign intermediaries.

Acceptance of cryptocurrencies

📊 Aleksandr Pankin, the deputy minister of Foreign Affairs of Russia, said it’s “possible” Moscow could replace its US dollar reserves with digital currencies. Pankin confirmed Russia’s intentions that also include the usage of US dollars in settlement with foreign partners.

📊 Russian President, Vladimir Putin, said that crypto currencies were too unstable to be used to settle oil contracts but that they still deserved a place as a means of payment.

📊 President of El Salvador, Nayib Bukele, said that the inflow of funds in the accounts of citizens’ Chivo crypto wallets greatly exceeds the outflow. According to him, this became especially noticeable during the price increase of bitcoin.

📊 President of Mexico, Andrés Manuel López Obrador, said the country was unlikely to follow in El Salvador’s footsteps by adopting cryptocurrencies like bitcoin as legal tender alongside fiat.

📊 Brazilians have bought more than $4 billion in cryptocurrencies in 2021 so far, according to a report by the Central Bank of Brazil. Hyperinflation is said to be the main reason for crypto investing as protection against economic problems.

📊 Processing company, Stripe, announced the recruitment of engineers and designers “to build the future of Web3 payments”.

📊 Payment startup, Strike, has let its users from 48 U.S. states, instantly convert all or a portion of their paychecks into the original cryptocurrency.

📊 Just hours after declaring its cryptocurrency payments pilot a success, United Wholesale Mortgage (UWM), decided to scrap the trial-run program it launched in August. The second-biggest mortgage company ultimately decided to scrap crypto acceptance because of “incremental costs and regulatory uncertainty.”

CBDC and stablecoins

📊 G7 finance leaders laid out guidelines for central bank digital currencies. They have also stressed the importance of stablecoin regulation. In their opinion, stablecoin issuers have to comply with regulatory standards and eliminate any risks of financial instability before the launch of their projects.

📊 The Central Bank of Japan will continue to explore the possibility of issuing a CBDC, but will not consider digital yen to be the only solution to the problem of payment digitalisation.

📊 The Bank of Canada has no plans to introduce a digital currency unless there is a strong demand for it.

📊 A consortium of institutions led by Euroclear has completed a test run of the use of central bank digital currency (CBDC) for settling French treasury bonds on a blockchain.

📊 According to the International Monetary Fund (IMF), cryptocurrencies, including stablecoins and DeFi, pose risks to the global economy due to their high volatility and lack of transparency. The IMF is calling for “global standards for crypto assets” to prevent the “risk of contamination” of adjacent markets.

📊 Lawmakers, speaking at the Fourth G20 Finance Ministers and Central Bank Governors meeting, stated that stablecoins should not be allowed to operate until all relevant concerns are addressed. At the meeting, which was held on 13th October, they discussed legal, regulatory, and oversight requirements for the stablecoin industry.

📊 Analysts at Fitch Ratings said that a sudden mass redemption of stablecoins could affect the stability of short-term credit markets citing Tether as an example. They believe that these risks can increase pressure for tighter regulation of the nascent sector.

📊 The CFTC settled charges against Tether and Bitfinex, ordering the companies to pay civil fines totalling $42.5 million.

📊 Facebook has finally launched a pilot of its Novi digital wallet in the US and Guatemala. Initially, the wallet will enable customers to send and receive money using only the Pax Dollar (USDP) stablecoin. Novi will support the Diem stablecoin, as soon as it receives regulatory approval.

📊 Five democratic senators called on Facebook founder and CEO, Mark Zuckerberg, to stop the launch of its new cryptocurrency wallet Novi before the proper regulatory framework is built.

Mining

📊 The U.S. has replaced China as the world’s biggest bitcoin miner, according to a Cambridge Centre for Alternative Finance study. The U.S. share of the global hash rate grew from 17% in April to 35% in August. Other leaders include Kazakhstan (18%), Russia (11%) and Canada (9.6%).

📊 As a result of the latest recalculation, Bitcoin’s mining difficulty has increased by 1% – to 20 trillion hashes. This is the seventh consecutive mining difficulty increase after China’s crackdown on Bitcoin miners. Such sustained difficulty in growth was last recorded in May 2019, when the market started to recover from the crypto winter.

📊 Bitcoin mining pools BTC.com and AntPoo announced that they would not provide their mining services to users in mainland China starting from 15th October. Chinese journalist, Colin Wu, reported that mining pool F2Pool would also stop servicing mainland Chinese users.

📊 Russian Energy Minister, Nikolai Shulginov, announced that the authority is working on a new framework to raise tariffs for cryptocurrency miners.

📊 The head of the State Duma Committee on the Financial Market, Anatoly Aksakov, called on to legislate the taxation procedure for miners.

📊 The payment processing company, Square, is considering developing a bitcoin mining system based on “custom silicon and open source”. The head of the company, Jack Dorsey, is confident that mining should be more accessible and decentralised, which will allow the Bitcoin network to become more resilient.

NFT and gaming

📊 According to Dapp Radar, 754,000 out of 1.54 million or 49% of wallets registered in the third quarter have interacted with blockchain-based games at least once. Over the same period, 2.3 billion in-game NFT collectibles were sold.

📊 The payment giant, Visa, is launching an NFT support program to help artists join the digital art space.

📊 Valve Corporation, the parent company of one of the largest video game platforms Steam, has announced a ban on applications built on blockchain technology, as well as apps that issue or allow an exchange of cryptocurrencies or NFTs.

Meanwhile Valve’s main competitor, Epic Games, said that it is “open to games that support cryptocurrency or blockchain-based assets” on its game store.

EXMO news

2FA becomes more convenient. Now you can receive a verification code as a push notification from the EXMO mobile app.

EXMO supports the monthly reports published by CryptoCompare. Read the Exchange Review of September 2021 and stay on top of cryptocurrency trends with access to proven insights from the global leader in digital asset analytics.

Achievements on EXMO: first winners are announced. Congratulations to the first trader who has collected 50 achievements on EXMO and won the EXMO merch pack along with the EXMO Premium Pro package for 3 months.

Crypto market snapshot for Q3 2021 is published. The analytical report presents 2021’s third quarter in review: capitalisation, trading volumes, gainers and losers, as well as the correlation of cryptocurrency rates by month and for the entire quarter.

That’s all for this week! Follow EXMO on YouTube, Twitter and Telegram to stay tuned to the main events and trends in the crypto market.