Back to News

Back to News

Weekly recap: crypto market resistance

Global regulators are increasing pressure on the crypto market with Turkey’s President declaring “war” on digital assets. Meanwhile, investors, miners and even some countries are accumulating bitcoin amid its recent drop. Read the Weekly recap to find out more about the main events of the crypto market that happened between 15th and 22nd September 2021.

Crypto market in numbers

Crypto market capitalisation over the past 7 days has decreased by almost 13% to $1.87 trillion, according to CoinMarketCap.

Trading volumes increased with the market fall. Daily trading volumes rose 24% to $134 billion over the week. On Monday, they grew to $151 billion without reaching the local maximum level of $246 billion that was seen after the market crash on 7th September 2021.

The Crypto Fear & Greed Index dropped to 21 points amid the market turbulence on Monday, leaving “Neutral” and entering the “Fear” zone.

Bitcoin dominance during the past 7 days grew by 0.81% to 42.6%, according to CoinMarketCap. Some drawdown was observed simultaneously with a short-term increase in ether.

On 16th September, the share of ether rose to 19.51%, but only stayed above 19% for two days. Over the week, it fell by 0.23% to 18.4%.

Bitcoin’s 30-day volatility index declined by 19th September, falling from 3.4% to 3.2%, according to CryptoCompare. However, from the beginning of this week, the indicator began to grow and by 22nd September it reached 3.78%, exceeding the peak on 7th September at 3.7%. This is the maximum value of the index since 20th July 2021.

All Time High

| Coin | Date | ATH on EXMO, $ |

| ATOM | 22.09.2021 | 44.5 |

Gainers of the week (16th – 22nd September 2021)

| Coin | Opening price 16.09, $ |

Opening price 22.09, $ |

Change |

| VLX | 0.145 | 0.156 | 7.3% |

Losers of the week (16th – 22nd September 2021)

| Coin | Opening price 16.09, $ |

Opening price 22.09, $ |

Change |

| HP | 0.0014 | 0.0008 | -42.4% |

| XTZ | 6.98 | 4.67 | -33.1% |

| PRQ | 0.73 | 0.49 | -32.7% |

| LINK | 32.74 | 22.06 | -32.6% |

| TONCOIN | 0.87 | 0.62 | -28.7% |

Easily track gainers and losers within the Simple trade section on EXMO. Check real-time updates in the last 24 hours, week and month.

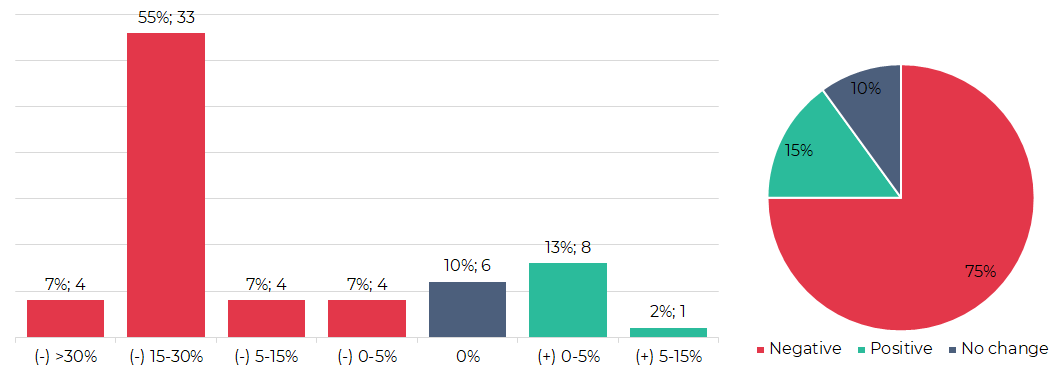

Segmentation of cryptocurrencies based on trading results (16th – 22nd September 2021)

Most traded coins (15th – 21st September 2021)

| Coin | Trading volumes, $ |

| BTC | 40,593,621 |

| ETH | 34,737,459 |

| XRP | 7,833,075 |

| CRON | 3,237,836 |

| ADA | 2,197,649 |

| LTC | 2,087,796 |

| DASH | 1,646,122 |

| DOGE | 974,732 |

| EXM | 895,932 |

| TRX | 796,223 |

Top crypto market driving factors

The overall crypto market

▼ 14.09.2021 – Chinese property giant, Evergrande, has warned of growing default risks. The bankruptcy of a company can negatively affect the global economy.

