Back to News

Back to News

Weekly recap: long-awaited market growth

Ethereum is very close to completing The Merge, CME Group launches euro-denominated Bitcoin and Ether futures, while investments targeting the crypto industry have already outpaced all of 2021. Read the Weekly recap to find out more about the main events of the crypto market that happened between 4th and 11th August 2022.

Crypto market in numbers

The cryptocurrency market cap has remained above the $1 trillion mark for more than three weeks. The median value of the indicator over the past 30 days has also managed to hold at above $1 trillion. Over the past seven days, the crypto market cap grew by 8% and as of 11th August stands at about $1.15 trillion, according to CoinMarketCap.

Weekly trading volumes decreased by 18.5% compared to the previous period, amounting to $470 billion. On 09th August, they sharply jumped to $101 billion, which is 50% higher than the weekly average of $67 billion. Higher trading activity was also recorded in the following two days.

The Cryptocurrency Fear & Greed Index has remained at above 30 points for two weeks. The 30-day median value of the index rose to 31 points. On 09th and 11th August, the index rose above 40 points. In general, market sentiment is increasingly moving towards the “Greed” zone.

Ether continues to strengthen relative to Bitcoin. Bitcoin’s market share has fluctuated between 40% and 41% since 05th August 2022. At the same time, the market share of ether rose by 1.3% over the week to 19.8%, hitting a three-month high. The ETH exchange rate against BTC has increased by 9% over the week, and by 43% over the past two months.

Bitcoin volatility remains relatively moderate. The 30-day volatility index stands at 3.07% today, down 0.16% on the week. For ether, the exact indicator rose from 5.76% to 5.82%.

Gainers of the week (05th – 11th August 2022)

| Coin | Opening price 05.08, $ | Opening price 11.08, $ | Change |

| GNY | 0.0107 | 0.0202 | 89.1% |

| IQN | 0.41 | 0.55 | 33.5% |

| DCR | 29.02 | 38.45 | 32.5% |

| NEAR | 4.79 | 6.17 | 28.8% |

| TON | 1.04 | 1.29 | 24.0% |

Losers of the week (05th – 11th August 2022)

| Coin | Opening price 05.08, $ | Opening price 11.08, $ | Change |

| WXT | 0.0075 | 0.0072 | -4.9% |

Easily track gainers and losers within the Simple trade section on EXMO. Check real-time updates in the last 24 hours, week and month.

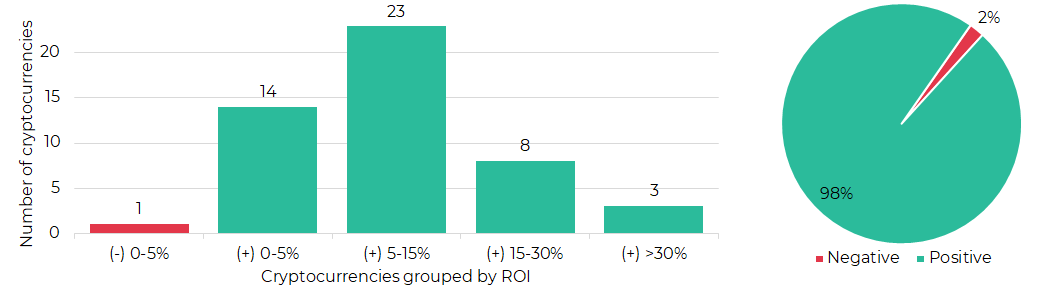

Segmentation of cryptocurrencies based on trading results

(05th – 11th August 2022)

Most traded coins (04th – 10th August 2022)

| Coin | Trading volumes, $ |

| BTC | 12,211,252 |

| ETH | 11,358,006 |

| ROOBEE | 1,612,539 |

| XRP | 1,099,104 |

| ETC | 770,042 |

| WAVES | 641,360 |

| LTC | 587,548 |

| GMT | 539,578 |

| TON | 524,237 |

| DASH | 246,495 |

Top crypto market driving factors

Overall crypto market

▲ 05.08.2022 – Blockworks: BH Digital, Brevan Howard Asset Management’s dedicated crypto arm, raised around $1 billion from institutional crypto investors.

▲ 07.08.2022 – Messari: investments targeting the crypto industry reached $30.3 billion in the first half of 2022, outpacing all of 2021.

