Back to News

Back to News

Weekly recap: crypto market enters correction after hitting new all time highs

BTC funds are ramping up investments amid the launch of bitcoin futures ETFs, whilst long-term holders shrink their balances. Meanwhile, Walmart is placing bitcoin terminals in its stores, and Mastercard is bringing crypto onto its network. Read the Weekly recap to find out more about the main events of the crypto market that happened between 22nd and 29th October 2021.

Crypto market in numbers

Crypto market capitalisation was above $2.5 trillion for most of the week. Amid the decline on 27th October, it fell by almost 2% in a week, according to CoinMarketCap.

The fall in the price of bitcoin and other cryptocurrencies was accompanied by a significant increase in trading volume. Daily volumes reached nearly $160 billion on 27th October, the highest level since 9th September, according to CoinMarketCap. For a week, the indicator has almost doubled.

The Crypto Fear and Greed Index maintains its position in the “Greed” zone. On 21st October, amid a new bitcoin ATH, the indicator entered the “Extreme Greed” zone by reaching 84 points – the maximum value in the last 30 days. Today, it stands at 73 points.

The dominance of bitcoin over the week gradually decreased from 47.5% to 44.8%. At the same time, the share of ether increased slightly – from 18% to 19.2%.

The 30-day bitcoin volatility index over the past week continued its downward trend, falling to 3.5%. The index has risen slightly over the past two days to 3.6% by 27th October, according to CryptoCompare.

All Time High

| Coin | Date | ATH on EXMO, $ |

| ONE | 26.10.2021 | 0.36 |

| BTC | 21.10.2021 | 67359.22 |

| ETH | 21.10.2021 | 4394.62 |

| DOT | 21.10.2021 | 44.66 |

Gainers of the week (21st – 27th October 2021)

| Coin | Opening price 21.10, $ |

Opening price 27.10, $ |

Change |

| ONE | 0.25 | 0.35 | 35.9% |

| VLX | 0.14 | 0.18 | 27.2% |

| ROOBEE | 0.0073 | 0.0091 | 25.0% |

| PRQ | 0.71 | 0.84 | 18.2% |

| ATOM | 36.06 | 42.60 | 18.1% |

Losers of the week (21st – 27th October 2021)

| Coin | Opening price 21.10, $ |

Opening price 27.10, $ |

Change |

| HP | 0.00198 | 0.00121 | -38.9% |

| HB | 0.0033 | 0.0024 | -26.5% |

| ZAG | 0.69 | 0.53 | -23.9% |

| GNY | 0.37 | 0.29 | -21.7% |

| ONT | 1.09 | 0.96 | -11.7% |

Easily track gainers and losers within the Simple trade section on EXMO. Check real-time updates in the last 24 hours, week and month.

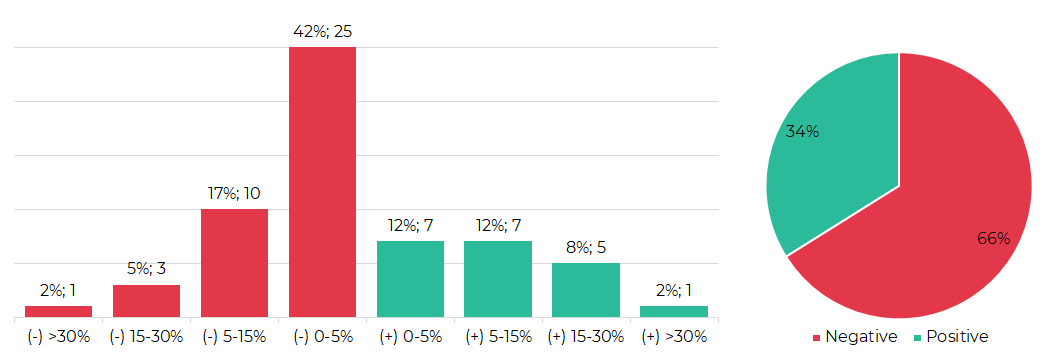

Segmentation of cryptocurrencies based on trading results (21st – 27th October 2021)

Most traded coins (20th – 26th October 2021)

| Coin | Trading volumes, $ |

| BTC | 54,692,341 |

| ETH | 36,885,845 |

| XRP | 7,403,586 |

| LTC | 2,703,119 |

| DOGE | 1,960,889 |

| CRON | 1,895,127 |

| ZEC | 1,569,047 |

| ADA | 1,254,329 |

| ROOBEE | 1,213,175 |

| DASH | 1,104,325 |

Top crypto market driving factors

The overall crypto market

▲ 25.10.2021 – CNBC: Mastercard is preparing to announce that any bank or merchant on its vast network will soon be able to provide crypto services.