▲ 15.09.2021 – Stablecoin issuer, Tether, says it has never held any commercial paper or other debt issued by Evergrande.

▲ 16.09.2021 – The government of Laos authorised six companies to start mining and trading cryptocurrencies such as bitcoin, ethereum and litecoin.

▼▲ 17.09.2021 – CryptoQuant: stablecoin reserves are joining the BTC downtrend movement which has been occurring since early September.

▲ 17.09.2021 – Coinalyze: altcoins dominate the total futures trading volume by over 54%. Bitcoin’s share is 28%, while ether’s is at 19%.

▲ 20.09.2021 – CoinShares: crypto funds have been seeing increased capital inflows from institutional investors for the fifth consecutive week.

▲▼ 22.09.2021 – Evergrande announced that it has agreed a deal with domestic bondholders that may allow it to avoid default on one of its interest payments.

▲ 22.09.2021 – The People’s Bank of China pumped 120 billion yuan ($18.6 billion) into the banking system through reverse repurchase agreements due to concerns over a debt crisis at Evergrande roiling global markets.

Bitcoin (BTC)

▲ 15.09.2021 – Glassnode: bitcoin exchange balances have returned to 13.1% of circulating BTC supply, winding back the clock on inflows to February 2018. The trend towards a decrease in exchange reserves has been observed since March 2020, when the price of BTC fell to $5,000.

▲ 16.09.2021 – IntoTheBlock: the aggregate turnover of large BTC transactions, on 15th September, reached a record $480 billion. In bitcoins, the volume reached a two-year high – over 10 million BTC.

▲ 16.09.2021 – Santiment: between 13th and 15th September, large bitcoin wallets accumulated 60,000 BTC, after which the coin’s rate increased by 5%.

▲ 17.09.2021 – Starting 17th September, UK residents can buy, hold, and sell bitcoin, ethereum, bitcoin cash, and litecoin from their PayPal mobile apps.

▲ 17.09.2021 – IntoTheBlock: ether and bitcoin rates outperformed the Nasdaq 100, S&P 500 and Dow Jones indices over the past 30 days.

▼ 20.09.2021 – Bloomberg: Bitcoin’s 30-day correlation with the S&P 500 peaked at 0.43 since October 2020. On 20th September, the stock market continued its decline which began the previous week: the S&P 500 index fell 1.7% – it’s the worst result in a day since May.

▲ 20.09.2021 –The Government of El Salvador purchased an additional 150 BTC amid the BTC rate drawdown to $45,000.

▼ 20.09.2021 – Glassnode: long-term holders are now realising profits from BTC they have acquired between the $18,000 and $31,000 levels.

▲ 20.09.2021 – Glassnode: bitcoin miners have been in accumulation mode over the last 6 months. Since January, their reserves have grown to 13,000 BTC.

▲▼ 20.09.2021 – CoinShares: bitcoin saw inflows of $15 million out of total $41.6 million investments in digital asset funds. BTC has suffered the most from negative investor sentiment with inflows only during three of the last 16 weeks.

Ethereum (ETH)

▲ 15.09.2021 – After the London update on 5th August, 297,000 ETH worth more than $1 billion were burned. On average, about 5 ETH is burned per minute.

▲ 16.09.2021 – American cinema chain, AMC Theaters, announced that by the end of the year it will start accepting payments not only in BTC, but also in ETH, LTC and BCH.

