Back to News

Back to News

Weekly recap: ETH outpaces BTC

Ether outpaces Bitcoin in price growth since the beginning of the year, mining pools are being blocked in China, while El Salvador and the largest investors continue to buy BTC. Read the Weekly recap to find out more about the main events of the crypto market that happened between 24th November and 1st December 2021.

Crypto market in numbers

Crypto market capitalisation in 7 days rose 2.3% to $2.65 trillion, according to CoinMarketCap. There was no pronounced upward or downward movement during this period.

By the end of the week, daily trading volumes on the market also showed a slight increase of 2.9% to $130 million. The greatest revival of trading was observed on 26th November, on Black Friday, when during the American session, daily volumes rose to $170 million almost 2 times – up to $92 million.

The Crypto Fear and Greed Index has been in the “Fear” zone for almost the entire week. On 1st December, its value stood at 34 points.

Bitcoin dominance declined 0.8% over the week. On 1st December, its market share is 40.7%. Ether’s market share increased by 1.4% to 21.1%. The cryptocurrency has not exceeded 21% since July 2017. Over the past 7 days, the price of ETH has increased by 10%, while the BTC rate remained practically unchanged. The growth of assets since the beginning of the year is 94% and 546%, respectively.

ETH is almost back to its all-time high of early November. To reach this level, the asset needs to grow by 4%. BTC needs to rise by 21% to return to its previous all time high. Against this background, discussions were resumed on the possibility of ousting bitcoin from first place, in terms of capitalisation, by the second cryptocurrency. In order to achieve this, ETH needs to grow by another 49% relative to BTC.

Over the past 24 hours, ether trading volumes have almost equaled those of bitcoin – $30 million and $34 million, respectively. Bitcoin’s 30-day Volatility Index jumped sharply from 2.87% to 3.25% from 25th to 26th November. Since then, the indicator has held above 3.2%. The index reached 3.28% on 1st December, according to CryptoCompare.

Gainers of the week (25th November – 1st December 2021)

| Coin | Opening price 25.11, $ |

Opening price 01.12, $ |

Change |

| SHIB | 0.0000396 | 0.0000483 | 22.1% |

| XTZ | 5.02 | 5.60 | 11.6% |

| QTUM | 15.22 | 16.55 | 8.7% |

| ETH | 4,411.66 | 4,746.71 | 7.6% |

| WAVES | 20.90 | 22.30 | 6.7% |

Losers of the week (25th November – 1st December 2021)

| Coin валюта |

Opening price 25.11, $ |

Opening price 01.12, $ |

Change |

| HP | 0.0018 | 0.0012 | -33.9% |

| HB | 0.0035 | 0.0029 | -17.4% |

| TONCOIN | 3.64 | 3.03 | -16.8% |

| ZEC | 271.17 | 225.69 | -16.8% |

| GNY | 0.37 | 0.32 | -13.3% |

Easily track gainers and losers within the Simple trade section on EXMO. Check real-time updates in the last 24 hours, week and month.

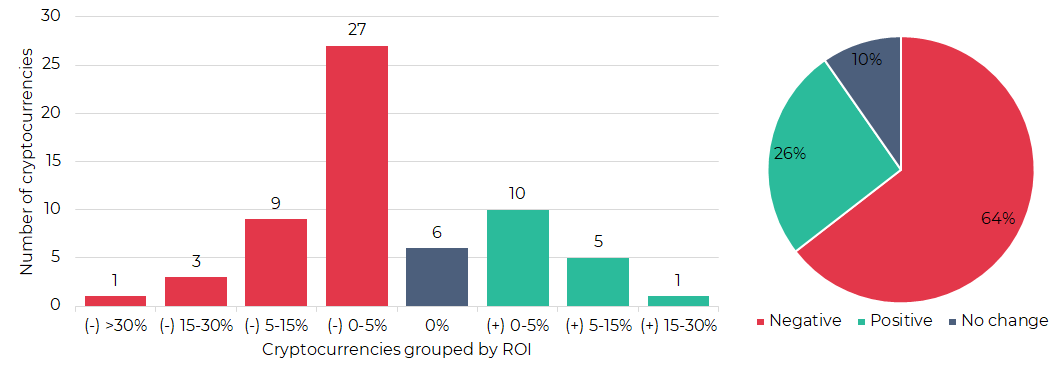

Segmentation of cryptocurrencies based on trading results (25th November – 1st December 2021)

