Back to News

Back to News

Weekly recap: increased crypto volatility amid the chaos in the world

EU clarifies crypto is covered in sanctions against Russia. Meanwhile, whales continue to accumulate ETH, institutional investors increase their crypto holdings by over three times and BTC mining difficulty drops for the first time since November 2021. Read the Weekly recap to find out more about the main events of the crypto market that happened between 05th and 11th March 2022.

Crypto market in numbers

Over the week, the cryptocurrency market cap decreased by 3% to $1.77 trillion. The indicator mostly ranged between $1.7 trillion and $1.8 trillion, according to CoinMarketCap. Between 08th and 09th March, the market made attempts to rise above the $1.8 trillion mark amid the crypto regulation news in the United States.

Between 04th March and 10th March, the crypto market trading volumes stood at $558 billion, down 12% from a week earlier. The average daily trading volume for the period was $80 billion.

The Cryptocurrency Fear & Greed Index has remained in the “Extreme Fear” zone for almost the entire week. Between 05th and 11th March, the median value of the index was 22 points.

Bitcoin’s volatility remained relatively high. The 30-day volatility index remained above the 4% level for the past 12 days, according to CryptoCompare. On 11th March, its value stood at 4.47%

The three-month correlation between Ethereum and Bitcoin rose to a 20-month all-time high. The indicator reached 89%, according to skew. An all-time low was observed in January 2021 at the level of 55%.

Gainers of the week (05th – 11th March 2022)

| Coin | Opening price 05.03, $ | Opening price 11.03, $ | Change |

| WAVES | 19.43 | 28.76 | 48.0% |

| ZEC | 123.25 | 166.17 | 34.8% |

| DASH | 94.48 | 110.56 | 17.0% |

| PRQ | 0.26 | 0.29 | 13.0% |

| OMG | 4.16 | 4.49 | 7.9% |

Losers of the week (05th – 11th March 2022)

| Coin | Opening price 05.03, $ | Opening price 11.03, $ | Change |

| MNC | 0.00082 | 0.00072 | -11.8% |

| SMART | 0.00152 | 0.00138 | -9.6% |

| ATOM | 31.84 | 29.50 | -7.4% |

| SOL | 92.82 | 87.41 | -5.8% |

| SHIB | 0.0000249 | 0.0000238 | -4.4% |

Easily track gainers and losers within the Simple trade section on EXMO. Check real-time updates in the last 24 hours, week and month.

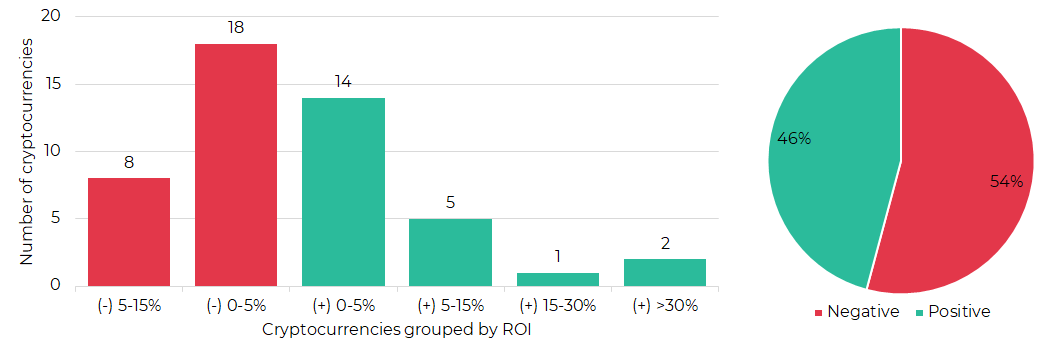

Segmentation of cryptocurrencies based on trading results

(05th – 11th March 2022)

Most traded coins (04th – 10th March 2022)

| Coin | Trading volumes, $ |

| BTC | 32,582,683 |

| ETH | 17,818,007 |

| XRP | 4,854,233 |

| IQN | 4,138,832 |

| WAVES | 3,377,117 |

| GMT | 2,649,629 |

| ROOBEE | 1,686,014 |

| LTC | 1,330,551 |

| TON | 1,145,654 |

| ZEC | 1,088,643 |

Top crypto market driving factors

Overall crypto market

▲ 04.03.2022 – The Virginia Senate unanimously passed a cryptocurrency banking bill, which permits banks to provide virtual currency custody services.

▲ 05.03.2022 – Payments company, PayPal, shuts down its services in Russia citing Russia’s military aggression in Ukraine.

▲ 06.03.2022 – The American payment systems Visa and Mastercard announced the suspension of their services in the Russian market.

