Back to News

Back to News

One year later: what has changed after the Bitcoin halving

A year ago, the third halving took place on the Bitcoin network. Learn how this event has affected the world’s largest cryptocurrency and what to expect from the next halving.

What is halving?

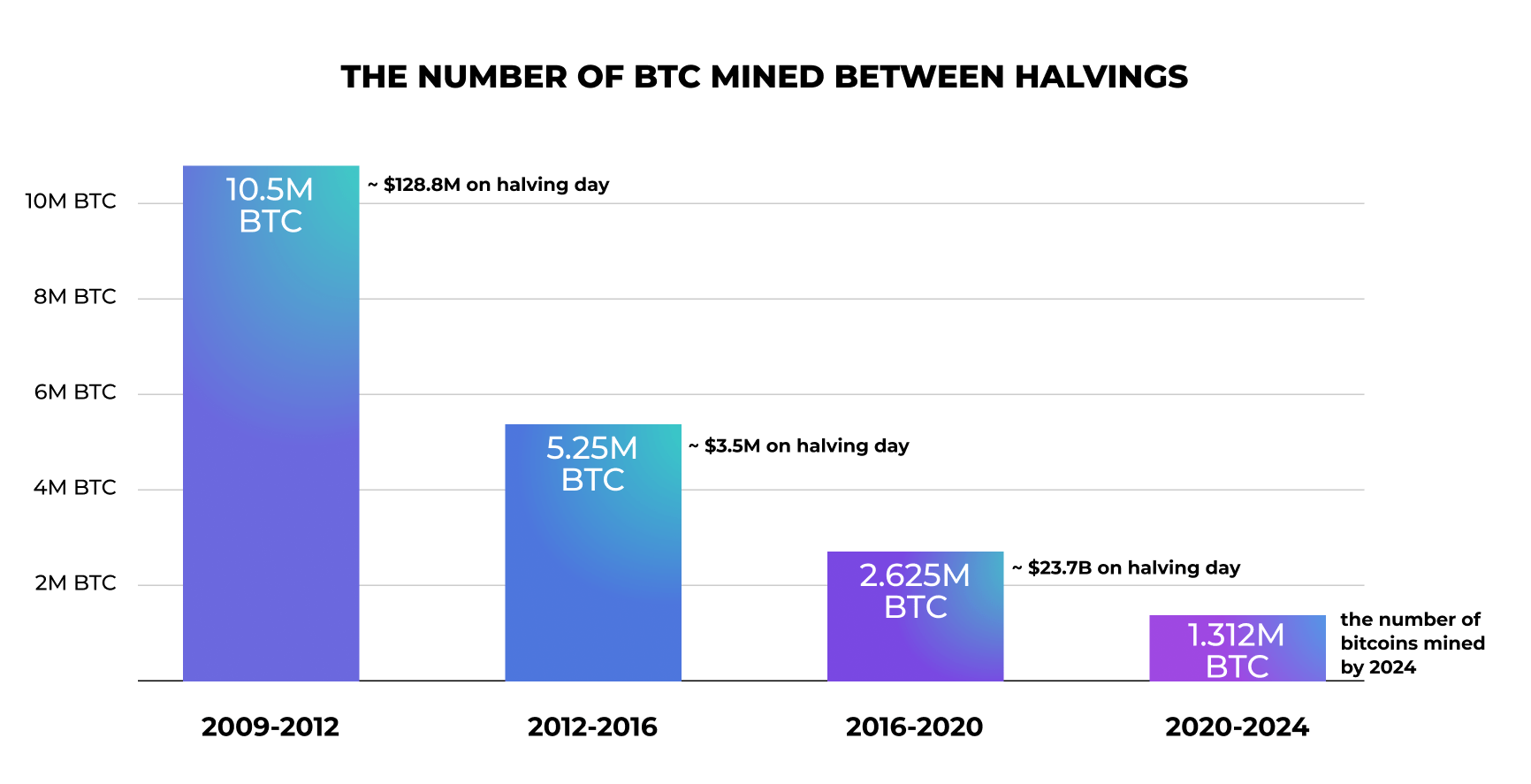

Halving, programmed by BTC creator Satoshi Nakamoto, means that the reward for mining a new block on the Bitcoin network is cut by half. This decrease of the reward occurs automatically after 210,000 blocks are added which is approximately once every four years.

| 1st halving | 2nd halving | 3d halving | |

| Date | November 21, 2012 | July 9, 2016 | May 11, 2020 |

| Mining reward decrease | From 50 to 25 BTC per block | From 25 to 12.5 BTC | From 12.5 to 6.25 BTC |

| Price for 1 BTC on the day of halving | $12,27 | $666 | $9 033 |

| Price for 1 BTC one year after halving | $1,077 | $2,635 | ~$55,800 |

The halving’s main goal is to control the emission of the cryptocurrency and curb inflation. In total, 21,000,000 bitcoins can be mined. The last block is expected to be added in 2140.

Its limited supply is the main difference and advantage that Bitcoin has over fiat currencies. For instance, the US Federal Reserve issued more than $3 trillion in 2020 which caused serious concerns from investors. A possible rise in inflation in fiat currencies contributed to Bitcoin attaining the status of a reserve asset in 2020-2021. Analysts at JPMorgan Chase even stated that BTC could become an alternative to gold, and in March 2021 their opinion was confirmed by a Bloomberg report.

One year since the Bitcoin halving

As shown on CoinMarketCap, a year after the third halving, bitcoin has shown steady growth. In November 2020, BTC broke its 2017 price record, reaching $19,749. Since the second half of December 2020, bitcoin has set new records almost daily. This trend continued into 2021 as well. In January, BTC’s price hit $41,900, and on 14th April 2021, the cryptocurrency set a new all-time high at $64,863.

As for Bitcoin’s market cap, during the last year, it’s increased more than six times — from $158 billion to $1 trillion. In terms of market value, the cryptocurrency surpassed giants such as Facebook ($867 billion), Tesla ($605 billion) and Alibaba ($601 billion). Moreover, according to The Block, the number of active bitcoin addresses has increased from 47 to 50 million since the third halving.

Of course, the halving was not the only thing that influenced the BTC price. Among the reasons for its price growth, the following factors can be identified:

- Economic crisis due to the coronavirus pandemic.

- Increased interest from major institutional players in buying BTC, including MicroStrategy, Tesla, Square, Galaxy Digital Holdings, etc.

- Integration of crypto technologies by financial giants such as PayPal, Visa, Mastercard, BNY Mellon, Goldman Sachs, Revolut, etc.

- Greater regulatory certainty regarding cryptocurrencies.

What to expect from the upcoming halving

The next halving is expected in 2024. After block 840,000 is mined, the reward for miners will decrease from 6.25 to 3.125 BTC.

| Year | Reward for a block | |

| 4th halving | 2024 | 3,12 BTC |

| 5th halving | 2028 | 1,56 BTC |

| 6th halving | 2032 | 0,78 BTC |

| 7th halving | 2036 | 0,39 BTC |

| 8th halving | 2040 | 0,195 BTC |

| 9th halving | 2044 | 0,0975 BTC |

| 10th halving | 2048 | 0,04875 BTC |

The cryptocurrency market is highly volatile. Therefore, it is impossible to say with certainty how the fourth halving will affect the asset’s price. Further development of Bitcoin will depend on the interest of investors and the economic situation as well as the monetary policy of regulators.