Bitcoin (BTC)

▲ 20.10.2021 – The U.S. Securities and Exchange Commission (SEC) acknowledged a bitcoin futures ETF proposal from VanEck with trading scheduled for 25th October.

▲ 20.10.2021 – A spokesperson for Valkyrie Investments told CoinDesk that the Valkyrie bitcoin-linked fund also cleared the final regulatory hurdles. The new ETF is set to start trading on 22nd October.

▼ 21.10.2021 – Morgan Stanley is not allowing its advisors to offer clients the brand-new bitcoin futures-based ETF. The company is in the process of evaluating the product’s prospectus and conducting due diligence on the fund.

▲ 21.10.2021 – The Houston Firefighters’ Relief and Retirement Fund (Texas) has added Bitcoin and Ether worth $25 million to its portfolio.

▲ 21.10.2021 – American retail giant Walmart is letting customers buy bitcoin at dozens of its U.S. stores.

▲ 22.10.2021 – ProShares bitcoin futures ETF (BITO) has seen strong demand. With over 76% of contracts already being held, it is close to hitting the Chicago Mercantile Exchange’s (CME) limit for the number of permissible bitcoin futures contracts.

▲ 22.10.2021 – The Valkyrie Bitcoin Strategy Fund (BTF) started trading on the Nasdaq Exchange.

▲ 25.10.2021 – CoinShares: Bitcoin products and funds saw inflows of 1.45 billion over the past week. This amount accounted for 24% of the total inflows since the beginning of the year and turned out to be 21 times the amount of inflows seen in the previous week (earlier considered a record one in terms of investments).

▲▼ 25.10.2021 – Glassnode: Amid bitcoin hitting new ATHs, the balances of long-term holders saw a reduction of about 39.5K BTC over the past two weeks. In total, they are currently holding more than 13 million BTC – an all-time record.

Ethereum (ETH)

▲ 21.10.2021 – The media reports on the possibility of launching an ether futures ETF in the United States. VanEck and ProShares have submitted separate filings with the U.S. SEC for such products.

▲ 21.10.2021 – The Houston Firefighters’ Relief and Retirement Fund (Texas) has added Bitcoin and Ether worth $25 million to its portfolio.

▲ 27.10.2021 – The Altair hardfork, the first upgrade for Ethereum 2.0, is scheduled for 27th October. It is the first step towards bringing the Proof-of-Stake (PoS) consensus algorithm to the main Ethereum platform.

▲ 25.10.2021 – Sino Global Capital, the China-based crypto venture capital firm, has launched a $200 million fund aimed at supporting startups in the Ethereum and Solana ecosystems.

▼ 25.10.2021 – CoinShares: Ethereum saw outflows for a third consecutive week, totalling $1.4 million last week.

Cardano (ADA)

▲ 22.10.2021 – Australian luxury spirits maker, Strait Brands, taps the powers of the Cardano blockchain to manage its supply chain network.

▲ 25.10.2021 – CoinShares: Cardano-based products recorded inflows of $5.3 million over the past week, which is almost twice the amount of inflows seen during the previous week.

XRP (XRP)

▼ 20.10.2021 – A federal judge has approved the U.S. SEC’s request to extend the discovery phase of its lawsuit against Ripple by an additional two months.

▲ 25.10.2021 – Payment technology company, Pyypl, will use Ripple’s ODL solution and XRP cryptocurrency for cross-border payments between the Middle East and the Philippines.

▲ 26.10.2021 – Santiment: the XRP Network has seen a major rise in active addresses in October. Analysts note the increased social media attention to XRP and expect XRP price upticks in the near future.

Dogecoin (DOGE)

▼ 24.10.2021 – Elon Musk tweeted that neither he, nor the head of his family office, Jared Birchall, nor anyone he knows has anything to do with nonprofit organisation The Dogecoin Foundation.