Most traded coins (24th – 30th November 2021)

| Coin | Trading volumes, $ |

| BTC | 50,871,6636 |

| ETH | 41,147,907 |

| XRP | 9,921,097 |

| ZEC | 5,343,989 |

| SHIB | 4,263,417 |

| LTC | 2,647,126 |

| WAVES | 2,247,211 |

| ADA | 1,901,488 |

| DASH | 1,814,380 |

| SMART | 1,601,390 |

Top crypto market driving factors

Overall crypto market

▼ 24.11.2021 – Senate Banking Committee chair, Sherrod Brown, is calling on stablecoin operators to disclose information in relation to their processes by 3rd December 2021.

▲▼ 25.11.2021 – On 2nd December 2021, the SEC’s Investor Advisory Committee is set to hold a public meeting by remote means. The committee will discuss crypto and digital asset regulation, as well as analyse the consequences of exchange-traded crypto funds’ launch.

▼ 26.11.2021 – WHO recognised the new Covid strain, named Omicron, as a variant of concern. Financial market participants began to get rid of risky assets, including cryptocurrencies.

▼ 26.11.2021 – China has restricted access to domains of mining pools and crypto media.

▼ 26.11.2021 – China’s Central Bank is set to establish a crypto asset transaction tracking system to strengthen the regulation of digital assets.

▲ 28.11.2021 – Investing.com: up to 46% of unqualified Russian retail investors view cryptocurrencies as a potential defensive asset. Experts interviewed by Izvestia state that over the past year, Russians have increased their investments in the crypto market sixfold – to $300-500 billion.

▲ 29.11.2021 – CoinShares: digital asset investment products saw inflows totalling $306 million over the past week, which is the second-highest in six months, following the week when the first bitcoin ETF was launched.

▲▼ 30.11.2021 – Russian President, Vladimir Putin, believes that cryptocurrencies are not backed by anything and their volatility is colossal. Therefore, the risks are very high. He stated that perhaps this is the future; however, we need to carefully monitor the situation and how this process develops.

▼ 30.11.2021 – US Fed chair, Jerome Powel, stated that inflation is no longer temporary. Powell also said that the Fed may accelerate the winding down of bond-buying stimulus as the economy improves.

Bitcoin (BTC)

▲ 24.11.2021 – In the third quarter of 2021, Morgan Stanley funds significantly increased their exposure to Bitcoin through Grayscale Bitcoin Trust (GBTC). The Morgan Stanley Growth Portfolio increased its holdings of GBTC shares by 71% compared to the second quarter, Morgan Stanley Insight Fund – by more than 63% and Morgan Stanley Global Opportunity Portfolio – by 59%.

▲ 24.11.2021 – Blockdata: the Bitcoin network has processed more volume by dollar value than PayPal with an estimated average of $489 billion per quarter in 2021 compared to PayPal’s average of $302 billion per quarter. Both figures are, however, significantly lower than the average quarterly volumes of Mastercard and Visa: $1.8 trillion and $3.2 trillion, respectively.

▼ 25.11.2021 – CryptoCompare: bitcoin AUM fell by 9.5% to $48.7 billion in November, which is its largest month-on-month pullback since July.

▲ 26.11.2021 – Fintonia Group, a Singapore-based fund manager regulated by the Monetary Authority of Singapore (MAS), has launched two Bitcoin funds, with one of them being a physical one.

