Back to News

Back to News

Weekly recap: the bearish market lingers on

Exactly one year ago, we launched our Weekly recap section. Today we release the 46th weekly overview of the most important crypto market trends and changes that happened between 19th and 26th May.

Crypto market in numbers

The crypto market cap has remained flat for the second consecutive week. During the week, it fluctuated in the range of $1.23- $1.3 trillion, according to CoinMarketCap.

Crypto trading activity continued to decline, returning to February levels. Between 19th to 25th May, trading volumes stood at less than $500 billion, down 32% from the previous week. The daily average for the period was $71 billion.

The market is still seized by fear. For the last 18 days, the Cryptocurrency Fear & Greed Index has not risen above 14 points, remaining in the “Extreme fear” zone. This is the longest “Extreme fear” period observed after March 2020.

The dominance of bitcoin is getting stronger. On 26th May, bitcoin’s share of the crypto market rose to 45.4%.

Ether, along with other cryptocurrencies, is losing its ground. While on 12th May 2022, ETH’s share briefly rose to 20% amid a falling market, today it has dropped to 18.2% – the lowest level since mid-March.

Market volatility is increasing. Over the week, the 30-day bitcoin volatility index rose by 0.29% and exceeded 4%, returning to the levels observed at the end of March. Similarly, ether rose by 0.19%, remaining at 4.8% for most of the week.

Gainers of the week (20th – 26th May 2022)

| Coin | Opening price 20.05, $ | Opening price 26.05, $ | Change |

| ROOBEE | 0.0017 | 0.0026 | 55.3% |

| BTG | 20.34 | 25.27 | 24.2% |

| XTZ | 1.91 | 2.36 | 23.6% |

| GAS | 2.61 | 3.12 | 19.5% |

| TRX | 0.08 | 0.09 | 14.1% |

Losers of the week (20th – 26th May 2022)

| Coin | Opening price 20.05, $ | Opening price 26.05, $ | Change |

| VLX | 0.11 | 0.07 | -31.7% |

| CRON | 0.34 | 0.26 | -23.9% |

| GMT | 0.20 | 0.17 | -15.4% |

| HAI | 0.03 | 0.02 | -14.2% |

| WAVES | 6.91 | 6.00 | -13.1% |

Easily track gainers and losers within the Simple trade section on EXMO. Check real-time updates in the last 24 hours, week and month.

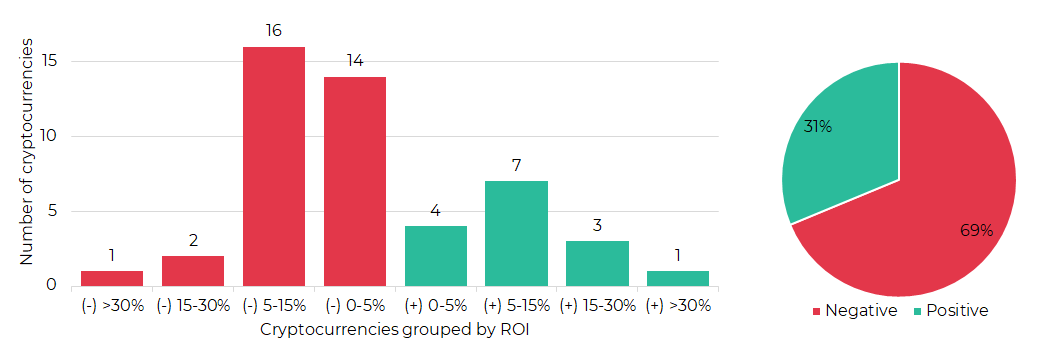

Segmentation of cryptocurrencies based on trading results

(20th – 26th May 2022)

Most traded coins (19th – 25th May 2022)

| Coin | Trading volumes, $ |

| BTC | 14,969,280 |

| ETH | 9,761,208 |

| XRP | 1,444,383 |

| GMT | 1,364,809 |

| ROOBEE | 1,189,790 |

| WAVES | 892,935 |

| LTC | 638,667 |

| SMART | 573,859 |

| ZEC | 464,274 |

| TON | 378,705 |

Top crypto market driving factors

Overall crypto market

▼ 19.05.2022 – IntoTheBlock: crypto is moving almost in tandem with traditional equities such as Nasdaq, S&P500 and Dow Jones. BTC and ETH correlation with such equities is 0.9.

▼ 19.05.2022 – Australia’s largest bank, Commonwealth Bank, has paused the launch of cryptocurrency trading through its app amid turmoil and uncertainty in the market.

▲ 19.05.2022 – Tether’s USDT stablecoin is beyond fully backed, according to the attestation conducted by the MHA Cayman accounting firm.

▲ 20.05.2022 – On Friday, the technology sector in the Asia-Pacific region recovered losses amid China’s latest monetary policy easing. China’s central bank kept some of its policy rates unchanged, others were cut.

▼ 22.05.2022 – The Guardian: Tether has paid out $10 billion in withdrawals since the start of May.

▼ 23.05.2022 – CoinShares: between 16th and 20th May, digital asset investment products saw outflows totaling $141 million. This is the second-largest weekly outflow year-to-date, after the first week of January. Bitcoin funds recorded the biggest weekly outflows.

▲ 23.05.2022 – CoinShares: Multi-asset investment products remain the stalwarts, with inflows totaling $9.7 million over the past week. Inflows year-to-date represent 5.3% ($185 million) of AuM.

▲ 23.05.2022 – Japanese bank Sumitomo Mitsui Trust will set up a company to provide digital asset custody services for institutional investors

▲ 25.05.2022 – Venture company Andreessen Horowitz raises a $4.5-billion crypto fund focused on crypto startups and Web3.