▲ 17.09.2021 – Ethereum’s co-founder, Vitalik Buterin, appeared in Time Magazine’s “100 Most Influential People List” of 2021 as one of the top innovators in the world.

▲ 17.09.2021 – IntoTheBlock: $1.2 billion worth of ETH were withdrawn from centralised exchanges in 24 hours. This withdrawal hit a new record for short-term outflow from exchanges.

▲ 17.09.2021 – Starting 17th September, UK residents can buy, hold, and sell bitcoin, ethereum, bitcoin cash, and litecoin from their PayPal mobile apps.

▲ 17.09.2021 – IntoTheBlock: ether and bitcoin rates outperformed the Nasdaq 100, S&P 500 and Dow Jones indices over the past 30 days.

▼ 20.09.2021 – JPMorgan: ether’s fair value is around $1,500 based on measures of network activity.

▼ 20.09.2021 – Kaiko: Ethereum’s dominance, in terms of trading volume among Layer 1 protocols, has dropped from 86% to 33%, since the beginning of the year.

Cardano (ADA)

▼ 17.09.2021 – 99% of smart contracts deployed in Cardano remain inactive, according to smartcontracts.vercel.app.

XRP (XRP)

▼ 17.09.2021 – British payment company, Paydek, will use Ripple technology to provide real-time cross-border transfers to Latin America.

▲ 20.09.2021 – Validators approved a proposal to lower the XRP Ledger’s minimum reserve requirement from 20 XRPs to 10 XRP.

▲ 21.09.2021 – XRPscan: since 1st September, Ripple’s former Chief Technology Officer, Jed McCaleb, has not sold a single XRP after receiving another monthly tranche from the company.

▼ 22.09.2021 – A New York court has denied Ripple Labs’ motion to compel the U.S. SEC to produce records of its employees’ crypto transactions.

Chainlink (LINK)

▼▲ 16.09.2021 – Santiment: the 7-day Market Value to Realised Value (MVRV) indicated that LINK is overbought. However, the daily number of active addresses on the network and the indicator of developer activity indicate a general bullish sentiment.

Litecoin (LTC)

▲ 15.09.2021 – Litecoin Foundation launched an LTC virtual debit card synchronised with Apple Pay, Google Pay and Samsung Pay.

▲ 16.09.2021 – American cinema chain, AMC Theaters, announced that it will start accepting payments not only in BTC, but also in ETH, LTC and BCH, by the end of the year.

▲ 17.09.2021 – Starting 17th September, UK residents can buy, hold, and sell bitcoin, ethereum, bitcoin cash, and litecoin from their PayPal mobile apps.

▲▼ 17.09.2021 – BitInfoCharts: 950 LTC accounts hold coins worth over $1 million. The three richest addresses control over 10% of LTC emissions.

Bitcoin Cash (BCH)

▲ 16.09.2021 – American cinema chain, AMC Theaters, announced that it will start accepting payments not only in BTC, but also in ETH, LTC and BCH, by the end of the year.

▲ 17.09.2021 – Starting 17th September, UK residents can buy, hold, and sell bitcoin, ethereum, bitcoin cash, and litecoin from their PayPal mobile apps.

Algorand (ALGO)

▲ 16.09.2021 – Investment company, SkyBridge Capital, raised $100 million for the newly announced Algorand fund.

Tron (TRX)

▲ 20.09.2021 – Deutsche Boerse has added Tron-based exchange traded notes to its listing.

Tezos (XTZ)

▲ 18.09.2021 – Tezos hit the top 10 cryptocurrencies, mentioned on Twitter between 13th and 19th September.

Waves (WAVES)

▲ 15.09.2021 – The Russian Federation of Practical Shooting conducted voting based on the blockchain service, Waves Enterprise.

Polkadot (DOT)

▲ 21.09.2021 – Deutsche Boerse listed VanEck’s new ETNs on DOT, SOL and TRX.