▲ 06.03.2022 – Moody rating agency has changed Russia’s sovereign credit rating from B3 to Ca. Obligations rated ‘Ca’ are highly speculative and are likely in, or very near, to default.

▲ 06.03.2022 – Santiment: during the last month, addresses with 10,000 to 10,000 USDT have added $1.06 billion in buying power or 2.7% of the total USDT supply.

▼ 07.03.2022 – The issuer of the USDC stablecoin, Circle, has temporarily disabled all fiat payments from accounts located in Russia.

▲ 07.03.2022 – CoinShares: between 28th February and 04th March, digital asset investment products saw inflows totaling $127 million – the largest in 11 weeks. Investments grew 3.5 times compared to the previous week.

▲ 07.03.2022 – CoinShares: between 28th February and 04th March, multi-asset investment products continued to see inflows, which totaled $8.6 million. Multi-asset has seen the most inflows year-to-date, totaling $104 million, representing 3.6% of assets under management (AuM) – the largest increase among all investment products.

▲ 07.03.2022 – On 14th March, the European Parliament Committee on Economics and Monetary Affairs will vote on a final draft of the bill aimed at regulating cryptocurrencies. The legislation will no longer include text that can be interpreted as a possible ban on proof-of-work crypto mining.

▲ 08.03.2022 – Between 09th March and 09th September 2022, the Central Bank of the Russian Federation banned banks from selling foreign cash and limited withdrawals to $10,000.

▲ 09.03.2022 – U.S. President Joe Biden ordered directing agencies across the federal government to study the implications of integrating crypto into the country’s financial system and coordinate efforts to regulate cryptocurrencies and other digital assets.

▲ 09.03.2022 – Credit Suisse: the increase in the use of bitcoin accelerates the process of formation of a new financial system.

▼ 09.03.2022 – The EU’s Committee of Permanent Representatives has approved additional sanctions on officials and agencies in Russia. The restrictions will also affect cryptocurrency assets.

▲ 09.03.2022 – The second oldest U.S. bank, State Street, has partnered with a London-based company, Copper, to offer custodial services on cryptocurrencies for institutional customers.

▼ 10.03.2022 – The US Bureau of Labor Statistics published updated data on inflation growth. Inflation around the U.S. reached a new 40-year high in February, with consumer prices jumping 7.9% from a year ago.

▲ 10.03.2022 – Bloomberg: Goldman Sachs Group is exploring offering over-the-counter bilateral crypto options.

▼ 10.03.2022 – European Central Bank will cut pandemic bond-buying in the next quarter of 2022.

▲ 10.03.2022 – Payment giant, Stripe, launches a suite of products to support crypto payments on its platform.

Bitcoin (BTC)

▲ 04.03.2022 – Santiment: the respective supplies of both Bitcoin and Tether have fallen in the past 30 days. For BTC, this has been the norm for a while, but for USDT, this fall began at the start of February. Analysts consider this to be a signal for a push back above $45,000.

▼ 05.03.2022 – For the first time since November 2021, the Bitcoin (BTC) mining difficulty adjustment has dropped, correcting 1.49%.

▲ 07.03.2022 – CoinShares: between 28th February and 04th March, Bitcoin saw inflows totaling $95 million last week, the largest single weekly inflow since early December 2021.

▲ 10.03.2022 – Mike McGlone, Senior Commodity Strategist at Bloomberg: Bitcoin forms the basis for a powerful rise to $100,000.

▼ 11.03.2022 – Datamish: Over two hours, some large traders borrowed around 1,500 BTC (~$60M) to short positions on a major exchange.

▲ 11.03.2022 – Glassnode: Bitcoin’s inflation rate has reduced to 1.7%.

Ethereum (ETH)

▲ 07.03.2022 – CoinShares: between 28th February and 04th March, Ethereum investment products attracted a total of $25 million – the largest inflow in 13 weeks. Since the beginning of the year, Ethereum saw outflows of $84 million.

▼ 07.03.2022 – DeFi Lama: Ethereum’s share of total value locked is at all-time lows trending below 55% for the first time ever.

▲ 07.03.2022 – Santiment: Ethereum’s addresses holding 1 million to 10 million ETH have accumulated 2.2% more of the total ETH supply over the past six months, despite the price correction.

▲ 08.03.2022 – Goldman Sachs is offering interested clients access to an ether (ETH) fund through Galaxy Digital.

▲ 09.03.2022 – Santiment: Ethereum’s billionaire addresses holding 1m to 10m ETH have accumulated 21.6% of all ETH supply.

▲ 10.03.2022 – The amount of coins locked on the Ethereum 2.0 deposit contract exceeded 10 million ETH (~$26.1 billion), which is equivalent to 8.4% of the total supply of the second-largest cryptocurrency in terms of market cap.

