Back to News

Back to News

Weekly recap: Chainlink strikes a partnership with SWIFT

Fasanara Capital and Pantera Capital are investing in crypto, Algorand and Tezos have launched upgrades, while developers may soon issue tokens on the Bitcoin network. Read the Weekly recap to learn more about the main crypto events that happened between 22nd and 29th September 2022.

Crypto market in numbers

The crypto market cap stood below $950 billion for almost the entire week. On 27th September, the indicator failed to gain a foothold above $975 billion and soon thereafter rolled back to $910 billion, according to CoinMarketCap. Currently, the indicator remains at the same level as seven days ago – $932 billion.

Weekly trading volumes rose to $531 billion – a 6% increase from the previous week. Trading activity remained subdued. The daily average stood at $76 billion.

The dominance of bitcoin remained almost unchanged during the week, amounting to 39.5%. The market share of ether rose slightly by 0.3% to 17.4%.

Bitcoin’s volatility has remained pretty moderate. Since 18th September, the 30-day volatility index has stayed at almost the same level. As of 29th September, it amounted to 3.3%.

Ethereum’s volatility has been gradually declining over the course of the week. As of 29th September, the 30-day volatility index dropped sharply to 4.0%, the lowest since mid-May.

Gainers of the week (23rd – 29th September 2022)

| Coin | Opening price 23.09, $ | Opening price 29.09, $ | Change |

| VLX | 0.047 | 0.055 | 17.4% |

| MKR | 722.18 | 812.74 | 12.5% |

| UNI | 6.47 | 7.15 | 10.5% |

| CRON | 0.17 | 0.19 | 8.3% |

| SOL | 35.66 | 37.44 | 5.0% |

Losers of the week (23rd – 29th September 2022)

| Coin | Opening price 23.09, $ | Opening price 29.09, $ | Change |

| ROOBEE | 0.00086 | 0.00065 | -24.3% |

| PRQ | 0.13 | 0.11 | -14.6% |

| CHZ | 0.31 | 0.26 | -14.3% |

| YFI | 9,513.78 | 8,207.20 | -13.7% |

| GNY | 0.014 | 0.012 | -13.6% |

Easily track gainers and losers within the Simple trade section on EXMO. Check real-time updates in the last 24 hours, week and month.

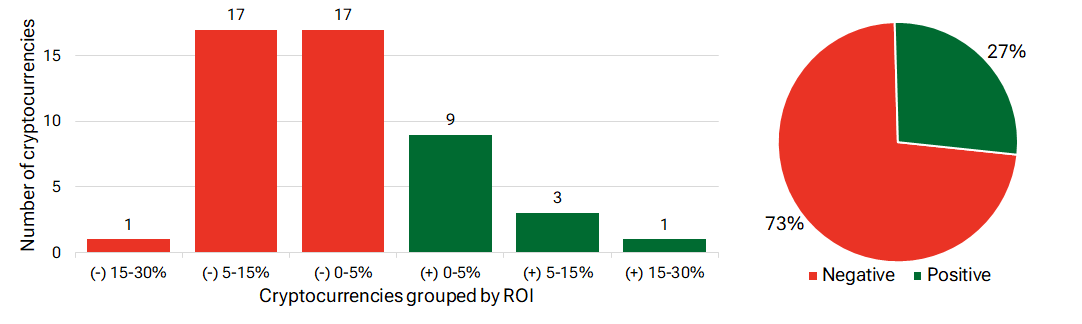

Segmentation of cryptocurrencies based on trading results

(23rd – 29th September 2022)

Most traded coins (22nd – 28th September 2022)

| Coin | Trading volumes, $ |

| BTC | 11,489,365 |

| ETH | 7,749,884 |

| DEBT | 4,049,172 |

| XRP | 3,633,585 |

| ROOBEE | 1,275,710 |

| LTC | 618,1292 |

| GMT | 540,004 |

| ADA | 303,772 |

| WAVES | 250,641 |

| ZEC | 247,900 |

Top crypto market driving factors

Overall crypto market

▲ 23.09.2022 – Singapore’s largest bank, DBS, expands crypto trading services for its 100,000 clients.

