Back to News

Back to News

Weekly recap: Cardano launches Vasil hardfork

Ethereum may be deemed a security in the USA, EOS has rebranded to the Antelope protocol, while the SEC and Ripple have filed motions for a summary judgment. Read the Weekly recap to learn more about the main crypto events that happened between 15th and 22nd September 2022.

Crypto market in numbers

The crypto market capitalisation fell by about 6% to $932 billion over the week. On Monday and Wednesday, the indicator fell to $900 billion, as a result of the news about the U.S. Federal Reserve’s rate hike.

Weekly trading volumes decreased by 15% to $500 billion. The weekly average was $71 billion. Marginal recovery was observed a week earlier amid the Ethereum Merge upgrade and probably due to positive developments in other crypto projects.

Hints of positive market sentiment dissipated. The Cryptocurrency Fear & Greed Index dropped to 20 points the very next day after the Ethereum transition to PoS. Between 16th and 22nd September, the median value of the index stood at 22 points.

Bitcoin’s dominance has stabilised. During the week, it fluctuated between 39% and 40%, according to CoinMarketCap. The market share of Ethereum declined by about 3% over the week after its transition to PoS on 15th September 2022 and now stands at above 17%.

Gainers of the week (16th – 22nd September 2022)

| Coin | Opening price 16.09, $ | Opening price 22.09, $ | Change |

| CHZ | 0.21 | 0.27 | 24.8% |

| XRP | 0.36 | 0.44 | 22.5% |

| ALGO | 0.33 | 0.38 | 15.9% |

| XLM | 0.11 | 0.13 | 11.9% |

Losers of the week (16th – 22nd September 2022)

| Coin | Opening price 16.09, $ | Opening price 22.09, $ | Change |

| GAS | 3.96 | 2.41 | -39.1% |

| ETC | 39.33 | 30.96 | -21.3% |

| TON | 1.83 | 1.48 | -19.1% |

| GNY | 0.016 | 0.013 | -18.3% |

| IQN | 0.40 | 0.34 | -17.1% |

Easily track gainers and losers within the Simple trade section on EXMO. Check real-time updates in the last 24 hours, week and month.

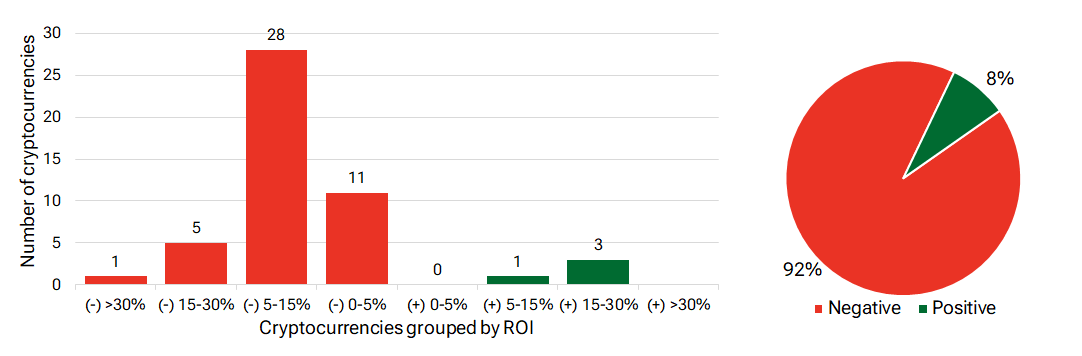

Segmentation of cryptocurrencies based on trading results

(16th – 22nd September 2022)

Most traded coins (15th – 21st September 2022)

| Coin | Trading volumes, $ |

| BTC | 16,453,426 |

| ETH | 12,494,473 |

| DEBT | 4,451,358 |

| XRP | 2,423,575 |

| ROOBEE | 1,353,815 |

| ETC | 1,111,622 |

| LTC | 673,636 |

| GMT | 556,822 |

| WAVES | 405,716 |

| TON | 338,195 |

Top crypto market driving factors

Overall crypto market

▲ 16.09.2022 – The White House has presented the first-ever framework on what crypto regulation in the U.S. should look like, including ways in which the financial services industry should evolve to make borderless transactions easier, and how to crack down on digital asset fraud.

▲▼ 16.09.2022 – The U.S. Department of Justice announced the creation of the nationwide Digital Asset Coordinator (DAC) Network to further its “efforts to combat the growing threat posed by the illicit use of digital assets to the American public”.

▲▼ 19.09.2022 – CoinShares: between 12th and 16th September 2022, digital asset investment products saw inflows totaling $7 million last week, indicating continued low activity.

▲ 19.09.2022 – CoinShares: inflows to multi-asset crypto funds totaled $1 million last week. Inflows since the beginning of the year have reached $224 million, almost matching Bitcoin’s total inflows.

▲ 20.09.2022 – Nasdaq is preparing to launch an institutional crypto custody service.

▼ 21.09.2022 – The U.S. Federal Reserve raised interest rates by 75 basis points to 3.25%.

▲▼ 21.09.2022 – The European Union has finalised the full text of its landmark ‘Markets in Crypto Assets (MiCA)’ legislation.

▲ 21.09.2022 – Societe Generale (GLE), the third-largest French bank, has introduced new services for asset manager clients that will allow them to offer crypto funds in a “simple and adapted” way.

▲ 21.09.2022 – Japanese banking giant, Nomura, is launching a new venture capital unit to invest in the crypto space.

