Back to News

Back to News

Weekly recap: crypto market awaits a bullish rally

Whales set a new record for the number of held BTC, which exceeded the $47,000 mark in price. Meanwhile, China is preparing to release the digital yuan to the masses for the 2022 Olympics. Read the Weekly recap to find out more about the main events of the crypto market that happened between 8th and 15th September 2021.

Crypto market in numbers

Crypto market capitalisation has held above $2 trillion during the week and currently stands at $2.13 trillion, according to CoinMarketCap.

Daily trading volumes, which rose sharply on 8th September amid the market crash, returned to their usual levels. Over the week, they decreased by 56% to $106.8 billion.

By 11th September, the Crypto Fear & Greed Index had moved into the “Fear” zone and remained at about 30 points for several days. Currently, there is some recovery to 49 points of the “Neutral Zone” level.

Bitcoin dominance experienced a slight decline over the week from 42.1% to 41.6%. Over the past 30 days, the share of the first cryptocurrency on the market has decreased more noticeably – by 2.6%.

The share of ether dropped 0.7% over the week to 18.7%. A slight increase in altcoin dominance was observed only in the first week of September.

Bitcoin’s 30-day volatility index, after a sharp jump on 7th September to 3.7%, fell to 3.42% over the week, according to CryptoCompare.

As stated by Dropstab, BTC needs to rise by 37.5% to return to its ATH, ETH by 28%, ADA by 29.5% and XRP by 235%.

All Time High

| Coin | Date | ATH on EXMO, $ |

| ATOM | 14.09.2021 | 38.50 |

| DOT | 14.09.2021 | 40.00 |

| CRON | 13.09.2021 | 2.70 |

| ONE | 13.09.2021 | 0.23 |

| ALGO | 10.09.2021 | 2.44 |

Gainers of the week (9th – 15th September 2021)

| Coin | Opening price 09.09, $ |

Opening price 15.09, $ |

Change |

| XTZ | 4.43 | 7.23 | 63.3% |

| ATOM | 20.98 | 34.26 | 63.3% |

| HP | 0.0009 | 0.0014 | 53.6% |

| DOT | 28.23 | 37.50 | 32.8% |

| TRX | 0.09 | 0.12 | 27.5% |

Losers of the week (9th – 15th September 2021)

| Coin | Opening price 09.09, $ |

Opening price 15.09, $ |

Change |

| DOGE | 0.26 | 0.24 | -6.6% |

| BTG | 69.92 | 66.65 | -4.7% |

| DCR | 148.67 | 142.96 | -3.8% |

| WXT | 0.0079 | 0.0076 | -3.7% |

| IQN | 1.91 | 1.85 | -3.6% |

Easily track gainers and losers within the Simple trade section on EXMO. Check real-time updates in the last 24 hours, week and month.

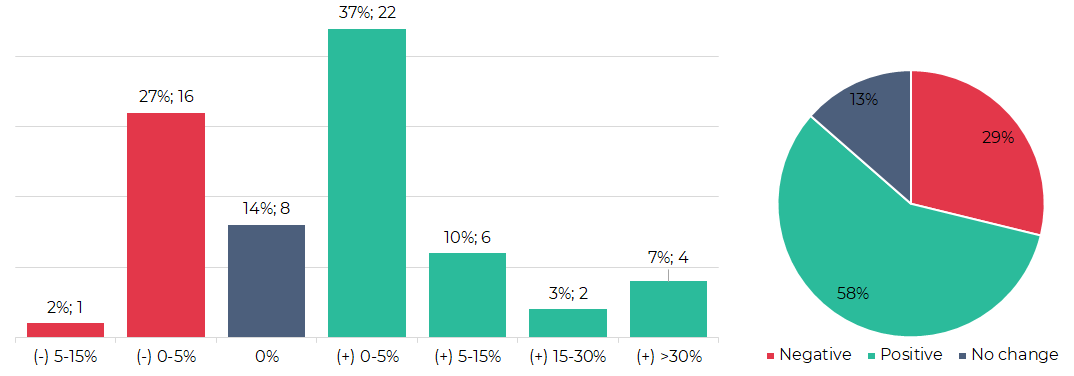

Segmentation of cryptocurrencies based on trading results (9th – 15th September 2021)

Most traded coins (8th – 14th September 2021)

| Coin | Trading volumes, $ |

| BTC | 38,621,748 |

| ETH | 32,346,883 |

| XRP | 12,441,673 | ADA | 4,023,847 |

| CRON | 3,579,786 |

| LTC | 3,256,367 |

| ALGO | 1,809,148 |

| DASH | 1,590,048 |

| WAVES | 1,373,384 |

| ROOBEE | 1,208,026 |

Top crypto market driving factors

The overall crypto market

▲ 14.09.2021 – Coin Metrics: the total number of unique cryptocurrency wallets created on major blockchains continues to grows, indicating market recovery after the crash.

