Back to News

Back to News

Weekly recap: the market continues to go down

Crypto hedge fund, Three Arrows Capital, plunges into liquidation due to debt, OTC platform Genesis Global Trading faces hundreds of millions in potential losses, while almost $4 billion bitcoin miner loans are at risk of default. Meanwhile, Goldman Sachs plans to buy Celsius Network in the event of a bankruptcy filing. Read the Weekly recap to find out more about the main events of the crypto market that happened between 23rd and 30th June 2022.

Crypto market in numbers

The crypto market’s capitalisation remained at above $900 billion for most of the week. Since 23rd June, a gradual recovery was observed. On Sunday, the indicator rose to $976 billion, according to CoinMarketCap. But on 30th June, it moved down and headed towards $850 billion.

Trading activity continued to decline. Between 23rd and 29th June, trading volumes stood at $401 billion, down 22% compared to the previous week. The average daily trading volume for the week was $57 billion.

The Cryptocurrency Fear & Greed Index indicated a slight market sentiment improvement. Its median value was 12 points, up 3 points from the previous week.

Bitcoin’s dominance hovered just below 43% during the entire week. The market share of ether rose to 15.7% at the beginning of this week, after falling to 14.4% last Thursday. But after that, the indicator rolled back to 14.6%.

The market remained highly volatile. The 30-day bitcoin volatility index held above 4.8% all week. Only on 29th June, it did drop to 4.56%. The 30-day ether volatility index climbed to 6.5% over the weekend. Yesterday, it stood at about 6.13%.

Gainers of the week (24th – 30th June 2022)

| Coin | Opening price 24.06, $ | Opening price 30.06, $ | Change |

| EXM | 0.018 | 0.022 | 20.2% |

| ZRX | 0.33 | 0.35 | 7.3% |

| TON | 1.19 | 1,21 | 1.5% |

Losers of the week (24th – 30th June 2022)

| Coin | Opening price 24.06, $ | Opening price 30.06, $ | Change |

| ONE | 0.036 | 0.019 | -47.8% |

| PRQ | 0.15 | 0.12 | -23.3% |

| WAVES | 6.97 | 5.39 | -22.7% |

| SOL | 42.84 | 33.87 | -20.9% |

| ALGO | 0.38 | 0.30 | -20.7% |

Easily track gainers and losers within the Simple trade section on EXMO. Check real-time updates in the last 24 hours, week and month.

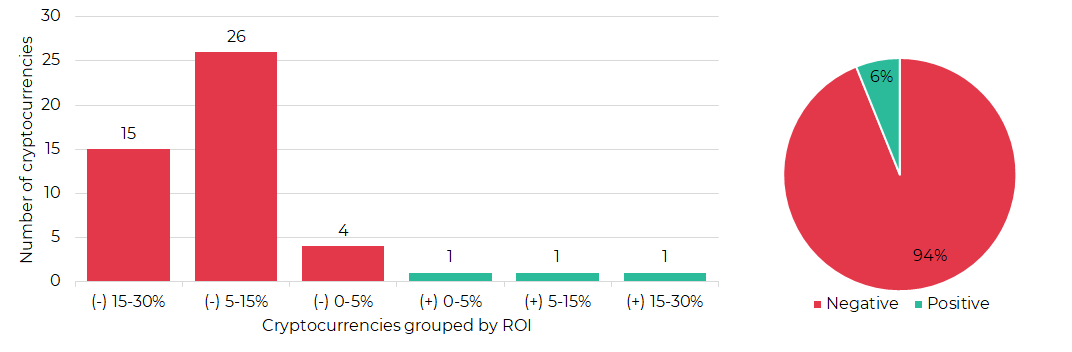

Segmentation of cryptocurrencies based on trading results

(24th – 30th June 2022)

Most traded coins ( 23rd – 29th June 2022)

| Coin | Trading volumes, $ |

| ETH | 10,080,695 |

| BTC | 9,395,929 |

| XRP | 1,347,755 |

| WAVES | 811,619 |

| LTC | 639,902 |

| ROOBEE | 623,287 |

| GMT | 614,376 |

| TON | 502,215 |

| BCH | 261,279 |

| ADA | 255,562 |

Top crypto market driving factors

Overall crypto market

▼ 23.06.2022 – The Monetary Authority of Singapore (MAS) has opposed the legalisation of private cryptocurrency companies, but intends to support government initiatives.

▼ 24.06.2022 – Three Arrows Capital (3AC) hedge fund is neither registered with the Dubai Financial Services Authority nor regulated by the entity.

▼ 24.06.2022 – The Wall Street Journal: the crypto lending platform, Celsius Network, has hired restructuring consultants to advise on a possible bankruptcy filing.

▲ 25.06.2022 – Goldman Sachs is looking to raise $2 billion to buy Celsius assets at bargain prices if the crypto lender goes bankrupt.

▲▼ 25.06.2022 – On 30th June, The European Parliament, the European Commission and the Council of the EU will hold a final discussion of the MiCA bill on the regulation of cryptocurrencies.