▲ 25.09.2022 – California Governor, Gavin Newsom, refused to sign a bill that would establish a licensing and regulatory framework for digital assets.

▲▼ 26.09.2022 – CoinShares: between 19th and 23rd September, digital asset investment products saw inflows totaling $8.3 million, marking a tepid investor appetite for digital assets at present. The trading turnover for investment products remains half the weekly average for this year at $1 billion.

▲ 26.09.2022 – CoinShares: multi-asset (multi-token) investment products recorded inflows totaling $1.8m last week.

▲ 27.09.2022 – Bank of America: stablecoins flowing into exchanges touched $490 million — a 58% seven-day increase and the third consecutive week of inflows. The crypto market is probably headed for an eventual recovery.

▲ 27.09.2022 – Fasanara Capital, the London-based asset management and technology platform, announced the launch of a $350 million venture fund dedicated to finding the next-generation global fintech and Web3 pioneers.

▲▼ 28.09.2022 – In an online discussion organised by the Bank of France, the heads of the world’s leading central banks called for increased regulation of the decentralised finance (DeFi) sector amid its rapid development.

▲▼ 28.09.2022 – Federal Reserve Chair, Jerome Powell, called for better regulation of cryptocurrencies, adding that the crypto market downturn is giving regulators more time to identify crypto regulation weaknesses, but the crypto winter will not last forever, so it is necessary to speed up.

▲ 28.09.2022 – Pantera Capital plans to raise $1.25 billion for its second blockchain fund.

▲ 28.09.2022 – The Bank of England (BOE) will temporarily start to buy long-dated bonds and suspend quantitative tightening tactics.

Bitcoin (BTC)

▼ 23.09.2022 – On 23rd September, the largest cryptocurrency fund, Grayscale Bitcoin Trust (GBTC), was trading at a 35.18% discount.

▼ 25.09.2022 – Santiment: addresses holding between 100 BTC to 10,000 BTC hold their lowest amount of BTC since April 2020 – 45.7% of the total BTC supply.

▲ 26.09.2022 – CoinShares: between 19th and 23rd September, Bitcoin investment products saw inflows totaling $2.6 million. A seven-week bull run on Bitcoin-short positions ended with outflows of $5.1 million.

▲ 28.09.2022 – Lightning Labs released the first version of the Taro open-source software to enable minting, sending and receiving tokens, including stablecoins, on the Bitcoin blockchain.

▼ 28.09.2022 – As a result of the latest recalculation, Bitcoin’s mining difficulty has fallen by 2.14% to 31.36T – the first decrease since 21st June 2022.

▼ 28.09.2022 – Arcane Research: the majority of public mining companies reported a net loss in the second quarter of 2022.

▼ 29.09.2022 – Glassnode: miner balances have seen large outflows since the BTC price fell from the local high of $24.500. Aggregate miner profitability is still under a degree of stress with around 8,000 BTC/month being spent to cover USD-denominated costs.

Ethereum (ETH)

▲▼ 24.09.2022 – Ethereum developers are considering the integration of anonymous transactions.

▲ 26.09.2022 – CoinShares: Ethereum investment products recorded inflows totaling $6.9 million last week. This was the first positive sentiment after the successful Merge and following a 4-week run of outflows

XRP (XRP)

▲ 23.09.2022 – Ripple Labs CEO Brad Garlinghouse: SEC’s lawsuit against Ripple will be decided by a judge, not a jury because the judge has sufficient evidence to rule from the bench.

▲ 23.09.2022 – Santiment: active shark and whale addresses holding 1m to 10m XRP have been in an accumulation pattern since late 2020. The top 330 XRP addresses with over 10 million XRP hold an all-time low of 70.75% of the total XRP supply.

▲ 28.09.2022 – SBI Holdings, one of the top financial conglomerates in Asia, expanded its partnership with Ripple to further leverage on-demand liquidity for treasury management.