▲ 26.11.2021 – El Salvador’s Bitcoin Fund bought an additional 100 BTC amid BTC’s price decline.

▲▼ 27.11.2021 – Glassnode: On 25th and 26th November, Bitcoin’s network circulation exceeded 200,000, which indicates that more coins entered the market amid last week’s price correction.

▼ 28.11.2021 – Glassnode: bitcoin’s $5,000 undervaluation caused short-term holders to panic sell their BTC, with many of them selling at a loss.

▼ 29.11.2021 – Bitcoin mining difficulty has decreased for the first time since China’s crypto ban. As a result of the latest recalculation, the indicator decreased by 1.49% to 22.3 million hashes.

▼ 29.11.2021 – CryptoCompare: bitcoin’s share of crypto funds decreased by 3% in November amid an increasing amount of altcoin inflows.

▲ 29.11.2021 – Microstrategy has purchased an additional 7,002 bitcoins for about $414.4 million, at an average price of around $59,187 per bitcoin. As of 29th November, the company now has 121,044 BTC in its treasury. According to Bitcoin Treasuries, MicroStrategy owns 0.576% of the total BTC supply.

▲ 29.11.2021 – One of the largest US investment companies, Invesco, is set to launch a physically-backed Bitcoin ETP (BTIC) on Deutsche Börse’s XETRA plattform.

▲ 29.11.2021 – Ecoinometrics: bitcoin whales have once again started accumulating cryptocurrency. Between 25th October and 22nd November, increased BTC withdrawals from large wallets were observed.

▲ 29.11.2021 – Glassnode: bitcoin options open interest exceeded 400,000 BTC, which earlier forced traders to cover their positions. While there is no significant preponderance between long or short positions, it is difficult to predict further BTC price movements.

▲▼ 29.11.2021 – Santiment: the number of active addresses on the Bitcoin network continues to fall despite BTC’s price decline. Having neared record highs of 1.19 million, the number of daily active addresses dropped by 17%. Some investors are likely to go “dormant”.

▲ 01.12.2021 – Fidelity Investments has launched a Bitcoin exchange-traded fund in Canada.

Ethereum (ETH)

▲ 24.11.2021 – The Ethereum network has burned over 1 million ETH since the London upgrade. ETH emission has decreased by 39%, while inflation on the network has slowed to 1.8% per year.

▲ 24.11.2021 – JPMorgan Chase: ether could be a better bet for investors than bitcoin.

▲ 27.11.2021 – Ethereum co-founder, Vitalik Buterin, has introduced the new Ethereum improvement proposal (EIP-4488) aimed at lowering gas fees.

▲ 29.11.2021 – Dune Analytics: the number of Ethereum DeFi users reaches a record high of over 4 million, growing roughly eightfold in a year.

▲ 29.11.2021 – CoinShares: Ethereum saw inflows totalling $23 million last week, marking its 5th consecutive week of inflows.

▲ 29.11.2021 – American investment firm, Kelly Intelligence, files to launch an ether futures ETF with the SEC.

▲ 01.12.2021 – Santiment: Ethereum’s mega whale addresses, holding between 100,000 to 10 million ETH, have accumulated a record high of 52.6 million ETH or 44.4% of ETH total supply. Over the past 12 days, they have bought 676,000 ETH.

Cardano (ADA)

▲ 28.11.2021 – MuesliSwap has launched as the first decentralised exchange on the Cardano mainnet.

▼ 29.11.2021 – CoinShares: cardano saw outflows for the second consecutive week, which resulted in a 20% cardano AUM decrease to $87 million. Last week, $1.1 million DOT was withdrawn.

▲▼ 30.11.2021 – Messari: from the beginning of November, the number of active addresses on the Cardano network has almost tripled: from 161,330 to 485,693. But by the end of the month, this number dropped by 2.5 times – to 194,000.

XRP (XRP)

▲ 24.11.2021 – Fox Business: U.S. SEC officers involved in the case against Ripple could have close ties with Ethereum.

