Back to News

Back to News

Weekly recap: institutional investors return to cryptocurrencies

Long-term holders accumulated BTC amid a market crash, while short-term ones sold off assets, Ethereum mining speed set new records, and Visa processed $2.5 billion in cryptocurrency transfers during the first quarter of the 2022 fiscal year. Read the Weekly recap to find out more about the main events of the crypto market that happened between 26th January and 2nd February 2022.

Crypto market in numbers

The capitalisation of the crypto market recovered by 3% over the week to $1.77 trillion, according to CoinMarketCap. The 30-day median value is $1.97 trillion.

Trading volumes over the past week fell by 24% to $506 billion, the lowest level since July last year. The average daily trading volume for the week dropped to $72 billion. The greatest recovery in the market was observed on 26th February: amid the U.S. Federal Reserve meeting, daily trading volumes reached almost $100 billion.

The Crypto Fear & Greed Index moved from the “Extreme Fear” zone to the “Fear” zone, rising above 25 points. Its value on 2nd February stood at 28 points. The median value of the index for the week is 24 points.

Bitcoin dominance has dwindled to 41.12% after hitting a three-month high of 42.17% a week earlier. At the same time, ether’s market share rose from 17.52% to 18.6%, according to CoinMarketCap.

The 30-day Bitcoin Volatility Index fell by 0.22% to 2.71% over the week.

Gainers of the week (27th January – 2nd February 2022)

| Coin | Opening price 27.01, $ | Opening price 02.02, $ | Change |

| HP | 0.0004 | 0.0008 | 109.0% |

| XTZ | 3.05 | 3.84 | 25.7% |

| MKR | 1 817.33 | 2 275.12 | 25.2% |

| TONCOIN | 2.27 | 2.82 | 24.0% |

| SOL | 95.20 | 112.36 | 18.0% |

Losers of the week (27th January – 2nd February 2022)

| Coin | Opening price 27.01, $ | Opening price 02.02, $ | Change |

| CRON | 1.13 | 0.89 | -21.2% |

| WAVES | 10.49 | 9.23 | -12.0% |

| ATOM | 33.21 | 29.38 | -11.5% |

| MNC | 0.00115 | 0.00103 | -10.7% |

| SMART | 0.00179 | 0.00165 | -7.8% |

Easily track gainers and losers within the Simple trade section on EXMO. Check real-time updates in the last 24 hours, week and month.

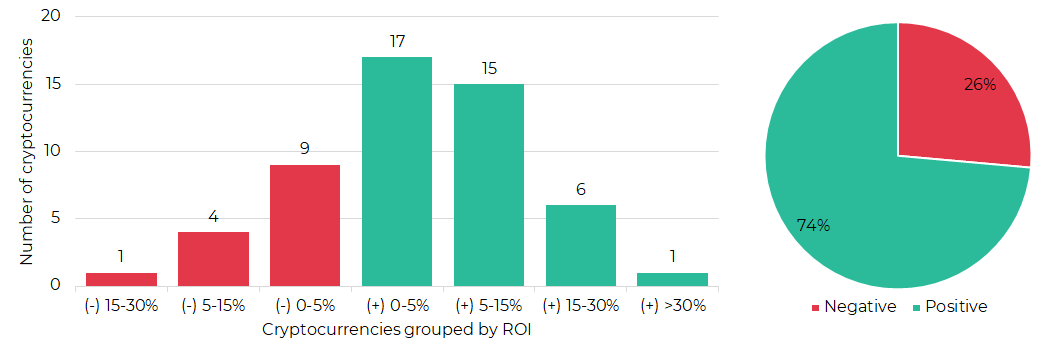

Segmentation of cryptocurrencies based on trading results (27th January – 2nd February 2022)

Most traded coins (26th January – 1st February 2022)

| Coin | Trading volumes, $ |

| BTC | 25,215,285 |

| ETH | 25,075,047 |

| XRP | 3,723,072 |

| IQN | 2,674,376 |

| GMT | 1,722,088 |

| ROOBEE | 1,664,502 |

| TONCOIN | 1,594,230 |

| ADA | 1,201,552 |

| LTC | 1 140 335 |

| WAVES | 975,706 |

Top crypto market driving factors

Overall crypto market

▼ 26.01.2022 – The US Federal Reserve has outlined that their main task for 2022 is to fight inflation that has reached 7%. The Fed chair, Jerome Powell, has promised to raise rates at every Fed meeting but kept it within the current range of 0-0.25% for now. The Fed has also reduced its bond-buying program, which is expected to end in March this year.