Cardano (ADA)

▲ 23.09.2022 – The Input Output Global (IOG) team successfully triggered the Vasil upgrade on the Cardano mainnet. Full Vasil capability will be available to developers after the next epoch, on 27th September 2022.

Solana (SOL)

▲ 22.09.2022 – Decentralised blockchain, Solana, surpassed 100 billion transactions.

Polkadot (DOT)

▲ 23.09.2022 – Tether announced the launch of USDT on the Polkadot blockchain platform. The stablecoin is now live on a total of eleven networks and counting.

▲ 26.09.2022 – The Polkadot team announced an updated project roadmap. By the end of the year, developers are set to deploy a major upgrade on the Kusama testnet. The hardfork will speed up block validation by 10 times to 6 seconds, increasing the transaction throughput to 1 million transactions per second (TPS). The async hardfork on Polkadot is scheduled for the first half of 2023.

▲ 28.09.2022 – Circle expands USDC to five new blockchains. The stablecoin will begin to circulate on the Arbitrum One, NEAR, Optimism and Polkadot chains by the end of this year, while also entering the Cosmos ecosystem sometime in early 2023.

Cosmos (ATOM)

▲ 27.09.2022 – Cosmos developers dropped a new white paper aimed at strengthening interoperability and security, along with key changes to its Cosmos (ATOM) token. ATOM issuance will decrease at a declining rate until it reaches the steady state phase. Changes are expected to be made on-chain on 03rd October 2022.

▲ 28.09.2022 – Circle expands USDC to five new blockchains. The stablecoin will begin to circulate on the Arbitrum One, NEAR, Optimism and Polkadot chains by the end of this year, while also entering the Cosmos ecosystem sometime in early 2023.

Chainlink (LINK)

▲ 27.09.2022 – Financial services firm, Galaxy Digital, has teamed up with Chainlink Labs, to provide crypto pricing data to blockchains.

▲ 28.09.2022 – Chainlink Labs developed feeds that display NFT floor prices via a Cloud service.

▲ 28.09.2022 – Chainlink Labs announced the launch of Chainlink SCALE – a program encouraging blockchain ecosystem development related to oracles.

▲ 29.09.2022 – The interbank messaging system, SWIFT, partnered with Chainlink to work on a proof-of-concept (PoC) project which allows traditional finance firms to transact across blockchain networks.

▲ 29.09.2022 – At SmartCon 2022, Chainlink co-founder, Sergey Nazarov, unveils plans to launch staking in December, plus a new economic model for the Web3 services platform.

NEAR (NEAR)

▲ 28.09.2022 – Circle expands USDC to five new blockchains. The stablecoin will begin to circulate on the Arbitrum One, NEAR, Optimism and Polkadot chains by the end of this year, while also entering the Cosmos ecosystem sometime in early 2023.

Algorand (ALGO)

▲ 22.09.2022 – On 21st September 2022, devs deployed the Algorand protocol upgrade, introducing State Proofs – the technology that enables the possibility to digitally sign any message in a decentralised manner.

▲ 23.09.2022 – Algorand Community Governance allocates 7 million ALGO from Q4 2022 governance rewards to DeFi governors.

Tezos (XTZ)

▲ 23.09.2022 – Tezos activated the Kathmandu protocol upgrade that added capabilities to support off-grid computing with layer 2 solutions, as well as simplified the block validation process to improve transaction throughput.

Harmony (ONE)

▲ 23.09.2022 – The team behind the Harmony protocol presented a fresh proposal for the recovery of assets lost in the hacking attack on the Horizon Bridge.

Velas (VLX)

▲ 28.09.2022 – Velas Network partnered with Bahamas-based digital asset investment firm, GEM Digital Limited, securing a $135 million investment.

EXMO news

LYO Credit (LYO) is listed on EXMO. The token is now available for deposits and trading with USDT.

Post Only, IOC and FOK: new options for orders on EXMO. Trade crypto more efficiently on EXMO with updated Limit Orders.