Bitcoin (BTC)

▼ 08.09.2021 – Two of MicroStrategy’s top executives sold a part of their options in August, in order to increase the company’s bitcoin reserves.

▼ 10.09.2021 – Glassnode: the number of addresses holding 1,000 or more bitcoins dropped to a 15-month low of only 2,125.

▲ 13.09.2021 – MicroStrategy has purchased an additional 5,050 bitcoins for approximately $242.9 million in cash.

▲ 14.09.2021 – Glassnode: long-term holders currently own the most coins in history, hitting 12.97 million BTC (~$596.6 billion).

Ethereum (ETH)

▲ 08.09.2021 – Santiment: the top 10 largest whale addresses now own 21.38% of all ETH, which is the largest supply since 4th May 2017.

▲ 09.09.2021 – Ethereum’s daily issuance went negative for the third time.

▲ 10.09.2021 – Open Interest (OI) for Ethereum futures on CME Group’s exchange reached $800 million, approaching May’s all-time high. The daily trading volume exceeded $2 billion.

▲ 13.09.2021 – The total value of blocked assets (TVL) in Arbitrum’s second-level Ethereum solution grew by more than 3200% over the week and reached $2.2 billion.

Cardano (ADA)

▲ 12.09.2021 – The Alonzo upgrade that brings smart contract capability to the network was successfully deployed on the Cardano blockchain.

XRP (XRP)

▲12.09.2021 – Japanese crypto exchange TAOTAO, owned by SBI Holdings, will relist XRP on 22nd September 2021.

Litecoin (LTC)

▲ 08.09.2021 – Litecoin developers have announced the release of OmniLite – a decentralised platform that allows for creating tokens/assets via the Litecoin blockchain.

▲ ▼ 13.09.2021 – A fake press release announced that Walmart would be accepting payments in Litecoin. Walmart reached out to CNBC to immediately deny the reports.

Algorand (ALGO)

▲ 08.09.2021 – Cloud solutions provider, Guardrail, accepts a grant from the Algorand Foundation to develop solutions for Algorand’s node infrastructure on AWS, Azure and GCP.

▲ 10.09.2021 – Algorand Foundation launches Viridis Fund that will provide 150 million Algo to support DeFi innovation.

▲13.09.2021 – e-Money announced that it will launch its European-currency pegged stablecoins on the Algorand blockchain.

Harmony (ONE)

▲ 09.09.2021 – Harmony announced the launch of a $300 million ecosystem fund aimed at attracting developers and investors.

Zcash (ZEC)

▲ 10.09.2021 – The Zcash Foundation team said that at the end of August, the total value of the shielded Sapling pool reached an all-time high of 743,000 ZEC. The number of transactions has doubled compared to last year.

Crypto market trends

Regulation

📊 According to data from Good Jobs First’s violation tracker, the fines levied against digital asset exchanges account for less than 1% of those against traditional financial institutions. Data shows that there were $332.9 billion in penalties from banks, investment firms and brokers during the last 20 years.

Fines for crypto-related violations have hardly totalled $2.5 billion in the U.S. In the coming years, the study’s authors expect many new enforcement actions to be implemented from U.S. regulators against those in the crypto space.

📊 The Treasury and Internal Revenue Service (IRS) retain cryptocurrency tax guidance as a ‘priority’ for 2021-2022.

📊In a prepared statement for his testimony at the Senate Committee on Banking, Gary Gensler, the U.S. SEC chairman, noted that the SEC will tighten the regulation of cryptocurrency exchanges, paying special attention to unregistered securities.

📊 Seychelles’ Financial Services Authority is working on a policy to either prohibit or license crypto trading platforms as registered international businesses.

📊 After 24th September, almost 40 of South Korea’s estimated 60 crypto operators are expected to be shut down due to non-compliance with legal requirements.