▼ 27.06.2022 – Cryptocurrency investor and analyst, Mike Alfred: US law enforcement prevented Celsius CEO, Alex Mashinsky, from leaving for Israel.

▼ 27.06.2022 – The Block: Celsius Network is resisting a recommendation from its own lawyers to file for Chapter 11 bankruptcy. According to people who know the situation, the company believes users can show their support by engaging “HODL Mode” in their Celsius accounts.

▼ 27.06.2022 – Crypto broker, Voyager Digital, issued a notice of default to hedge fund Three Arrows Capital (3AC).

▼ 27.06.2022 – The Wall Street Journal: more hedge funds are betting against Tether as crypto melts. Tether CTO, Paolo Ardoino, noted that it seemed to be a coordinated attack from the beginning. The company holds over 100% stablecoin collateral, with all USDT redeemed at $1.

▼ 27.06.2022 – CoinShares: between 20th and 24th June, digital asset investment products saw outflows totaling $423 million, the largest since records began by a wide margin. However, in percentage terms, these were the third largest on record, representing 1.2% of AuM. Almost all outflows come from the Canadian Purpose Bitcoin ETF. The outflows occurred on 17th June but were reflected in last week’s figures due to trade reporting lags.

▲ 27.06.2022 – CoinShares: multi-asset investment products saw inflows totaling $2.2 million last week.

▼ 28.06.2022 – Canada-based investment firm, Cypherpunk Holdings (HODL), has sold all of its bitcoin and ether holdings.

▲ 28.06.2022 – A spokesperson for Celsius has denied rumours that the company’s CEO tried to flee the U.S. last week. The firm continues working on restoring liquidity.

▼ 29.06.2022 – Sky News: a court in the British Virgin Islands has ordered the liquidation of Singapore-based Three Arrows Capital.

▼ 29.06.2022 – The Wall Street Journal: Celsius had double the risk profile of traditional banks.

▼ 30.06.2022 – CoinDesk: cryptocurrency market maker and lending firm, Genesis Trading, is facing potential losses into “hundreds of millions,” due to the loss of liquidity of counterparties 3AC and Babel Finance.

Bitcoin (BTC)

▼ 24.06.2022 – Bloomberg: the fall of Bitcoin put $4 billion in miner loans at risk of default. Galaxy Digital, as well as NYDIG, BlockFi, CelsiusNetwork, Foundry Networks and Babel Finance have been heavily lending against hardware, said Ethan Vera, co-founder of the mining pool, Luxor Technologies.

▼ 25.06.2022 – Estimated power consumption of the Bitcoin network has fallen by over 25% already. Miners have begun to stop using obsolete equipment, which is becoming unprofitable.

▼ 25.06.2022 – JPMorgan strategist, Nikolaos Panigirtzoglo: mining companies in need of liquidity in the third quarter are able to continue to exert downward pressure on the quotes of BTC.

▲ 27.06.2022 – CoinShares: between 20th and 24th June, Bitcoin funds, with the exception of Purpose Bitcoin ETF, saw aggregate inflows of $70 million.

▼ 27.06.2022 – CoinShares: in general bitcoin saw outflows totaling $453 million over the past week, leaving total Bitcoin AuM at $24.5 billion – the lowest level since the beginning of 2021. Year-to-date inflows now total $26 million.

▲▼ 27.06.2022 – CoinShares: between 20th and 24th June, short-Bitcoin saw inflows totaling $15 million – 59% of inflows since the beginning of the year. The reason behind this was the launch of the first US-based Short Bitcoin Strategy ETF from ProShares. However, other similar BTC funds suffered outflows.

▲ 28.06.2022 – U.S. Securities and Exchange Commission Chair Gary Gensler: bitcoin (BTC) is a commodity.

▼ 29.06.2022 – 75% of Marathon Digital Holdings’ mining capability was out of commission since a severe storm hit Montana on 11th June. Marathon’s CEO, Fred Thiel, stated that the facility could begin mining again at a reduced capacity as early as the first week of July.

▲ 29.06.2022 – Analytical software provider, MicroStrategy, has purchased an additional 480 bitcoins for about $10.0 million at an average price of about $20,817 per bitcoin.

Ethereum (ETH)

▲ 23.06.2022 – IntoTheBlock: Ethereum’s active addresses increased by 28% since the beginning of the year.

▲ 25.06.2022 – The Norwegian government will launch a solution to create capitalisation tables on the Ethereum blockchain.

▼ 24.06.2022 – Lido DAO begins voting on whether to limit its Ethereum staking dominance.

▲ 27.06.2022 – CoinShares: between 20th and 24th, Ethereum saw inflows totaling $11 million, the first following 11 consecutive weeks of outflows.

▼ 27.06.2022 – Morgan Stanley report: if Ethereum moves to a proof-of-stake (PoS), it will slow the demand for graphics processing units (GPUs) and dramatically reduce energy requirements. Moving to PoS won’t solve Ethereum’s scaling problems such as the number of transactions per second or result in lower transaction fees.