▲ 07.08.2022 – Morgan Stanley is looking for a product development manager with a primary focus on building crypto products.

▲ 08.08.2022 – CoinShares: between 01st and 05th August, digital asset investment products saw inflows totaling $3 million, marking the sixth consecutive week of inflows that total $529 million (1.7% of total AuM).

▲ 08.08.2022 – CoinShares: despite the crash in prices observed in Q2 2022, 32 new investment products were launched, second only to the peak of product launches at 33 seen in Q4 2021.

▲ 09.08.2022 – U.S. Banking giant, Citigroup, is hiring two digital assets risk managers focused on cryptocurrencies, stablecoins and DeFi.

▲ 09.08.2022 – JPMorgan analysts: the “contagion effect” from the collapse of Terra has already been overcome, and the transition of the Ethereum network to PoS expected in September of this year will have a positive impact on the entire industry.

▲ 10.08.2022 – Santiment: the ratio of Tether on exchanges has increased from 19.7% in May to a whopping 42.0% three months later. This can be viewed as both a signal that traders have taken profits as prices have rebounded and a sign of a 2-year high in buying power.

▲ 10.08.2022 – The annual inflation rate declined to 8.5% from 9.1% in June, below estimates of 8.7%.

Bitcoin (BTC)

▲ 04.08.2022 – As a result of the latest recalculation, Bitcoin’s mining difficulty rose by 1.7% to 28,17 T, for the first time since the start of June.

▲ 04.08.2022 – Major derivatives marketplace, CME, aims to launch trading for Bitcoin and Ether euro futures contracts.

▲ 08.08.2022 – CoinShares: Between 01st and 05th August, Bitcoin saw very few outflows totaling $8.5 million, while short-bitcoin investment products saw a record outflow for the second consecutive week, totaling $7.5 million.

▲ 08.08.2022 – Kaiko: Bitcoin’s 30-day rolling correlation with the aggregate bond index (AGG) and the tech-heavy Nasdaq 100 has declined to a three-month low over the past few weeks.

Ethereum (ETH)

▲ 04.08.2022 – Major derivatives marketplace CME aims to launch trading for Bitcoin and Ether euro futures contracts.

▲ 08.08.2022 – CoinShares: between 01st and 05th August, Ethereum saw inflows totaling $16 million and is enjoying a seventh consecutive week of inflows totaling $159 million.

▲ 08.08.2022 – Kaiko: ETH options activity has surged, with open interest surpassing BTC options for the first time ever. Since 01st January 2022, ETH option investors have been piling into the $2,500–3,000 strike.

▲ 11.08.2022 – The Goerli testnet has been successfully merged and is now a full Proof-of-Stake chain. The next step is the mainnet merge planned for September 2022.

▲ 11.08.2022 – The total value of ETH 2.0 deposit contracts exceeded 13 million ETH worth about $25 billion.

XRP (XRP)

▲ 11.08.2022 – Reuters: Ripple Labs, Inc. is interested in purchasing the assets of the bankrupt crypto lender, Celsius Network.

Polkadot (DOT)

▲ 04.08.2022 – Blockchain infrastructure platform, Alchemy, has joined forces with the Astar project to develop Web3 in the Polkadot ecosystem.

Dogecoin (DOGE)

▲ 05.08.2022 – Elon Musk: the actual transactional throughput capability of DOGE is much higher than Bitcoin.

Uniswap (UNI)

▲ 05.08.2022 – The Uniswap Labs community has already begun mulling over a new proposal to form a non-profit Uniswap Foundation to support and expand the Uniswap ecosystem. To make the vision a reality, the developers asked for $74 million.

EXMO news

Top up your balance in PLN with a reduced fee. We’ve reduced fees for depositing PLN via Visa/Mastercard from 2.99% to 1.49%.

DEBT (DEBT) will soon be listed on EXMO. Soon, you will be able to trade in DEBT/BTC and DEBT/USDT pairs.

The EXMO Save Ukraine Relief Fund donated ambulances and fire engines to Ukraine. The fund bought six ambulances and one fire engine for a total sum of $220,000 to help Ukrainian cities affected by war.

That’s all for this week! Follow EXMO on YouTube, Twitter and Telegram to stay tuned to the main events and trends in the crypto market.