📊 The Central Bank of Russia has recommended that domestic commercial banks classify their customer’s crypto exchange-related card and e-pay transactions as suspicious and block them.

📊 Mauricio Moura, a current director of the Central Bank of Brazil, stated that local regulators are preparing a regulation banning anonymity in cryptocurrency transactions in the country.

📊 The US Senate discussed the need to regulate cryptocurrency exchanges. SEC Chairman, Gary Gensler, highlighted that all cryptocurrency exchange listing securities must register with the SEC. According to Gensler, the department intends to introduce stricter regulations for crypto platforms.

CBDC and stablecoins

📊 The Bank of International Settlements has urged central banks to facilitate the development of CBDCs to compete with initiatives in the private sector, including cryptocurrencies.

📊 The U.S. Treasury Department met with representatives of the banking community and credit unions to quiz them about the risks and benefits that stablecoins pose to the traditional U.S. financial system.

📊 According to Bloomberg, the Treasury Department and other federal agencies are nearing a decision on whether to launch an examination of stablecoins. It has not specified when the investigation will begin and which companies will be examined. The media conglomerate also reports that the President’s Working Group plans to issue stablecoin recommendations by December 2021.

📊 According to The Washington Post, the White House is extremely concerned about the growth potential of the Diem stablecoin and its possibility to threaten the entire economy. Despite the fact that Diem is an independent association, it is backed by Facebook. At the same time, a Diem executive, who spoke on the condition of anonymity to reveal private discussions, said that regulators had told Diem that its stablecoin design was “positive”.

📊 The launch of the digital ruble, the third form of money issued by the Bank of Russia, will become one of the key digitisation projects before 2030.

Acceptance of cryptocurrencies

📊 On 7th September, the day when El Salvador’s Bitcoin law took effect, the country’s public debt market was under the selling pressure of bond investors amid BTC’s price decrease to $44,000. Bonds with short-term maturities have yielded more than long term ones. Such a situation indicates the risks of a recession, as well as problems with servicing obligations that the country may face.

📊 El Salvador expects to attract foreign investors by exempting them from paying tax on Bitcoin gains.

📊 Starbucks, Pizza Hut and McDonald’s started accepting Bitcoin in El Salvador after the country adopted the cryptocurrency as legal tender. Bancoagrícola, El Salvador’s largest financial institution, began supporting a broad variety of Bitcoin-related services.

📊 Zimbabwe’s finance minister, Mthuli Ncube, expressed the opinion that the use of cryptocurrency and its introduction into everyday economic circulation could become the solution to the country’s financial problems. Ncube believes that it is necessary to create a state unit to study possible options for using bitcoin, and local banks should be allowed to invest in it.

📊 According to a poll created by YouGov, 27% of Americans would support making bitcoin legal tender.

📊 A survey carried out by Sherlock Communications shows that 48% of Brazilians supported making bitcoin their official currency, while only 21% rejected the idea.

Big business

📊 Two Fairfax County funds from the US state of Virginia have submitted applications to the regulator for approval of a $50 million investment in the Parataxis Capital Management fund.

📊 Hedge fund, Brevan Howard, said it would launch a new unit, BH Digital, to expand further into crypto.

📊 Bitwise launches the world’s first “Ex Bitcoin” crypto index fund. The company states that Bitcoin’s share of the total market capitalisation of the crypto space has fallen from 69% to 42% in the past year, while altcoins have grown in importance.

📊 Mastercard said that it entered into an agreement to buy CipherTrace, a blockchain analytics start-up.

📊 Global investment bank, Morgan Stanley, will create a dedicated digital asset research team.

📊 According to media reports, European bank CACEIS, owned by Crédit Agricole and Banco Santander, is developing cryptocurrency storage solutions.

Tokenisation

📊 Switzerland’s stock exchange SIX has received regulatory approval to launch its long-awaited bourse for digital assets. But despite obtaining two licenses from the Swiss Financial Market Supervisory Authority (FINMA), the exchange will not trade Bitcoin or other cryptocurrencies. The main goal of a new platform is to tokenise bonds and launch a Security Token Offering (STO) – tokenised IPO. The SIX developers also expect to issue NFT tokens.

📊The German Ministry of Finance has begun collecting comments on the draft resolution on the possibility of tokenising mutual fund shares.

That’s all for this week! Follow EXMO on YouTube, Twitter and Telegram to stay tuned to the main events and trends in the crypto market.