Back to News

Back to News

Weekly recap: Ethereum is one step closer to PoS

Ukraine legalised virtual assets, the European Parliament supported the bill on the regulation of cryptocurrencies and the “Merge” was successfully completed on Ethereum’s testnet. Meanwhile, digital assets recorded outflows for the first time in seven weeks. Read the Weekly recap to find out more about the main events of the crypto market that happened between 11th and 17th March 2022.

Crypto market in numbers

Over the past several days, an upward trend in the cryptocurrency market was observed. Over the week, capitalisation grew by almost 5% to $1.84 trillion, according to CoinMarketCap. The median value of the indicator for 30 days stands at $1.76 trillion.

However, there was no significant increase in trading activity. Between 10th and 16th March, trading volumes were about $539 billion, down 1.5% from a week earlier. A noticeable increase in trading volumes was recorded on Wednesday: $103.6 billion compared with an average daily volume of $77 billion over the past seven days. A marginal trading revival continued on Thursday.

Market sentiment remains negative. On 17th March, the Cryptocurrency Fear & Greed Index moved out of the “Extreme Fear” zone reaching the level of 27 points. The median value of the index for the week is 22 points.

Bitcoin’s share of the market has not dropped below 42%, since the beginning of March. The dominance of the first cryptocurrency has noticeably strengthened since the beginning of the year, when its market share was about 40%, according to CoinMarketCap. Occasionally, BTC dominance rises to 43%.

Ethereum’s dominance gained 0.56% over the week, reaching 18.39%. However, since the beginning of the year, its market share has decreased.

Bitcoin’s volatility remains relatively high. The 30-day volatility index has stayed above 4% since 28th February and above 4.5% for the past four days, according to CryptoCompare.

Gainers of the week (11th – 17th March 2022)

| Coin | Opening price 11.03, $ | Opening price 17.03, $ | Change |

| MNC | 0,00072 | 0,00091 | 25,2% |

| CRON | 0,85 | 0,94 | 10,6% |

| LINK | 14,15 | 15,52 | 9,6% |

| SMART | 0,0014 | 0,0015 | 8,5% |

| LTC | 108,69 | 117,00 | 7,6% |

Losers of the week (11th – 17th March 2022)

| Coin | Opening price 11.03, $ | Opening price 17.03, $ | Change |

| DASH | 110,56 | 103,24 | -6,6% |

| BTG | 32,23 | 30,76 | -4,6% |

| DCR | 57,66 | 56,05 | -2,8% |

| ZEC | 166,17 | 161,80 | -2,6% |

| GAS | 4,85 | 4,73 | -2,6% |

Easily track gainers and losers within the Simple trade section on EXMO. Check real-time updates in the last 24 hours, week and month.

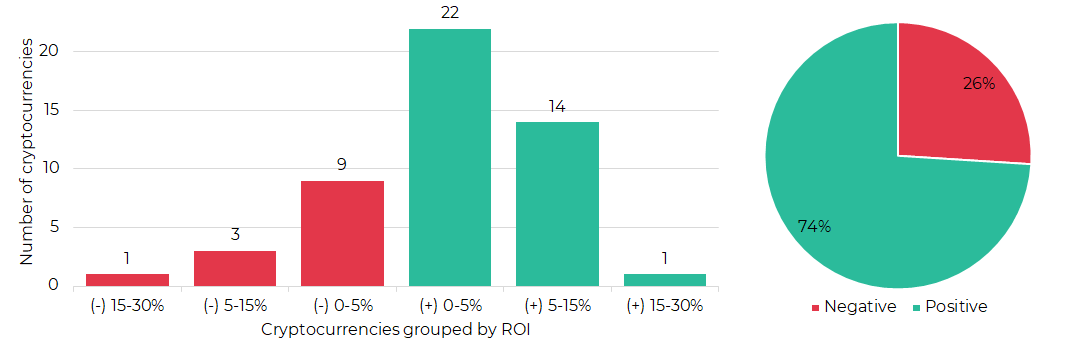

Segmentation of cryptocurrencies based on trading results

(11th – 17th March 2022)

Most traded coins (11th – 16th March 2022)

| Coin | Trading volumes, $ |

| BTC | 19,764,334 |

| ETH | 12,041,256 |

| XRP | 4,357,849 |

| IQN | 2,429,669 |

| GMT | 1,900,124 |

| WAVES | 1,714,080 |

| ZEC | 1,472,467 |

| ROOBEE | 1,343,793 |

| LTC | 886,173 |

| DASH | 536,121 |

Top crypto market driving factors

Overall crypto market

▲ 11.03.2022 – China is experiencing its most significant Covid-19 outbreak since the early days of the pandemic, igniting a flurry of new restrictions and travel measures.

▼ 11.03.2022 – Bloomberg: Fir Tree Capital Management, one of the U.S. largest hedge funds, is shorting Tether (USDT). The structure is counting on a fall in the value of securities from the Tether reserves associated with Chinese developers.

▲ 14.03.2022 – The Economic and Monetary Affairs Committee of the European Parliament has voted against the Proof-of-Work ban.

▼ 14.03.2022 – CoinShares: digital asset investment products saw outflows totaling $110 million last week, following a seven-week run of inflows. Total net Inflows since the beginning of the year have decreased to $107 million.