Dogecoin (DOGE)

▲ 22.09.2021 – AMC Entertainment chairman-CEO, Adam Aron, conducted a Twitter poll on whether the company should add Dogecoin to the list of accepted cryptocurrencies.

Zcash (ZEC)

▲ 21.09.2021 – Zcash developers will improve the scalability and privacy of Filecoin and Ethereum.

Crypto market trends

Regulation

📊 US Securities and Exchange Commission Chairman, Gary Gensler, reiterated in an interview with The Washington Post that platforms supporting tokens with “attributes of an investment contract” will face challenges.

📊 The US Treasury has included the Suex cryptocurrency exchanger with offices in Moscow and St. Petersburg in the sanctions list. According to the agency, the service facilitated transactions for ransomware, darknet and scam projects.

📊 The crypto community drew attention to the US Tax Code amendment, which will oblige cryptocurrency recipients to verify the personal information of senders, in case a transaction exceeds $10,000 in value.

📊 According to media reports, US President Joe Biden’s administration is developing a number of measures for combating hackers’ cryptocurrency payments used for ransomware attacks.

📊 The US Senate also called for increased oversight of cryptocurrency usage by ransomware. The letter to regulators emphasises the need to tighten compliance with KYC procedures and notes that decentralised exchanges and OTC platforms don’t have such requirements.

📊 The IRS will provide funds for TRM Labs to develop a tool for tracking transactions between blockchains.

📊 Jointly with credit institutions, the Bank of Russia will develop a mechanism for blocking payments to cryptocurrency exchanges and exchangers.

📊 Deputy Chairman of the Central Bank of the Russian Federation, Sergei Shvetsov, said that the Bank of Russia will not contribute to expanding access to cryptocurrencies for unqualified investors.

📊 The National Bank of Ukraine supports the development of the digital currency industry. At the same time, the Bank intends to prevent the ousting of the hryvnia as the only legal tender in the country.

📊 The President of Turkey said that his state is “at war” with cryptocurrencies.

CBDC and stablecoins

📊 As reported by a business daily newspaper, Vedomosti, the representatives of the Russian banking sector still do not understand why the country needs a digital ruble.

📊 Capitalisation of decentralised stablecoins exceeded $10 billion. The sector is dominated by DAI and TerraUSD (UST).

📊 According to recommendations developed by the US Treasury Department for issuers of stablecoins, the holders of these assets should be able to convert them into the assets backing them for free, Bloomberg has reported citing sources. Officials are worried about the rapid growth of the sector’s capitalisation and with the possibility of tokens such as Facebook’s Diem being issued.

The publication’s sources have not ruled out the Financial Stability Oversight Council taking action due to the economic threats that stablecoins could pose, which could lead to the introduction of even stricter regulation.

Acceptance of cryptocurrencies

📊 Residents of El Salvador’s capital protested against bitcoin legalisation and the president’s policies on 15th September. Demonstrators set one Bitcoin ATMs on fire.

📊 On 16th September, the spread of Salvadoran bonds to US bonds reached a record high. There are growing fears that the country will not be able to reach an agreement with the International Monetary Fund on a $1 billion loan amid a downgrade of its credit rating due to bitcoin being accepted as a recognised form of payment.

📊 El Salvador’s Court of Accounts intends to conduct a “legal analysis” of the cryptocurrency purchases by government officials. The investigation’s results can be further sent to the General Prosecutor’s Office.

📊 El Salvador’s President, Naib Bukele, said that 1.6 million people (~25% of the population) have already connected the BTC Chivo Wallet in 12 days.

📊 On 16th September, Central Bank Resolution 215 from 2021 came into force in Cuba, legalising commercial cryptocurrency transactions and investments.

📊 The authorities in Laos have allowed six companies to mine and trade bitcoin, ether and litecoin.

📊 Estonian Prime Minister, Kaya Kallas, said that she rules out implementing cryptocurrencies into the country’s economy.

