Back to News

Back to News

Weekly recap: bitcoin joined the Guinness Book of World Records

Tesla hung onto its BTC holdings in Q3 2022, Google Cloud will accept crypto payments, while Ripple NFTs may soon launch on XRP Ledger. Read the weekly recap to learn more about the main crypto events that happened between 13th and 20th October 2022.

Crypto market in numbers

Over the week, the crypto market capitalisation mainly fluctuated between $910 billion and $940 billion. Last month, the indicator tried to gain a foothold above the $900 billion mark.

Weekly trading volumes increased to $390 billion, 19% up compared to the previous period. According to CoinMarketCap, a week earlier, the indicator fell to a year-low of $327 billion.

On the morning of 13th October, significant jumps in the daily trading volume were observed. The indicator then crossed the $200 billion mark, with a daily average of only $56 billion. This increase was followed by a drop in the crypto market cap. It decreased by 3.3% to $815 billion in seven hours, which coincided with the report on the U.S. annual inflation rate. In the following two days, market participants were more active, with the cap briefly rising above $940 billion.

The Cryptocurrency Fear & Greed Index remained in the “Extreme Fear” zone for the entire week. During the month, the indicator fluctuated in a small range between 20 and 24 points. Although market sentiments are pessimistic, the level of fear is lower than in May and June. At that time, the crypto market cap mostly stood above the current levels, but the index remained below 18 points, even falling to 6 points. Probably, now there are no significant reasons within the sector that can cause fear. Instead, many long-term positive events have been observed. A negative impact on the market sentiment is mainly caused by the general economic situation.

The volatility of cryptocurrencies has been greatly reduced. According to TradingView, bitcoin’s volatility has fallen to a two-year low. According to CoinMarketCap, BTC’s 30-day volatility stays at 1.78% – a 1.6% decrease from the previous month. A similar indicator for ETH is 2.33% – 2.3% less than in the previous month.

Gainers of the week (14th – 20th October 2022)

| Coin | Opening price 14.10, $ |

Opening price 20.10, $ |

Change |

| MKR | 999.81 | 1 171.66 | 17.2% |

| HAI | 0.016 | 0.019 | 16.3% |

| GNY | 0.0119 | 0.0133 | 12.2% |

| UNI | 6.92 | 7.06 | 2.0% |

| TON | 1.30 | 1.32 | 1.9% |

Losers of the week (14th – 20th October 2022)

| Coin | Opening price 14.10, $ |

Opening price 20.10, $ |

Change |

| ROOBEE | 0.00085 | 0.00063 | -26.4% |

| PRQ | 0.111 | 0.095 | -14.2% |

| BTG | 21.06 | 18.51 | -12.1% |

| CHZ | 0.21 | 0.18 | -11.8% |

| NEAR | 3.49 | 3.13 | -10.3% |

Easily track gainers and losers within the Simple trade section on EXMO. Check real-time updates in the last 24 hours, week and month.

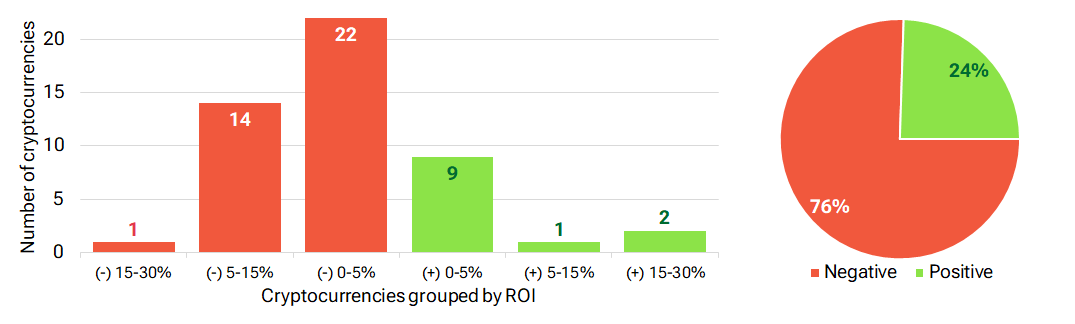

Segmentation of cryptocurrencies based on trading results

(14th – 20th October 2022)

Most traded coins (13th – 19th October 2022)

| Coin | Trading volumes, $ |

| BTC | 10,037,768 |

| ETH | 4,520,276 |

| DEBT | 3,457,063 |

| ROOBEE | 1,360,552 |

| XRP | 1,340,348 |

| ETC | 486,461 |

| WAVES | 468,282 |

| GMT | 364,472 |

| LTC | 345,676 |

| TRX | 240,903 |

Top crypto market driving factors

Overall crypto market

▼ 13.10.2022 – According to the Labour Department, the annual U.S. inflation rate remained largely unchanged in September, hitting 8.2% – 0.1% up than expected.