▼ 24.10.2021 – In a comment under the post of Dogecoin co-founder Billy Marcus, Elon Musk noted that Twitter has become a platform for the spread of fraudulent cryptocurrency schemes.

▲ 24.10.2021 – Elon Musk calls Dogecoin “people’s crypto” and claims that many of his Tesla and SpaceX employees own the meme cryptocurrency.

Chainlink (LINK)

▲ 22.10.2021 – The Associated Press taps the Chainlink oracle network to make its data accessible to leading blockchains.

▲ 25.10.2021 – Terra blockchain developers have started testing ChainLink price feeds.

Stellar (XLM)

▲ 25.10.2021 – The Stellar Development Foundation (SDF) announced that Flutterwave, a global payments technology company, has launched two new remittance corridors between Europe and Africa on the Stellar network.

Uniswap (UNI)

▲ 26.10.2021 – Digital asset investment company, Valour, announced the launch of the Valour Uniswap ETP on the Boerse Frankfurt Zertifikate AG.

Cosmos (ATOM)

▲ 21.10.2021 –Terra’s UST stablecoin and sought-after governance token, LUNA, have been integrated into the Cosmos ecosystem.

▲ 22.10.2021 – Asia Digital Bank Ltd. (Labuan Investment Bank) has partnered with blockchain tech provider, Bianjie, to build a new digital infrastructure that bridges the gap between centralised and decentralised finance. ADB’s new system will be powered by Cosmos.

Crypto market trends

Regulation

📊 The Financial Action Task Force (FATF) has finalised the crypto anti-money laundering guidance for cryptocurrency firms that will be published next week. The guidance does not contain new requirements but explains how FATF standards apply to stablecoins.

📊 The Federal Deposit Insurance Corporation (FDIC) looking to provide a clearer path of how banks and their clients could hold cryptocurrencies. Jelena McWilliams, who chairs the FDIC, said the team of U.S. bank regulators is working on a relevant roadmap for banks. The roadmap will include clearer rules over holding cryptocurrencies in custody to facilitate client trading, using them as collateral for loans, or even holding them on balance sheets like more traditional assets.

📊 The SEC gets a path to rein in stablecoins as the U.S. weighs new rules, according to Bloomberg. It is expected that stablecoins will be saddled with the same requirements as bank deposits.

📊 The Commodity futures exchange commission (CFTC) is investigating decentralised prediction platform, Polymarket, according to a report from Bloomberg. The regulator initiated an investigation as Polymarket is in talks to secure a new round of funding that could value the platform at nearly $1 billion.

📊 China Tax News, a Chinese Official Newspaper, asks the Chinese government to impose taxes on crypto. It states that the Chinese crypto ban does not exempt owners of digital assets from paying taxes on income from crypto storage and activities outside the country’s borders.

CBDC and stablecoins

📊 G7 finance officials and Central Bank governors agreed on 13 public policy principles for retail central bank digital currencies (CBDC). The joint statement notes the need to coordinate the launch of CBDC by any state at an international level.

📊 The Chinese government is reportedly pressing US-based firms, including McDonald’s, Nike and Visa, to accept digital yuan payments.

📊 Members of the Eurasian Economic Union (EAEU) stated that they have no plans to introduce a single digital currency. The parties do not have a common opinion on the need to develop a harmonised legal framework on the use of digital assets, digital signs and cryptocurrencies in the union.

📊 Nigeria has become the first African nation to launch a digital currency – the eNaira. The country’s authorities opposed the use of cryptocurrencies in the republic. The Central Bank of Nigeria has prohibited cryptocurrency transactions and the country has followed China’s footsteps in piloting digital currency.

📊 Research firm, Hindenburg Research, has offered a $1 million reward for disclosing previously unknown collateral for Tether.

📊 Stablecoin issuer, Tether, will begin testing the Notabene digital user identity solution. This will help Tether to comply with the FATF requirements.

Acceptance of cryptocurrencies

📊 Cointelegraph, referring to the former chairman of the Fintech Association of Hong Kong (FTAHK), Henri Arslanian, states that the number of traditional OTC crypto brokers in Hong Kong certainly stands out. The media also notes that physical crypto storefronts are “a unique trademark” of the region. Besides this, an older customer base is said to be important for creating mainstream adoption since many of these people still hold fiat currency and only trust traditional financial systems.