▲ 28.06.2022 – Anchorage Digital, a digital platform that owns the first federally chartered crypto bank, launches Ethereum staking for institutional investors after the network’s long-promised shift PoS.

▼ 28.06.2022 – Santiment: the ratio of positive to negative comments on Ethereum is the lowest in the last 4 years.

▲ 30.06.2022 – Santiment: Ethereum shark and whale addresses (holding between 100 to 100,000 ETH) collectively added 1.1% more of the coin’s supply to their bags.

XRP (XRP)

▲ 23.06.2022 – The XRPL Labs team launches Xumm Wallet Pro Beta, while XRP gains 14%.

▲ 24.06.2022 – Ripple opens a new office in Toronto that will serve as a key engineering hub.

▲ 26.06.2022 – Ripple co-founder and former CTO, Jed McCaleb, now has less than 114 million XRP left in his wallet. He is anticipated to run out of it in 30 days.

Cardano (ADA)

▲ 23.06.2022 – The Cardano Foundation (ADA) has joined the Linux Foundation as a Gold member.

▲ 24.06.2022 – Cardano founder and Ethereum co-founder, Charles Hoskinson, has suggested a different approach to the regulation of cryptocurrencies in the form of a public-private partnership similar to the internet.

▼ 28.06.2022 – Santiment: Cardano is seeing the least amount of unique addresses interacting on its network in a year. On top of this, sentiment on social platforms has fallen to a 4-month low.

▲ 30.06.2022 – The Cardano blockchain developers submitted an updated proposal to hard fork the Cardano testnet. If everything goes smoothly, the upgrade to the testnet will take place on 03rd July.

Solana (SOL)

▲ 24.06.2022 – Solana Laboratories unveiled the Saga, its first smartphone based on the Android operating system. The device will be preinstalled with a set of Solana Mobile Stack (SMS) tools, which allows you to create decentralised applications for mobile phones.

Dogecoin (DOGE)

▲ 27.06.2022 – IntoTheBlock: on 26th June, the number of large DOGE transactions (transactions worth more than $100 million) jumped to 943 from 505 recorded the day before.

▲ 27.06.2022 – IntoTheBlock: the total DOGE miner reserve decreased by 32% year-to-date, to the levels last seen in December 2013.

▲ 27.06.2022 – IntoTheBlock: the number of addresses holding Dogecoin for more than one year has increased by more than 40% year-to-date. The number of short-term holders has fallen by six times.

Polkadot (DOT)

▲ 30.06.2022 – Polkadot’s founder announced that the blockchain’s governance model would undergo a new transformation to increase decentralisation and throughput of the decision-making system.

Uniswap (UNI)

▲ 24.06.2022 – Bloomberg: decentralised exchange (DEX) Uniswap has overtaken its host blockchain Ethereum, in terms of fees paid.

Chainlink (LINK)

▼ 29.06.2022 – Santiment: on 28th June, 80.88 million unique LINK tokens were moved – the second largest level ever recorded.

Cosmos (ATOM)

▲ 28.06.2022 – The Cosmos Hub team is set to introduce the interchain security feature between August and September.

Maker (MKR)

▲ 28.06.2022 – MakerDAO, the issuer of the Dai (DAI) stablecoin, voted on how to allocate 500 million DAI of treasury funds into investments in US Treasury bills and bonds.

EOS (EOS)

▲ 27.06.2022 – Ethereum co-founder Vitalik Buterin: EOS is Ethereum on steroids.

Waves (WAVES)

▲▼ 24.06.2022 – Blockworks: Waves founder, Sasha Ivanov, is holding over $530 million worth of debt to avoid USDN depeg.

Dash (DASH)

▲ 23.06.2022 – Dash Core Group rolled out a new fractional masternode staking feature on the official Dash Wallet mobile app.

Harmony (ONE)

▼ 24.06.2022 – Harmony’s cross-chain protocol, the Horizon Bridge, has been hacked, leading to a loss of around $100 million in ETH.

▼ 26.06.2022 – Harmony Protocol is offering a $1 million bounty for the return of funds stolen in the attack.

▼ 28.06.2022 – PeckShield: assets stolen from the Horizon Harmony Bridge have come into motion.

Toncoin (TON)

▲ 28.06.2022 – On the night of 28th June, the last Toncoin was mined signaling the successful closure of TON’s initial distribution. The only way to obtain new coins mow is TON staking.

EXMO news

Unique EXM quarterly burn. The largest quarterly burn of EXMO Coin – EXMO’s native token – will take place this week, on 05th July 2022. In addition, many pleasant surprises await you.

Trade profitably with EXMO Premium: receive fees discounts of up to 100%. We have launched the EXMO Premium program, which will replace EXMO Cashback. Trade with a larger trading volume without incurring further cashback charges.

That’s all for this week! Follow EXMO on YouTube, Twitter and Telegram to stay tuned to the main events and trends in the crypto market.