▼ 26.01.2022 – The House of Representatives committee will hold a virtual hearing on stablecoins scheduled for 8th February.

▼ 26.01.2022 – Bloomberg: the US SEC has launched an investigation into the activities of lending service providers regarding the legality of their provision of interest on digital asset deposits.

▲▼ 27.01.2022 – The Ministry of Finance has prepared its own concept of cryptocurrency regulation in the Russian Federation, which involves conducting operations with digital assets through banks, full user identification and tracking transactions.

▲▼ 27.01.2022 – The Federal Financial Monitoring Service supports the position of the Ministry of Finance of the Russian Federation regarding cryptocurrency regulation.

▼ 27.01.2022 – The Russian Central Bank expressed comments on a number of points regarding the concept of cryptocurrency regulation proposed by the Ministry of Finance. The Bank of Russia noted that the admission of cryptocurrencies to the financial system carries risks for its stability.

▲ 28.01.2022 – Asset management firm Fidelity has filed for two more ETFs with the SEC to track crypto firms and those active in the metaverse niche.

▲ 28.01.2022 – VISA customers made more than $2.5 billion in payments from crypto wallet-linked cards during the company’s first financial quarter of 2022. That is 70% of the company’s crypto volume for all of the 2021 fiscal year.

▲ ▼ 31.01.2022 – The U.S. Senate hearing on stablecoins is scheduled for 15th February.

▲ 31.01.2022 – CoinShares: digital asset investment products saw inflows for a second week. Between 24th January and 28th January, they accounted for $19 million. The outflow of funds has reached $232 million since the beginning of the year.

▲ 31.01.2022 – CoinShares: over the past week, multi-asset funds recorded the largest inflows totaling $32 million.

Bitcoin (BTC)

▲ 26.01.2022 – IntoTheBlock: bitcoin long-term holders remain unfazed by the recent drawdown. They have increased their positions by 4.91% over the past 30 days. At the same time, short-term holders are selling at a loss.

▲▼ 26.01.2022 – The U.S. SEC has postponed a decision on the ARK 21Shares Bitcoin ETF until 3rd April.

▲▼ 26.01.2022 – The U.S. SEC has delayed its decision on Teucrium Bitcoin Futures Fund until 8th April.

▲ 27.01.2022 – Tesla did not sell any bitcoin in the fourth quarter. The company holds bitcoin worth $1.26 billion.

▲ 27.01.2022 – Glassnode: BTC flows to major cryptocurrency exchanges have decreased by $1.2 billion over the past day.

▲ ▼ 27.01.2022 – Glassnode: bitcoin transfer volumes continue to be dominated by institutional size flows, with more than 65% of all transactions being larger than $1 million in value. The uptrend started around October 2020 when bitcoin prices were between $10,000 and $11,000.

▲ 26.01.2022 – Fidelity Investments Director of Global Macroeconomics, Jurrien Timmer: “Bitcoin clearly got caught in the liquidity storm that is now sweeping the more-speculative side of the stock market. But unlike non-profitable tech stocks, Bitcoin has a fundamental underpinning that will likely get more compelling over time.”

▼ 27.01.2022 – JPMorgan lowered its long-term theoretical bitcoin price target of $150,000 to $38,000 as surging volatility challenges institutional adoption.

▼ 27.01.2022 – The U.S. SEC refused to approve a Fidelity spot bitcoin exchange-traded fund (ETF).

▲ 29.01.2022 – Glassnode: more than 18,000 bitcoin worth $670 million left centralised exchanges on 27th January, which was the biggest single-day net outflow in over a month.

▲ 31.01.2022 – CoinShares: bitcoin saw inflows for a second week totaling $22 million.

▲ 01.02.2022 – MicroStrategy purchased an additional 660 bitcoins for approximately $25 million in January 2022. The company now owns more than 125,000 bitcoins.

▼ 01.02.2022 – Microstrategy lost $146 million from bitcoin impairment in the fourth quarter of 2021.

Ethereum (ETH)

▲ 26.01.2022 – Santiment: whales holding over 10,000 ETH have added 200,000 ETH (worth around $497.2 million) from weak hands since 20th January.

