Back to News

Back to News

EXMO has partnered with Koinly to facilitate tax reporting for users

Koinly will synchronize your wallets and exchange accounts to show your profits and losses for every transaction.

Our primary mission at EXMO is showing you how simple and enjoyable it is in the crypto world. We strive to make trading and all its characteristics easy and convenient for our customers. One of the most complex issues that traders face is reporting their taxes. Many countries such as the USA, Germany, Austria, Canada, UK, and Australia require the payment of taxes for operations with cryptocurrencies. The process can be time-consuming due to the lack of guidelines and the numerous trades involved.

To facilitate tax reporting for all our customers, EXMO has partnered with Koinly, a leading cryptocurrency tax platform that allows crypto investors to generate capital gain reports compliant with local laws.

Figuring out the cost-basis and keeping track of the tax liability is essential to reduce the tax burden. Koinly will synchronize your wallets and exchange accounts to show your profits and losses for every transaction.

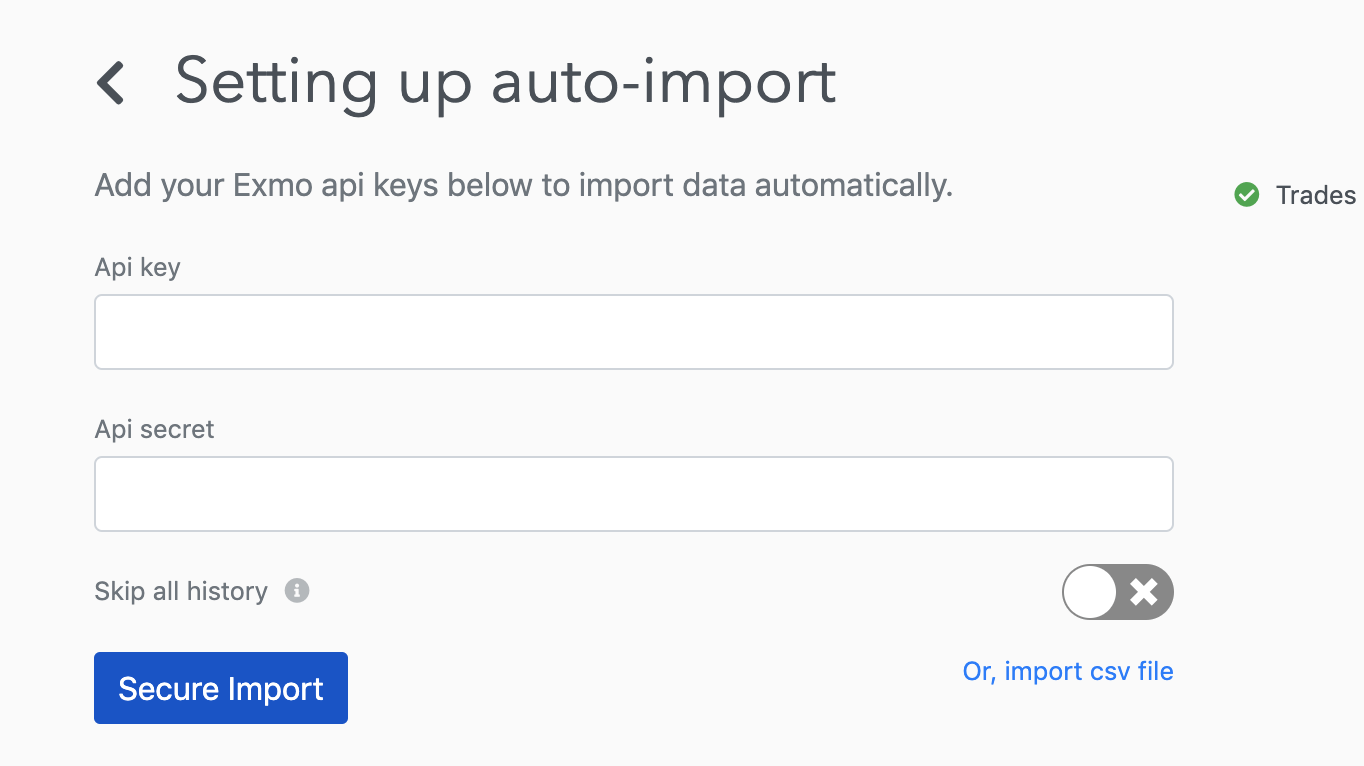

Setting up Koinly with your EXMO API keys

You can start using Koinly by first creating an API key in your account. Once you have done that, follow these steps:

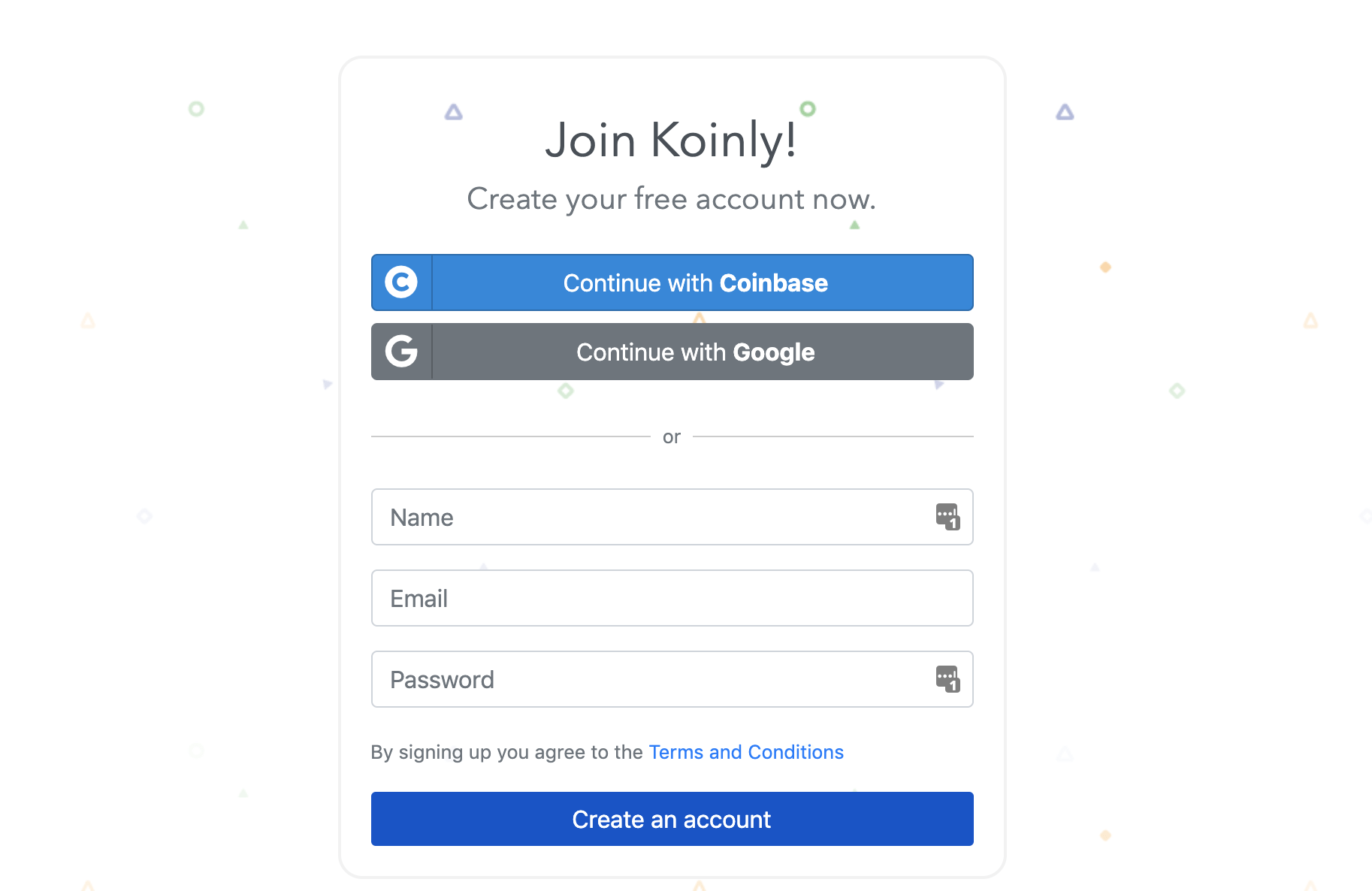

- Sign up to Koinly

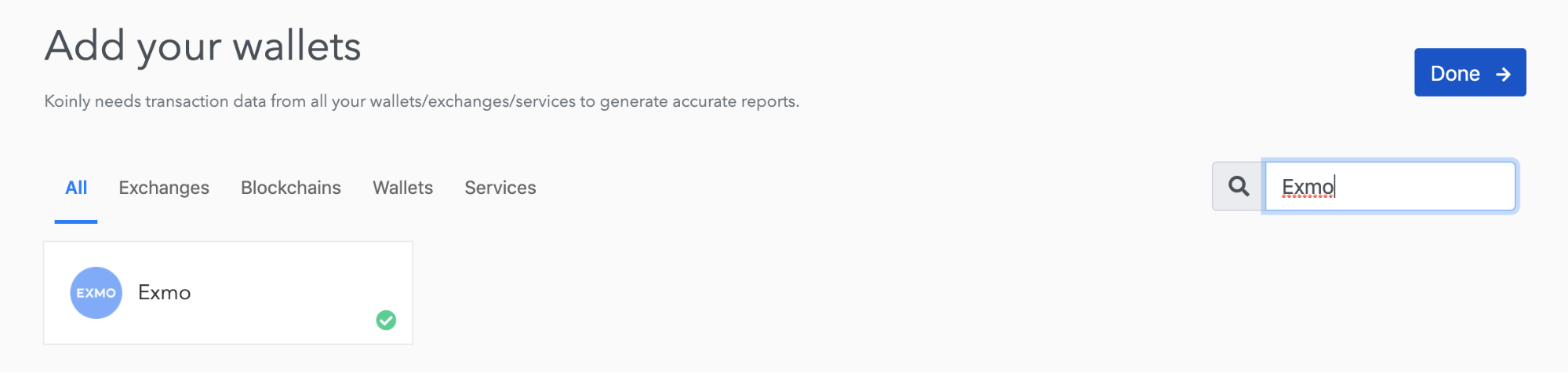

- Select EXMO from the Wallets page

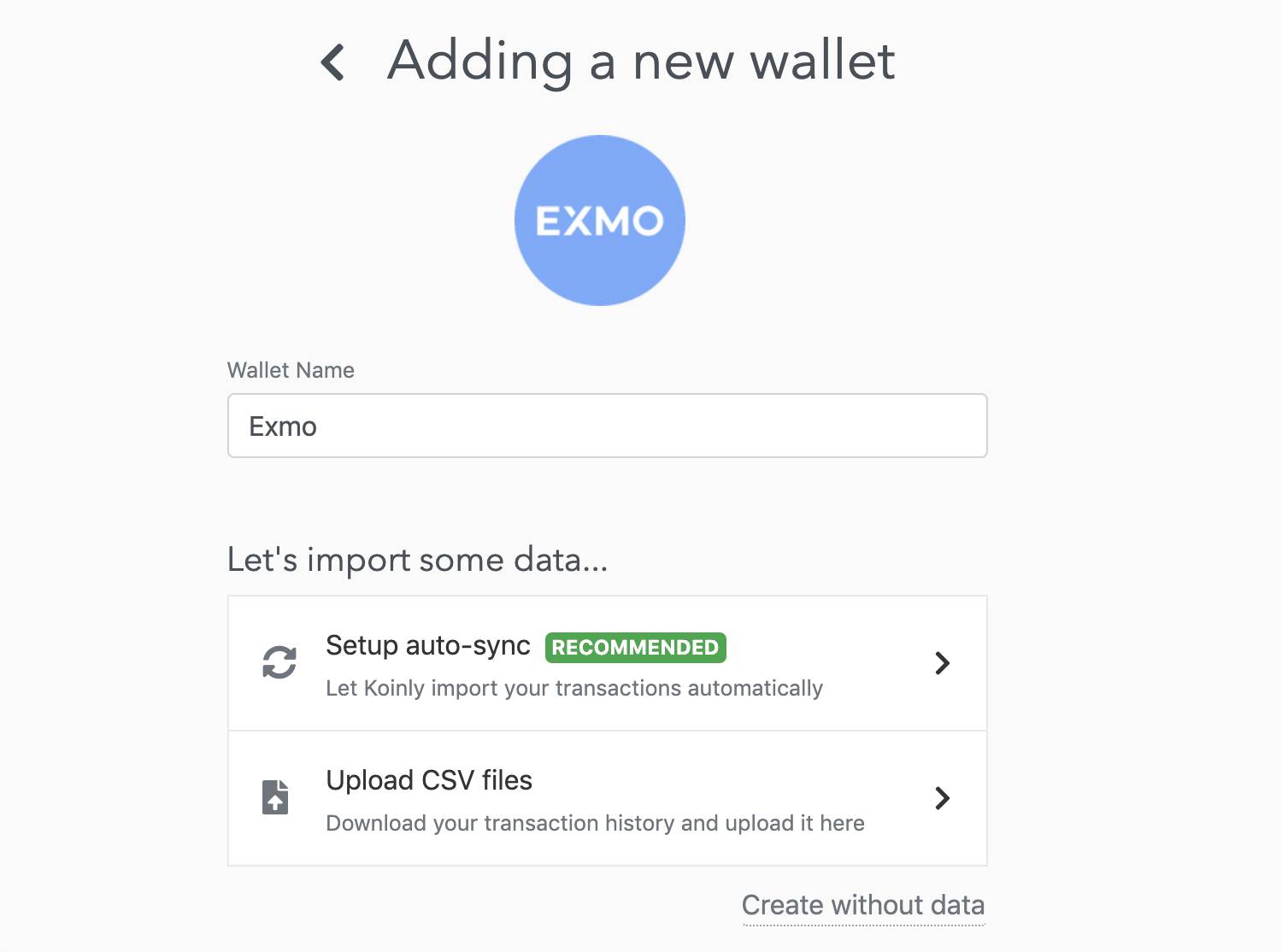

- Click on Setup auto-sync

- Enter your EXMO API keys

- That’s it. Check the full guide for more detailed information.

You will now be able to synchronize all your transactions and trading history and analyze your taxable profit/loss. You can also download your complete tax report on the Tax Reports page.

And here is the cherry on top: EXMO users can get a special 15% discount by signing up using this link!