▲ 13.10.2022 – Google is to accept cryptocurrency payments for its cloud services. These include bitcoin, bitcoin cash, dogecoin, ether and litecoin among others.

▲ 14.10.2022 – Mastercard’s head of crypto and blockchain, Raj Dhamodharan, covered the key projects that the company is working on to unlock the full potential of crypto and make it a means of settling payments.

▲ 17.10.2022 – Payments giant, Mastercard, partnered with the crypto trading platform, Paxos, to launch a solution that will help banks offer cryptocurrency trading.

▲ 17.10.2022 – Société Générale, France’s third-largest bank, obtained regulatory approval to operate as a digital asset service provider in the country.

▲ 17.10.2022 – CoinShares: between 10th and 14th October 2022, digital asset investment products saw inflows totaling $12.2 million.

▼ 17.10.2022 – European Commission: in case there is a need for load shedding in the electric grid and network, EU member states must also be ready to stop crypto-assets mining.

Bitcoin (BTC)

▲ 17.10.2022 – Glassnode: the total amount of HODLed or lost bitcoins reached a five-year high of over 7.5 million BTC.

▲▼ 17.10.2022 – It took more than an hour to mine a single block of Bitcoin on 16th October. As a result of the latest difficulty adjustment on 10th October, BTC’s mining difficulty surged to 35.61 T. Last year, amid a mining ban in China, it took 100 minutes to create one Bitcoin block.

▲▼ 17.10.2022 – Bitcoin Mining Council: Bitcoin mining hashrate is up 73% year-over-year while energy usage is up 41% year-over-year. Bitcoin is currently using 0.16% of global energy production.

▼ 17.10.2022 – Greenpeace wants Bitcoin to follow Ethereum’s example by moving to proof-of-stake that slashed ETH’s carbon emissions by more than 99%.

▲▼ 17.10.2022 – CoinShares: between 10th and 14th October 2022, Bitcoin saw inflows totaling $8.8 million. Short-bitcoin investment products recorded inflows totaling $6.7 million.

▲ 18.10.2022 – Bitcoin officially entered the Guinness World Records for a number of entries, including the most valuable and the first decentralised cryptocurrency.

▼ 18.10.2022 – CryptoQuant: over 37,800 BTC left crypto exchanges on 18th October 2022. This marked the biggest Bitcoin daily outflow since 17th June 2022, when traders withdrew nearly 68,000 BTC.

▲ 19.10.2022 – Tesla did not buy or sell any bitcoin in the third quarter of 2022. The company now holds $218 million worth of digital assets.

Ethereum (ETH)

▲ 14.10.2022 – Ethereum-based wallet, Metamask, added instant bank-to-crypto transfers via the automated clearing house company, Sardine.

▲ 17.10.2022 – Ethereum has launched a testnet for the Shanghai upgrade. Now, developers can start working on the implementation of the upgrade to the mainnet, which is likely to continue until September 2023.

▼ 17.10.2022 – CoinShares: between 10th and 14th October 2022, Ethereum saw a second week of minor outflows totaling $3.9 million.

▲ 19.10.2022 – Fidelity Digital Assets, an independent subsidiary of financial services company Fidelity Investments, will start offering institutional customers the ability to buy, sell and transfer ether starting 28th October.

XRP (XRP)

▲ 17.10.2022 – Ripple starts testing the XRP Ledger sidechain that is compatible with Ethereum smart contracts.

▲ 19.10.2022 – Ripple NFT collections will go live on the XRP Ledger in two weeks if 80% of the network’s validators vote in favour of the initiative.

Dogecoin (DOGE)

▲ 19.10.2022 – CoinWarz: the total hash rate of the Dogecoin blockchain briefly hit a seven-month high of 815 TH/s on 18th October 2022.

Polkadot (DOT)

▲ 17.10.2022 – 15,433 developer contributions were recorded on Polkadot’s GitHub in Q3 2022, the highest recorded on any network, including Ethereum.

Tron (TRX)

▲ 13.10.2022 – The government of Dominica has partnered with the smart contract blockchain platform, Tron, to issue Dominica Coin (DMC), a token that promotes the Caribbean nation’s natural and cultural heritage.

Uniswap (UNI)

▲ 13.10.2022 – Uniswap Labs raised $165 million via a Series B funding round.

▲ 14.10.2022 – Decentralised exchange Uniswap will soon be deployed on a privacy-focused layer-2 tool, zkSync, following the community vote.

Chiliz (CHZ)

▲ 17.10.2022 – Chiliz, a blockchain firm and creator of the Socios.com fan token platform, has expanded its staff by 70% this year despite the crypto winter.

EXMO news

The quarterly burn of EXMO Coin (EXM) took place. We burned 561,061 EXM, after which its total circulation supply decreased to 219.7 million.