▲ 27.01.2022 – Ethereum mining hashrate reached a new ATH of 1117,8 Th/s.

▲ 31.01.2022 – Glassnode: Ethereum number of addresses holding at least 0.1 ETH reached an ATH of 6,823,620.

▼ 31.01.2022 – CoinShares: Ethereum continued to suffer from outflows of $27 million over the past week. Eight consecutive weeks of outflows now total $272 million.

Cardano (ADA)

▲ 28.01.2022 – Santiment: whales, holding between 10,000 and 1 million ADA, own 113% more in their collective bags since 17th January. Over the past 10 days, they have accumulated $53.6 million in tokens.

▲ 29.01.2022 – Over 1000 smart contracts have been deployed on the Cardano network since the Alonzo update in September 2021.

▼ 31.01.2022 – CoinShares: between 24th January and 28th January, Cardano saw outflows totaling $0.4 million.

▲ 01.02.2022 – Cardano developers have announced that the next update is set to increase the block size by 11%, thereby increasing network capacity.

Solana (SOL)

▲ 27.01.2022 – Solana Labs has disclosed the upgrades that it will prioritise in the near term, in order to solve the network’s current scaling challenges.

▼ 31.01.2022 – CoinShares: between 24th January and 28th January, Solana saw outflows totaling $2.3 million.

▲ 01.02.2022 – Solana-based crypto wallet Phantom has raised $109 million in a Series B funding round and become a unicorn with a $1.2 billion valuation.

▲ 01.02.2022 – Labs launches Solana Pay, a payments protocol for digital commerce that will allow merchants to accept crypto payments directly from consumers.

XRP (XRP)

▲ 31.01.2022 – CoinShares: of all altcoin-based funds only Litecoin and XRP saw inflows over the past week: $0.6 and $0.3 million, respectively.

Polkadot (DOT)

▲ 31.01.2022 – VanEck launches its first multi-token cryptocurrency fund called VanEck Vectors Crypto Leaders ETN (VTOP) in Europe. The product tracks the six largest cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Polkadot (DOT), Solana (SOL), Tron (TRX), Avalanche (AVAX) and Polygon (MATIC).

▼ 31.01.2022 – CoinShares: between 24th January and 28th January, Polkadot saw outflows totaling $5.3 million.

Dogecoin (DOGE)

▲ 01.02.2022 – The founder of the Ethereum blockchain, Vitalik Buterin, has confirmed that he is assisting in Dogecoin’s Proof-of-Stake transition.

Shiba Inu (SHIB)

▲ 31.01.2022 – PlaySide Studios, Australia’s largest video game developer, announced that its collaboration with Shiba Inu developers won’t be limited to launching a play-to-earn game.

Stellar (XLM)

▲ 27.01.2022 –The Stellar blockchain platform will support smart contracts. Developers are now exploring blockchain programming languages for writing smart contracts.

Chainlink (LINK)

▲ 26.01.2022 – Chainlink developers released version v1.1.0 with major updates, including the addition of multi-chain support and transaction simulation functionality.

Litecoin (LTC)

▲ 31.01.2022 – Litecoin developers have announced that they are ready to launch the much-anticipated Mimblewimble upgrade. The upgrade will allow network users to choose confidential transactions.

▲ 31.01.2022 – CoinShares: of all altcoin-based funds only Litecoin and XRP saw inflows over the past week: $0.6 and $0.3 million, respectively.

Tron (TRX)

▲ 31.01.2022 – VanEck launches its first multi-token cryptocurrency fund called VanEck Vectors Crypto Leaders ETN (VTOP) in Europe. The product tracks the six largest cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Polkadot (DOT), Solana (SOL), Tron (TRX), Avalanche (AVAX) and Polygon (MATIC).

▲ ▼ 31.01.2022 – CoinShares: Tron recorded no inflows and outflows between 15th and 21st January.

Chiliz (CHZ)

▲ 26.01.2022 – FC Spartak Moscow team has announced that they will launch a fan token in partnership with Chiliz.

0x (ZRX)

▲ 31.01.2022 – The developers of 0x Protocol have announced the launch of their latest update that will allow developers to build an NFT marketplace on various blockchains.

That’s all for this week! Follow EXMO on YouTube, Twitter and Telegram to stay tuned to the main events and trends in the crypto market.