▲ 25.05.2022 – JPMorgan: cryptos had overtaken real estate as one of the preferred “alternative assets”.

Bitcoin (BTC)

▼ 23.05.2022 – CoinShares: outflows from digital asset funds recorded between 16th and 20th May were caused by outflows from bitcoin-based products, totaling $153.5 million. The Purpose Bitcoin ETF saw the majority of outflows totaling $150 million. Inflows to this ETF reduced by almost 44% since the beginning of the month to $191.7 million.

▼ 23.05.2022 – Guggenheim Partners: Bitcoin could drop further and fall to $8,000 from its current levels amid the U.S. Federal Reserve’s hiking of interest rates and tightening of monetary policy.

▼ 23.05.2022 – Glassnode: until the middle of 2022, the market will focus on hedging risks and/or speculating on a further price reduction. However, on a long-term basis, optimistic sentiment prevails.

▲ 24.05.2022 – The Central African Republic is to launch a bitcoin investment platform.

▲ 24.05.2022 – Fidelity’s bitcoin index fund has raised a total of $126.5 million since its launch almost two years ago. While the fund’s size has grown modestly during its second year, the number of investors has increased from 83 to 689.

▲ 25.05.2022 – Online payments company, Stripe, is to resume accepting Bitcoin payments.

▲ 25.05.2022 – JPMorgan: $38,000 is a fair price for bitcoin.

▼ 26.05.2022 – The Bitcoin mining difficulty level fell by 4.33% to 29.9 trillion. This was the biggest drop since July of last year

Ethereum (ETH)

▲ 20.05.2022 – Ethereum co-founder Vitalik Buterin: the Ethereum blockchain network may switch to an updated version (Ethereum 2.0) as early as August. However, if risks of problems or delays arise, the merge might be pushed to September or October, he stated.

▲ 21.05.2022 – Devlin DeFrancesco has become the first INDYCAR racer to be paid in Ethereum.

▲ 22.05.2022 – During May, the popularity of the Ethereum Name Service (ENS) domain name system increased significantly. Almost all service metrics hit all-time highs.

▼ 23.05.2022 – CoinShares: between 16th and 20th May, outflows from Ethereum-based investment products almost stopped, with only $0.3 being withdrawn.

▼ 23.05.2022 – Glassnode: Ethereum’s median gas price dropped to 26.2 Gwei after short-term spikes to almost 500 Gwei. Such low levels were last observed in May-July 2021 and after March 2020.

▼ 23.05.2022 – Glassnode: Ether burn rate has plunged to its lowest levels. The share of minted ETH that were not burned reached a record 81.6%.

▼ 25.05.2022 – The Ethereum Beacon Chain experienced the largest block reorganisation since its launch.

XRP (XRP)

▲ 23.05.2022 – CoinShares: between 16th and 20th May, XRP investment products saw inflows totaling $0.7 million.

▲ 24.05.2022 – Ripple developers conduct tests to add NFT functionality to the network.

▼ 24.05.2022 – Co-founder of Ripple Labs and its first chief technology officer Jed McCaleb, who suspended selling his XRP coins in September last year, has resumed dumping large amounts of XRP, according to XRPscan. Since January, he has dumped about 464.8 million XRP worth $186,790,421 at the current exchange rate.

▲ 23.05.2022 – Ripple CEO, Brad Garlinghouse, met with the prime minister of Georgia, Irakli Garibashvili, in Davos to discuss technology and blockchain developments for future payment systems.

▲▼ 25.05.2022 – Santiment: XRP whales holding between 1 million and 10 million XRP had a 2.4% rise in their total holdings in just 11 days. They now hold their highest percentage of the asset’s supply in two months.

Cardano (ADA)

▲ 22.05.2022 – Cardano Insights: Cardano’s Milkomeda sidechain, which has been working for almost two months now, may become a roll-up to Cardano’s main chain to reduce transaction fees.

▲ 23.05.2022 – CoinShares: between 16th and 20th May, Cardano saw inflows totaling $1 million.

Solana (SOL)

▲ 23.05.2022 – CoinShares: between 16th and 20th May, Solana saw inflows totaling $0.5 million. Outflows since the beginning of May are now estimated at $2.9 million.

▲ 24.05.2022 – Privacy crypto browser, Brave, has added support for the Solana blockchain, Solana-based tokens (SPL) and its native token Solana (SOL).

Polkadot (DOT)

▲ 23.05.2022 – CoinShares: between 16th and 20th May, Polkadot saw inflows totaling $1 million. Outflows since the beginning of May have almost zeroed.

▲ 24.05.2022 – Polkadot has partnered with Frank McCourt’s Project Liberty to democratise social media data.

NEAR (NEAR)

▲ 24.05.2022 – ConsenSys announced a partnership between Infura, its leading blockchain development platform, and the NEAR Protocol.

Tron (TRX)

▲ 23.05.2022 – Defi Llama: Tron has become the third-largest DeFi platform in terms of total value locked (TVL), with an indicator growing by 23% or almost $1 billion over the day.

Zcash (ZEC)

▲ 22.05.2022 – The Electric Coin Company (ECC), the creator and developer of the ZCash (ZEC) cryptocurrency, launches Proof-of-Stake (PoS) transformation research.

Toncoin (TON)

▲ 24.05.2022 – TON mining will complete in 20 days.

That’s all for this week! Follow EXMO on YouTube, Twitter and Telegram to stay tuned to the main events and trends in the crypto market.