▼ 21.09.2022 – The chief executives of Citigroup, Bank of America and Wells Fargo said that they don’t have any plans to finance cryptocurrency miners at a congressional hearing.

▼ 22.09.2022 – The Bank of England raised interest rates by 50 basis points to 2.25%. The inflation rate is expected to exceed 10% in the next few months.

Bitcoin (BTC)

▼ 16.09.2022 – Santiment: between 07th and 13th September 2022, 1.69 million BTC (the equivalent to $33.5 billion) was moved to exchanges. This was the highest amount of BTC moved since October 2021.

▲▼ 19.09.2022 – CoinShares: between 12th and 16th September 2022, Bitcoin saw inflows totaling $17 million, the first inflows following a five-week run of outflows that totaled $93 million. Meanwhile, short-bitcoin also recorded minor inflows totaling $2.6 million, with total AuM close to a record $169 million.

▲ 20.09.2022 – Between 02nd August and 19th September 2022, MicroStrategy purchased an additional 301 BTC for approximately $6 million. The company now holds a total of 130,000 BTC.

Ethereum (ETH)

▼ 16.09.2022 – SEC Chairman Gary Gensler: cryptocurrencies and intermediaries that allow holders to “stake” their crypto may define it as a security under the Howey test.

▼ 19.09.2022 – CoinShares: between 12th and 16th September 2022, ether faced outflows of $15.4 million, marking a total of $80 million outflows during a four-week period.

▲ 19.09.2022 – Glassnode: over four days after the Merge, the PoS Ethereum chain issued 3,893 ETH, reflecting a remarkable 92.8% reduction relative to the deprecated system which would issue 48,400 ETH.

▼ 20.09.2022 – In a civil complaint against a crypto influencer, Ian Balina, the SEC U.S. suggested that it believes that the U.S. government has jurisdiction over all Ethereum transactions.

XRP (XRP)

▲ 18.09.2022 – On 17th September 2022, the U.S. SEC and Ripple Labs both called for a summary judgment in the U.S. District Court Southern District of New York.

▲ 19.09.2022 – Caroline Pham, one of five commissioners at the United States Commodity Futures Trading Commission, or CFTC, met with Ripple CEO, Brad Garlinghouse, as part of a “learning tour” involving crypto and blockchain.

▲ 22.09.2022 – U.S crypto advocacy group, the Chamber of Digital Commerce (CDC), has been granted approval from the Court of Southern District of New York to participate as an amicus curiae in the U.S. SEC case against Ripple Labs.

Cardano (ADA)

▲ 15.09.2022 – The Cardano Foundation has partnered with Georgia’s National Wine Agency to create a solution on the Cardano blockchain to ensure the quality and authenticity of Georgian wine.

▲ 18.09.2022 – The team of developers at Input Output Global (IOG, formerly IOHK) has initiated the final stages of activating the Vasil update on the Cardano mainnet.

Solana (SOL)

▲ 15.09.2022 – Sei Labs plans to launch the mainnet of Nitro, the first Solana Virtual Machine (SVM)-compatible blockchain, in early 2023. It will serve as a gateway between Solana and Cosmos, allowing developers to port decentralised applications. Founded by Goldman Sachs and Robinhood former employees, Sei raised a $5 million investment in late August.

▲ 19.09.2022 – CoinShares: Solana-based funds recorded $1.4 million of inflows last week.

▲ 22.09.2022 – Decentralised wireless network, Helium, has voted to ditch its own blockchain in favour of a move to Solana’s network.

Uniswap (UNI)

▲ 21.09.2022 – Uniswap Foundation announced the first wave of grants for a total of around $1.8 million, which will be distributed across 14 projects contributing to Uniswap ecosystem development.

Cosmos (ATOM)

▲ 15.09.2022 – Sei Labs plans to launch the mainnet of Nitro, the first Solana Virtual Machine (SVM)-compatible blockchain, in early 2023. It will serve as a gateway between Solana and Cosmos, allowing developers to port decentralised applications. Founded by Goldman Sachs and Robinhood former employees, Sei raised a $5 million investment in late August.

▲ 19.09.2022 – Kaiko: ATOM open interest has surged from under $50 million in mid-June to over $200 million now amid news about the new tokenomics for ATOM and a number of successful DeFi projects on the Cosmos network. The average funding rate has been on an upwards trend since the beginning of September, suggesting this latest surge in open interest is skewed towards the long side.

Chainlink (LINK)

▲ 16.09.2022 – The Chainlink team shared the results of testing DECO together with Teller, a DeFi protocol marketplace for digital asset lending. DECO is a privacy-focused oracle protocol that allows decentralised platforms to issue partially unsecured loans.

NEAR (NEAR)

▲ 21.09.2022 – The NEARCON BETA 2022 conference came to an end on 14th September 2022. Developers and partners of the NEAR ecosystem announced the launch of USDT on the NEAR blockchain and shared updates on the Aurora L2 solution.

EOS (EOS)

▲ 21.09.2022 – EOS block producers have executed a coordinated hard fork to Leap 3.1. EOS is finally migrating to the newly forged Antelope Framework and moving away from an EOS codebase managed by Block.one.

Waves (WAVES)

▲ 21.09.2022 – Waves Protocol announced a partnership with token bridge protocol, Allbridge. The partnership involves the integration of Waves with all of Allbridge’s 15 supported blockchains, including Solana and Ethereum.

EXMO news

New wallet addresses for Ethereum (ETH) and ERC-20 tokens. Due to a new update to optimise our platform and enhance its security, wallet addresses for depositing ETH and ERC-20 tokens will change.