▲▼ 26.11.2021 – Jeb McCaleb, the co-founder and former Chief Technical Officer (CTO) of Ripple, hasn’t sold any XRP since the end of August this year.

Polkadot (DOT)

▲ 25.11.2021 – The Moonbeam smart contract platform wins Polkadot’s second parachain auction with $1.4 billion pledged.

▲ 29.11.2021 – CoinShares: Over the past week, polkadot was ranked first in terms of inflows relative to the total AUM, with 8.6% ($11.5 million) of AUM.

Dogecoin (DOGE)

▲ 24.11.2021 – Toronto-based health care services provider, Ask The Doctor, has added dogecoin, shiba inu and floki inu as payment options.

Shiba Inu (SHIB)

▲ 24.11.2021 – WhaleStats: Ethereum’s largest holders have accumulated nearly 50 trillion shiba inu “meme” tokens in their wallets ($2.1 billion as of 24th November), which is almost 9% of the token’s circulating supply. The total number of SHIB holders has reached a record high of above 995,000.

▼ 24.11.2021 – Nansen: an increasing number of wallets with significant holdings have been reducing their SHIB positions, possibly due to profit-taking. Data from blockchain data firm, Santiment, also shows that the number of SHIB transactions valued at more than $100,000 has been rising. The amount of daily unique addresses that deposit SHIB to centralised exchanges has also been increasing.

▲ 24.11.2021 – Toronto-based health care services provider, Ask The Doctor, has added dogecoin, shiba inu and floki inu as payment options.

▲ 25.11.2021 – Shiba Inu recently released a short video clip containing a possible hint about its future partnership. At the end of the video, the “WV” symbol was visible. Several days earlier, the lead developer of the SHIB team, Shytoshi Kusama, revealed that there is some good news right around the corner for the SHIB army.

▲ 26.11.2021 – Finbold: shiba inu has reached a milestone of over one million token holders, despite its 50% price decrease from the ATH recorded last month.

▲ 26.11.2021 – The electronic retail giant, Newegg, has finally confirmed that it will accept shiba inu payments.

▲ 27.11.2021 – Shytoshi Kusama has revealed the ecosystem development strategy for 2022. It includes the launch of the Shiba Inu Games platform, which will publish a series of games for mobile devices and computers. The first game will be developed by William David Volk, known as the co-designer of several mobile games, including iWhack, the very first iPhone game ever released.

▲ 30.11.2021 – WhaleStats: whales started acquiring SHIB again, and currently, they are holding more than $2.3 billion worth of tokens, which is 9% of the asset’s capitalisation.

Algorand (ALGO)

▲ 29.11.2021 – The Algorand Foundation has launched the largest ever altcoin option vaults in DeFi on ThetaNuts.

▲ 29.11.2021 – Algorand has become the first partner of Hivemind Capital Partners, a $1.5 billion multi-strategy venture fund, launched by a former Citi executive.

▲ 30.11.2021 – Borderless Capital, the Miami-based venture capital firm focused on the Algorand ecosystem, announced the launch of its $500 million Borderless ALGO Fund II.

Tezos (XTZ)

▲ 26.11.2021 – Linkin Park frontman, Mike Shinoda, is to launch music NFTs on the Tezos platform on 3rd December 2021.

PARSIQ (PRQ)

▲ 29.11.2021 – PARSIQ’s real-time monitoring technology has been successfully integrated into the Polygon Network.

EXMO news

GMT is listed on EXMO. The token is now available for deposits and trading in GMT/BTC and GMT/USDT pairs. In order to celebrate the listing, we have also launched a contest with a $10,000 prize pool.

Sologenic (SOLO) airdrop on EXMO. We are supporting the upcoming airdrop for XRP and SOLO holders from the SOLO Core Team.

That’s all for this week! Follow EXMO on YouTube, Twitter and Telegram to stay tuned to the main events and trends in the crypto market.