▲ 10.03.2022 – The Ethereum network nears 2 million ETH burned worth around $4.75 billion, according to ultrasound.money.

XRP (XRP)

▲ 07.03.2022 – Ripple expects to end its case with the U.S. Securities and Exchange Commission (SEC) sometime between 26th August and 18th November 2022.

▲ 10.03.2022 – Ripple has invested in NFT projects that will be launched on the XRP Ledger blockchain.

Cardano (ADA)

▼ 07.03.2022 – Crypto journalist, Laura Shin, has cast serious doubt over Cardano founder Charles Hoskinson’s degree claims and accused him of falsifying his credentials and educational bio.

▲ 09.03.2022 – BeInCrypto: the total value locked in the Cardano network has increased from $822,000 at the beginning of the year to $136 million in early March.

Solana (SOL)

▼ 05.03.2022 – Slowmist analysts issued a warning for the users regarding frequent Solana network phishing attacks.

▼ 07.03.2022 – CoinShares: Solana saw outflows of $1.7 million between 28th February and 04th March and $3.2 million since the beginning of March.

▲ 07.03.2022 – Adobe Behance will allow its users to display Solana-powered non-fungible tokens (NFTs) on their profiles.

Polkadot (DOT)

▼ 07.03.2022 – CoinShares: between 28th February and 04th March, Polkadot saw outflows totaling $0.9 million.

Dogecoin (DOGE)

▲ 04.03.2022 – DOGE’s co-creator confirmed the release of a new self-custodian Dogecoin iOS mobile wallet.

Shiba Inu (SHIB)

▲ 07.03.2022 – British digital payments platform Wirex has added support for the meme-inspired coin Shiba Inu ($SHIB) along with Luna Token (LUNA), Cosmos (ATOM), Enjin Coin (ENJ), BitcoinCash (BCH) and Orchid (OXT).

Cosmos (ATOM)

▲ 07.03.2022 – British digital payments platform Wirex has added support for Luna Token (LUNA), Cosmos (ATOM), Enjin Coin (ENJ), BitcoinCash (BCH), Orchid (OXT) and the meme-inspired coin Shiba Inu ($SHIB).

Chainlink (LINK)

▲ 10.03.2022 – Crypto market-making firm GSR has partnered with Chainlink to contribute price data to decentralised oracle networks (DONs).

▲ 10.03.2022 – Santiment: Chainlink’s key whale addresses that hold between 10,000 to 10 million LINK have accumulated 17.1 million LINK (~$230 million) since 27th February.

Tron (TRX)

▼ 09.03.2022 – The Verge published an article accusing Tron founder, Justin Sun, of violating Chinese and U.S. financial regulations, including insider trading and ICO fraud. It is also claimed that the Poloniex exchange, which is part of the Tron ecosystem, has only implemented an imitation of the “know your customer” (KYC) verification process.

▲ 10.03.2022 – Justin Sun called The Verge article “blatant misinformation”. He is ready to sue the author and publication for defamation.

Algorand (ALGO)

▲ 04.03.2022 – The Algorand blockchain released a major technical upgrade designed to support cross-chain interoperability and allow developers to easily build complex decentralised applications (dApps) based on its network.

yearn.finance (YFI)

▼ 06.03.2022 – Fantom Foundation’s Senior Solutions Architect, Anton Nell, and DeFi Ecosystem Lead Developer and yEarn Finance Founder, Andre Cronje, decided to leave the crypto industry.

▼ 10.03.2022 – Santiment: following Andre Cronje’s sudden exit, Yearn Finance network’s growth has turned to a downtrend.

Toncoin (TON)

▲ 07.03.2022 – Blockchain firm Matrixport has become an official partner of The Open Network. Matrixport will add Toncoin support to its institutional custodial service and integrate TON into various products.

PARSIQ (PRQ)

▲ 10.03.2022 – PARSIQ has partnered with decentralised storage platform, DeNet.

Wirex (WXT)

▲ 07.03.2022 – British digital payments platform Wirex has added support for Luna Token (LUNA), Cosmos (ATOM), Enjin Coin (ENJ), BitcoinCash (BCH), Orchid (OXT) and the meme-inspired coin Shiba Inu ($SHIB).

EXMO news

Cashback conditions have been revised. Since 09th March 2022, the conditions for calculating cashback have been revised, while basic trading fees remain unchanged.

‘Save Ukraine’ Relief Fund has raised another $594,000 and launched a website. Recently, the EXMO team launched the ‘Save Ukraine’ Relief Fund to raise funds for humanitarian aid.

That’s all for this week! Follow EXMO on YouTube, Twitter and Telegram to stay tuned to the main events and trends in the crypto market.