Back to News

Back to News

Weekly recap: spring rise of the crypto market

Tether issued an additional 1 billion USDT, Honduras and Malaysia could make bitcoin legal tender and Grayscale launched a fund based on the Ethereum Competitors Index. Meanwhile, ETH’s price rise is fueled by Buterin’s popularity, but the second-largest cryptocurrency keeps seeing outflows for the second consecutive week, along with other digital assets. Read the Weekly recap to find out more about the main events of the crypto market that happened between 18th and 24th March 2022.

Crypto market in numbers

The cryptocurrency market recovery continued over the past week. The sector’s capitalisation grew by almost 8% and came close to the $2 trillion mark on 24th March, according to CoinMarketCap.

Trading volumes recorded a slight increase compared to the previous two weeks. Between 17th and 23rd March, the indicator amounted to $618 billion – a 13% increase compared to the levels observed between 10th and 16th March. However, trading activity remains relatively low when compared to the previous year. The average daily trading volume for the week stands at $88 billion.

Market sentiment is improving. Between 18th and 24th March, the Cryptocurrency Fear & Greed Index rose by 15 points, reaching 40 points. The index has left the “Extreme Fear” zone and is moving confidently into the “Neutral” zone.

Bitcoin’s dominance is declining as the market continues to grow. The market share of the first cryptocurrency fell by 0.7% to 41.7% over the past week.

A number of Bitcoin and Ether forks have seen considerable growth during this week. However, there has been no news that is likely to reinforce this trend.

Bitcoin’s volatility has decreased slightly but remains relatively high compared to the period between November 2021 and February 2022. The 30-day volatility index fell by 0.25% to 4.32% over the past seven days.

Gainers of the week (18th – 24th March 2022)

| Coin | Opening price 18.03, $ | Opening price 24.03, $ | Change |

| ETC | 28.32 | 47.28 | 66.9% |

| BTG | 31.15 | 43.08 | 38.3% |

| DASH | 101.28 | 135.04 | 33.3% |

| QTUM | 6.19 | 8.21 | 32.6% |

| ADA | 0.88 | 1.15 | 31.4% |

Losers of the week (18th – 24th March 2022)

| Coin | Opening price 18.03, $ | Opening price 24.03, $ | Change |

| IQN | 3.17 | 2.81 | -11.5% |

| ONG | 0.77 | 0.68 | -10.6% |

| MNC | 0.00097 | 0.00090 | -6.9% |

| MKR | 2 234.05 | 2 094.70 | -6.2% |

| CRON | 0.91 | 0.89 | -2.3% |

Easily track gainers and losers within the Simple trade section on EXMO. Check real-time updates in the last 24 hours, week and month.

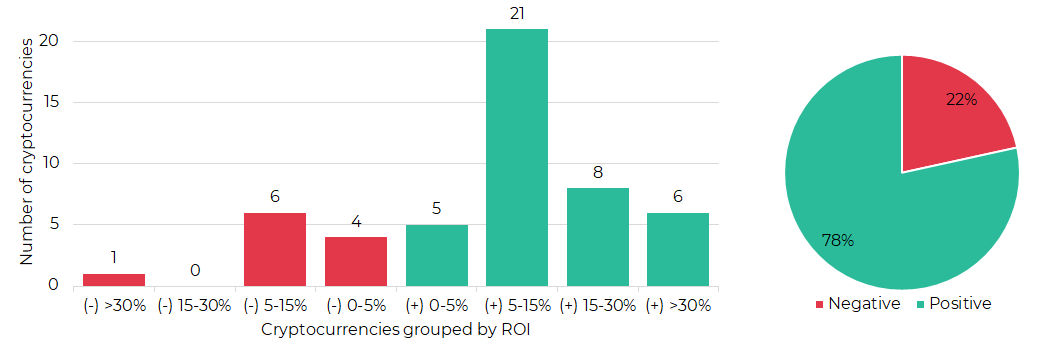

Segmentation of cryptocurrencies based on trading results

(18th – 24th March 2022)

Most traded coins (17th – 23rd March 2022)

| Coin | Trading volumes, $ |

| BTC | 20,914,595 |

| ETH | 13,708,511 |

| XRP | 2,699,409 |

| WAVES | 2,134,978 |

| ZEC | 1,812,901 |

| ETC | 1,738,252 |

| IQN | 1,432,068 |

| DASH | 1,328,765 |

| ROOBEE | 1,267,660 |

| LTC | 1,072,873 |

Top crypto market driving factors

Overall crypto market

▲ 18.03.2022 – Adjust and Apptopia analysts: in Q4 2021 alone, there were more than 100 million downloads of crypto applications.

▼ 18.03.2022 – The Argentine Senate has voted to approve an agreement with the International Monetary Fund restructuring $45 billion in debt. The institution’s proposal includes a ban on the circulation of cryptocurrencies in the country.