📊 The largest American retailer Walmart has installed 200 bitcoin terminals in its stores.

📊 The Korean Teachers’ Credit Union, which manages $40 billion in assets, plans to invest in bitcoin through investment products. If the initiative is implemented, it will become the first such organisation in the country to invest in BTC.

Big business

📊 Pimco, a $2 trillion investment firm, could potentially begin trading spot cryptocurrencies, the firm’s chief investment officer, Daniel Ivascyn, confirmed to CNBC.

📊 The crypto investment firm, Galaxy Digital, as well as venture capital companies, Multicoin Capital and Variant, plan to invest $325 million, $250 million and $110 million, respectively, in crypto startups.

📊 The Chicago Board Options Exchange (CBOE) confirmed it was buying Eris Digital Holdings (ErisX). Terms and amount of the deal were not disclosed. It is expected to close in the first half of 2022.

📊 Sequoia Capital, the world’s oldest venture capital firm is changing its fund structure entirely, which will enable it to further increase its investments in cryptocurrencies and IPOs.

Mining

📊 Kazakhstan Electricity Grid Operating Company stated that Kazakhstan will have to financially cover its unscheduled electricity consumption due to the influx of miners from China. The exact amount of the overpayment to Russia, the country’s gas provider, has not been disclosed.

📊 Legal mining market players bring Kazakhstan 98 billion tenge ($230 million) annually, according to the National Association of the Blockchain and Data Center Industry of Kazakhstan. The country can potentially collect about $300 million in tax revenues.

📊 Some miners from Kazakhstan began relocating to the United States. Many mining companies have suffered from power limitations during the winter period.

📊 Argentine lawmakers demand that the government disclose what the terms of the deal are with Bitfarms, concerning the construction of the Bitfarms mining centre in the country.

📊 Shares of Pennsylvania bitcoin miner Stronghold Digital Mining surged by about 60% on their first day of trading on Nasdaq. The company mines bitcoin from waste coal – a cheap source of power from thermal power plants.

📊 Bitcoin infrastructure firm Blockstream has completed six tranches of its Bitcoin mining security token offering (STO). In total, Blockstream has so far raised more than €30.9 million ($36 million) via the sale of Blockstream Mining Notice (BMN). The sixth tranche of its BMN token helped the company raise 13.9 million euros ($16.1 million).

📊 Bitcoin mining companies continue to increase their computing power. Last week, Hut8 and Greenidge Generation announced new acquisitions of ASIC mining machines.

NFT and gaming

📊 According to Galaxy Digital Research, NFT sales have already exceeded $3 billion in October.

📊 According to research from Moonstream, the top 17% of all addresses on the Ethereum network own about 81% of NFTs. Among them are whales, NFT platforms and exchanges.

📊 Chinese tech giants, Ant Group and Tencent, have changed the term “non-fungible tokens” (NFT) to “digital collectibles” on their platforms and sites. Journalist Colin Wu, citing his own sources, said that regulators have banned Internet companies from using the NFT name and tightened market surveillance.

📊 Reddit is looking to hire a senior backend engineer to develop its own NFT platform.

📊 Auction house Sotheby’s invests in a $20-million round for Mojito, an NFT commerce suite.

📊 According to the BGA report, the number of wallets registered in games on the blockchain reached 1.54 million in the third quarter – up 25% from the previous quarter and 509% from the same period last year. The accumulation, exchange and trading of in-game cryptocurrencies with other players have become key drivers of the growth in demand for blockchain games.

📊 Hong Kong-based mobile gaming and blockchain start-up, Animoca Brands, raised US$65 million in the second round of funding as its pre-money valuation hit $2.2 billion.

📊 NFT startup, Candy Digital, raised $100 million in a Series A financing round, raising its value to $1.5 billion. The company will be promoting the expansion of sports-focused collectible NFTs. Major League Baseball (MLB) has become the company’s first partner.

EXMO news

ROOBEE on EXMO: contest with Apple prizes and new pair with USDT. We have launched a Roobee contest, where you can win both Apple gadgets and ROOBEE tokens.

EXMO is supporting the upcoming airdrop for SGB holders from Flare Finance. EXFI will be distributed, in proportion to the number of tokens that the EXMO exchange receives.

That’s all for this week! Follow EXMO on YouTube, Twitter and Telegram to stay tuned to the main events and trends in the crypto market.