📊 According to Chainalysis, transmit volume in Africa amounted to $105.6 billion. It demonstrates a 1200% growth compared to last year’s numbers. The region’s crypto market remains the smallest in the world.

📊 According to the Fidelity Digital Assets survey, 90% of respondents find digital currencies an attractive investment tool. 8 out of 10 investors are considering including bitcoin in their portfolio. 52% have already invested in cryptocurrencies.

Decentralised Finance (DeFi)

📊 Cointelegraph: the Texas State Securities Board has filed for a hearing with the potential to impose a cease and desist order against crypto lending firm Celsius Network for not offering securities licensed at the state or federal level, while the New Jersey Bureau of Securities has ordered the platform to stop offering and selling interest-earning cryptocurrency products.

📊 The Economist magazine dedicated the cover of its next edition to decentralised finance, stating that “DeFi is certainly one of three tech traits disrupting finance”.

📊 According to JPMorgan, the second quarter of 2021 saw an increase in DeFi adoption by institutional investors as more than 60% of all DeFi transactions were over $10 million versus less than half in the broader crypto market.

📊 According to DappRadar, the share of DeFi protocols in the traffic of decentralised apps fell from 54% to 18% from June to August 2021.

📊 Since the beginning of this week, hackers have withdrawn 277 BTC from the pNetwork DeFi protocol, as well as 8,804.7 ETH and 213.93 BTC from the DeFi project, Vee․Finance. In total, about $47 million was withdrawn.

NFT and gaming

📊 DappRadar reports that the industry’s interest is shifting towards games, the number of Unique Active Wallets connected to game dapps increased 64% month-over-month, whilst DeFi and NFT unique wallets increased only 3% and 6%, respectively, during the same period. The share of games and NFT traffic among decentralised apps decreased from June’s level of 46% to 41%.

📊 According to DappRadar, the blockchain game Axie Infinity has reached record NFT sales of over $2 billion. Axie Infinity remains the most popular collectible game to date.

📊 Apple has blocked the update of the mobile ether wallet, Gnosis Safe, due to support for NFT storage.

📊 Mastercard has launched its first ever NFT which will be awarded via a sweepstake to one UK Mastercard holder.

📊 Decentralised music streaming platform, Audius, has successfully raised an additional $5 million. Famous artists such as Katy Perry, Jason Derulo, The Chainsmokers, Linkin Park’s Mike Shinoda and others have invested in the project.

📊 Russian rapper and video blogger, Morgenstern, will release a NFT series with new songs, music videos and other content.

📊 Burger King has announced the launch of a NFT campaign. As a part of this initiative, QR codes will appear on nearly six million meal boxes, unlocking a digital collectible.

Mining

📊 LSE-listed mining company, Argo Blockchain, has opened IPO on the Nasdaq stock exchange.

📊 In the second quarter of 2021, the revenue of a bitcoin mining hardware manufacturer, Canaan, reached $167.5 million which is the highest volume of quarterly sales in the history of the company. Canaan has announced a stock buyback program up to $20 million.

📊 Major bitcoin mining company, Genesis Digital Assets, has secured $431 million in funding to expand its industrial-scale mining operations in the United States and Nordics. The new funds will help the company to continue expanding operations from the current 170 megawatts to 1.4 gigawatts in mining capacity by 2023.

📊 Chinese provinces Hebei and Gansu will take measures to curb the mining and trading of cryptocurrencies. Inner Mongolia has hired a contractor to fight illegal mining.

EXMO news

Cryptohopper trading bot is now available to all EXMO traders. Connect your EXMO exchange account to Cryptohopper and benefit by making use of expert tools without requiring any special coding skills.

EXMO supports the monthly reports published by CryptoCompare. Read the Exchange Review of August 2021 and stay on top of cryptocurrency trends with access to proven insights from the global leader in digital asset analytics.

That’s all for this week! Follow EXMO on YouTube, Twitter and Telegram to stay tuned to the main events and trends in the crypto market.