▼ 18.03.2022 – Arcane Research: correlations in the crypto market are nearing all-time highs after rising steadily over the past year and are now approaching the highs from the bear market of 2018/2019. This paints a picture of an overall risk-averse sentiment in the market.

▼ 21.03.2022 – CoinShares: between 14th and 18th March, digital asset investment products saw a second consecutive week of outflows, totaling $47 million. 98% of outflows predominantly came from North American providers.

▲▼ 21.03.2022 – Santiment: on 17th and 19th March 2022, Tether saw the two largest spikes in USDT addresses interacting on the network, which indicates that big moves may be coming for crypto.

▲ 23.03.2022 – Whale Alert: stablecoin issuer Tether issued an additional 1 billion USDT.

▲ 23.03.2022 – Wall Street bank Cowen launches spot crypto trading for institutions.

Bitcoin (BTC)

▼ 18.03.2022 – As a result of the next recalculation, the complexity of bitcoin mining decreased by 0.35% to 27.45 million (T). The weakening dynamics can be attributed to rising electricity costs.

▲ 18.03.2022 – Santiment: Bitcoin’s ratio of positive vs. negative commentary indicates there are about five times the amount of positive posts vs. negative posts across Twitter, Discord, Reddit and Telegram. This ratio was observed when BTC prices jumped to local highs.

▲ 20.03.2022 – Glassnode: the supply of bitcoin on centralised exchanges has fallen to 2.51 million coins – the lowest level since November 2018.

▲ 21.03.2022 – Xiomara Castro, President of Honduras: “We must not allow El Salvador to become the only country that has escaped dollar hegemony. Honduras has the right to move towards the First World.”

▲ 21.03.2022 – Goldman Sachs executed its first over-the-counter (OTC) BTC trade through its trading partner Galaxy Digital Holdings. This is the first such transaction by a major U.S. bank.

▲ 21.03.2022 – Malaysia’s Communication Ministry has proposed to the government that cryptocurrencies such as bitcoin be adopted as legal tender.

▼ 21.03.2022 – CoinShares: between 14th and 18th March, Bitcoin saw the largest outflows, totaling $33 million, which is half the amount seen during the previous week. The outflows observed in the last two weeks now total $101 million but year-to-date flows remain positive at $64 million.

▼ 22.03.2022 – Glassnode: Crypto market selling pressure remains Asia-dominated.

▼ 23.03.2022 – The Central Bank of Honduras denied rumours about the country possibly adopting Bitcoin as legal tender like its neighbour, El Salvador.

Ethereum (ETH)

▲ 17.03.2022 – Optimism, a project that is developing a second-layer solution for scaling Ethereum, raised $150 million in a Series B funding round at a $1.65 billion valuation.

▲ 20.03.2022 – Glassnode: the overall supply of Ethereum on crypto exchanges has fallen to 21.6 million ETH, to its lowest level since 2018.

▼ 21.03.2022 – CoinShares: between 14th and 18th March, Ethereum saw outflows totaling $17 million last week, much less than the previous week which saw outflows of $50 million. The negative sentiment still pervades the asset in 2022, with year-to-date outflows at $151 million.

▲ 21.03.2022 – Santiment: investors accelerated ETH deposits into smart contract staking as the bank’s key rate in the U.S. rises and Ethereum is preparing to switch to PoS.

▲ 22.03.2022 – IntoTheBlock: 10 million ETH (~$29.6 billion) are now deposited into the Proof-of-Stake contract, which represents approximately 8.3% of all ETH in circulation. The amount of ETH staked has grown by 20% in the last 90 days and 10% in the past 30 days alone.

▼ 22.03.2022 – Grayscale Investments has announced the launch of a new fund, the Grayscale Smart Contract Platform ex Ethereum Fund (GSCPxE). It offers clients exposure to Cardano (24.63%), Solana (24.27%), Avalanche (16.96%), Polkadot (16.16%), Polygon (9.65%), Algorand (4.27%) and Stellar (4.06%).

▼ 22.03.2022 – Watch The Burn: the ETH burn rate on the network has fallen to the lowest level since the introduction of the EIP-1559 mechanism in August 2021. The reason behind this fall may be a decrease in interest in the NFT market.

▲ 23.03.2022 – NewsBTC: Ether’s price growth correlates with the times when the Ethereum founder’s name is trending on Google Searches worldwide. The most recent spike in searches is most likely due to the article on Vitalik Buterin released by TIME Magazine.

▲ 24.03.2022 – ANZ has become the first Australian bank to mint an Australia dollar (AUD) pegged stablecoin named A$DC, which is based on Ethereum.

XRP (XRP)

▲ 20.03.2022 – National Australia Bank (NAB) has signed agreements with two leading global financial institutions – Israel’s Bank Leumi and the Canadian Imperial Bank of Commerce (CIBC) – to form an international banking innovation alliance.

▲ 21.03.2022 – CoinShares: between 14th and 18th March, Ripple saw the largest inflows, totaling $1.1 million.