▼ 14.03.2022 – CoinShares: between 07th and 11th March, multi-asset investment products saw inflows totaling $12 million, remaining the most popular amongst investors.

▲ 14.03.2022 – A crypto custody startup backed by Standard Chartered, Zodia, is preparing to launch new products to help institutional investors earn a yield on token holdings.

▲ 14.03.2022 – The Committee on Economic and Monetary Affairs of the European Parliament adopted a bill on the regulation of cryptocurrencies MiCA by a majority vote.

▲ 16.03.2022 – Ukrainian President Volodymyr Zelenskyy legalised crypto in the country, signing into law a bill “On virtual assets”.

▲▼ 16.03.2022 – Delphi Digital: the top 5 stablecoin supply grew by $20 billion or nearly 13% year to date.

▲ 16.03.2022 – The Federal Reserve raised interest rates by a quarter percentage point to 0,5% and signalled hikes at all six remaining meetings this year.

Bitcoin (BTC)

▼ 11.03.2022 – The U.S. Securities and Exchange Commission rejected NYDIG Bitcoin ETF and Global X Bitcoin Trust listing proposals.

▲ 11.03.2022 – IntoTheBlock: currently over 99% of all Bitcoin volume comes from transactions of over $100,000.

▼ 14.03.2022 – CoinShares: between 07th and 11th March, Bitcoin saw outflows totaling $70 million.

▲ 14.03.2022 – Glassnode: the proportion of bitcoins accumulated in the last six months has dropped to an all-time low – 24.53%.

▲ 15.03.2022 – Glassnode: Bitcoin’s current price range of around $39,000 is the largest ever cluster in terms of on-chain volume (around 775,000 BTC).

▲ 15.03.2022 – Deloitte: Bitcoin (BTC) can become a base from which to create a faster and more secure ecosystem for central bank digital currencies (CBDCs).

▲ 15.03.2022 – Chicago Mercantile Exchange’s (CME’s) BTC futures contracts recorded the highest daily volume in nine months.

Ethereum (ETH)

▲ 11.03.2022 – Coin Metrics: close to 2 million ETH has been burned since the release of EIP-1559. This has caused Ethereum’s annualised inflation rate to dip lower than Bitcoin’s for most of the past seven months.

▼ 14.03.2022 – CoinShares: between 07th and 11th March, Ethereum saw the largest outflows totaling $51million.

▲ 15.03.2022 – Ethereum wallet MetaMask has passed 30 million users. Over the past four months, the number of active users increased by 42% and by about six times compared to April 2021.

▲ 15.03.2022 – Ethereum software company, ConsenSys, raised an additional $450 million in a Series D funding round. The new round values ConsenSys at more than $7 billion.

▲ 16.03.2022 – Ethereum Foundation: the “Merge” on the Kiln testnet was successfully completed.

▲ 16.03.2022 – Santiment: Ethereum’s utility has remained steady over the past four months, despite prices being cut by 35% over this time. At the same time, the amount of unique addresses interacting on the $ETH network has stayed flat.

XRP (XRP)

▼ 14.03.2022 – The court denied Ripple’s motion to dismiss the SEC’s case over XRP sales.

▲ 14.03.2022 – XRP Ledger Foundation rolls out token assessment format to provide transparency.

Cardano (ADA)

▲ 13.03.2022 – The Cardano ecosystem continues to grow, now with over 500 projects building on Cardano, since the integration of smart contracts.

Solana (SOL)

▲ 14.03.2022 – AmioTalio founder of Paradox Studios: Solana will leave Ethereum in the dust this year when it comes to gaming.

▲ 14.03.2022 – Solana-based NFT marketplace Magic Eden has raised $27 million in the latest funding round led by Sequoia and other investors.

Dogecoin (DOGE)

▲ 14.03.2022 – Elon Musk tweeted that he still owns and won’t sell Bitcoin, Ether and Dogecoin.

NEAR (NEAR)

▲ 14.03.2022 – NEAR Protocol has hit 100 million total transactions!

Uniswap (UNI)

▲ 17.03.2022 – Santiment: Uniswap has dominated the development activity leaderboard over the past month, with a staggering 1,070 notable GitHub submissions per day from their developers.

Stellar (XLM)

▲ 12.03.2022 – Stellar Development and MoneyGram International have announced a partnership with global “operational investor” Techstars to support Latin American fintech startups.

▲ 15.03.2022 – Stellar Development Foundation launched a $30-million investment fund to support projects in their early days.

Chiliz (CHZ)

▼ 13.03.2022 – Alexandre Dreyfus, the CEO and founder of fan token site Socios, has been accused of withholding payments in crypto for staff and investors to maintain the price of Chiliz.

yearn.finance (YFI)

▲ 16.03.2022 – Yearn Finance creator, Andre Cronje, is returning to DeFi. He has been reportedly deploying and funding multiple stablecoin pools. The connection with the Yearn Finance project has not been reported.

EXMO news

Landmark decision: Ukraine’s president just signed a law to legalise crypto. In February 2022, the Verkhovna Rada supported the amendments of the President of Ukraine on the law “On Virtual Assets”, and yesterday, 16th March 2022, the Ministry of Digital Transformation of Ukraine announced that the law was signed by Volodymyr Zelenskyy.

That’s all for this week! Follow EXMO on YouTube, Twitter and Telegram to stay tuned to the main events and trends in the crypto market.