▲ 22.03.2022 – The cross-chain protocol, Multichain, added support for the XRP Ledger, which will allow cryptocurrency transactions to be carried out with other blockchains.

▼ 23.03.2022 – The court has approved the SEC’s request for a time extension, despite Ripple’s opposition.

Cardano (ADA)

▲ 18.03.2022 – The Cardano team has updated its roadmap to include the options of token minting and burning.

▲ 22.03.2022 – Grayscale Investments has announced the launch of a new fund, the Grayscale Smart Contract Platform ex Ethereum Fund (GSCPxE). It offers clients exposure to Cardano (24.63%), Solana (24.27%), Avalanche (16.96%), Polkadot (16.16%), Polygon (9.65%), Algorand (4.27%), and Stellar (4.06%).

▲ 23.03.2022 – IntoTheBlock: ADA price keeps soaring as the accumulation patterns continue. Addresses holding 10-100 and 100,000-1 million ADA increased their balance by 12% and 11% in 30 days, respectively.

Solana (SOL)

▲ 21.03.2022 – CoinShares: between 14th and 18th March, Solana saw outflows totaling $0.7 million.

▲ 22.03.2022 – Grayscale Investments has announced the launch of a new fund, the Grayscale Smart Contract Platform ex Ethereum Fund (GSCPxE). It offers clients exposure to Cardano (24.63%), Solana (24.27%), Avalanche (16.96%), Polkadot (16.16%), Polygon (9.65%), Algorand (4.27%) and Stellar (4.06%).

▼ 22.03.2022 – NeoNexus, a popular NFT project in Solana, announced that it is winding up operations, claiming that “the activity, volume, and interest in the entirety of the Solana NFT space have decreased.” The project may face a class-action lawsuit.

▼ 23.03.2022 – The Solana stablecoin protocol Cashio has suffered an exploit leading to a complete collapse of its flagship stablecoin, CASH.

▲ 23.03.2022 – Video game developer, Krafton, announced a partnership with Solana Labs to build games based on blockchain technology.

Polkadot (DOT)

▲ 21.03.2022 – CoinShares: between 14th and 18th March, Polkadot saw outflows totaling $0.8 million amid continuing outflows from most cryptocurrencies.

▲ 22.03.2022 – Grayscale Investments has announced the launch of a new fund, the Grayscale Smart Contract Platform ex Ethereum Fund (GSCPxE). It offers clients exposure to Cardano (24.63%), Solana (24.27%), Avalanche (16.96%), Polkadot (16.16%), Polygon (9.65%), Algorand (4.27%) and Stellar (4.06%).

▲ 23.03.2022 – Parachain project, Acala, has launched the $250 million aUSD Ecosystem Fund to support early-stage startups building applications with strong stablecoin use cases on any Polkadot or Kusama parachain.

Shiba Inu (SHIB)

▼ 19.03.2022 – CoinMarketCap: between 16th and 17th March, the number of unique addresses on the Shiba Inu network dropped by 2.7%. Between January and February 2022, the daily number of on-chain transactions decreased by 9%.

▲ 22.03.2022 – PayBolt, a web3 crypto payment gateway, has integrated Shiba Inu as its newest cryptocurrency.

Litecoin (LTC)

▲ 18.03.2022 – Mimblewimble and Taproot updates have been deployed on the Litecoin testnet.

Chainlink (LINK)

▲ 21.03.2022 – Santiment: Chainlink has grown by 24% since 24th February, driven by spikes in LINK address activity.

▲ 23.03.2022 – Chainlink Labs announced a program that provides a blueprint to help new crypto projects in their blockchain business-building journey.

Uniswap (UNI)

▲ 22.03.2022 – CryptoRank: Uniswap has become the most developed project on Github in the last 30 days.

Algorand (ALGO)

▲ 22.03.2022 – Grayscale Investments has announced the launch of a new fund, the Grayscale Smart Contract Platform ex Ethereum Fund (GSCPxE). It offers clients exposure to Cardano (24.63%), Solana (24.27%), Avalanche (16.96%), Polkadot (16.16%), Polygon (9.65%), Algorand (4.27%) and Stellar (4.06%).

Stellar (XLM)

▲ 21.03.2022 – Stellar CEO Denelle Dixon: Stellar is still working with Ukraine on its central bank digital currency (CBDC) despite the armed conflict between Russia and Ukraine.

▲ 22.03.2022 – Grayscale Investments has announced the launch of a new fund, the Grayscale Smart Contract Platform ex Ethereum Fund (GSCPxE). It offers clients exposure to Cardano (24.63%), Solana (24.27%), Avalanche (16.96%), Polkadot (16.16%), Polygon (9.65%), Algorand (4.27%) and Stellar (4.06%).

EXMO news

That’s all for this week! Follow EXMO on YouTube, Twitter and Telegram to stay tuned to the main events and trends in the crypto market.