Back to News

Back to News

Weekly recap: the market is sliding out of the fear zone

Investors keep pulling money from ether investment products, Swiss banking group Swissquote is launching Tezos staking, Tezos secures a sponsorship deal With Manchester United, while Valour Solana ETP has begun trading on the Frankfurt Stock Exchange. Read the Weekly recap to find out more about the main events of the crypto market that happened between 2nd and 9th February 2022.

Crypto market in numbers

The cryptocurrency market continued to grow for the second consecutive week. According to CoinMarketCap, its capitalisation has increased by 14% since 2nd February to $2 trillion. However, so far there is no clear evidence that the indicator will remain above this level. The crypto market cap median value for the previous seven days stands at $1.9 trillion.

Crypto market trading activity remains relatively low, despite showing a slight recovery. Between 2nd and 8th February, trading volumes amounted to $549 billion, up 8.5% from the previous week. However, the indicator is at an even lower level than the values observed during December 2021 and January 2022, when trading volumes had already started declining.

Average daily trading volumes amounted to $78 billion over the past week. The highest trading activity was observed on 7th and 8th February – $96 billion and $104 billion, respectively.

The Cryptocurrency Fear & Greed Index left the extreme fear zone on 5th February and then moved from the fear zone to the neutral zone on 8th February. The median value of the index for the week is 33 points. On 9th February, the index stood at 54 points.

Over the week, Bitcoin dominance increased by 0.25% to 41.37%. Ethereum’s share of the crypto market rose by 0.19% to 18.86%. XRP dominance grew by 0.41% to 2.1% thanks to a whopping 40% price increase during the week, according to CoinMarketCap.

On 4th February, Bitcoin’s 30-day volatility index jumped sharply to 3.46%, from 2.83% observed the day before, according to CryptoCompare. Since then, the indicator has remained at the same level. On 9th February, the index value stood at 3.48%.

Gainers of the week (3rd – 9th February 2022)

| Coin | Opening price 03.02, $ | Opening price 09.02, $ | Change |

| SHIB | 0.000021 | 0.000031 | 46.5% |

| XRP | 0.62 | 0.88 | 43.8% |

| ROOBEE | 0.0026 | 0.0036 | 34.8% |

| ZEC | 100.40 | 134.81 | 34.3% |

| CHZ | 0.18 | 0.23 | 24.8% |

Losers of the week (3rd – 9th February 2022)

| Coin | Opening price 03.02, $ | Opening price 09.02, $ | Change |

| HP | 0.00076 | 0.00045 | -41.0% |

| TON | 2.74 | 2.23 | -18.7% |

| CRON | 0.88 | 0.84 | 5.2% |

| MNC | 0.00102 | 0.00100 | -2.4% |

| BTT | 0.0023 | 0.0022 | -1.7% |

Easily track gainers and losers within the Simple trade section on EXMO. Check real-time updates in the last 24 hours, week and month.

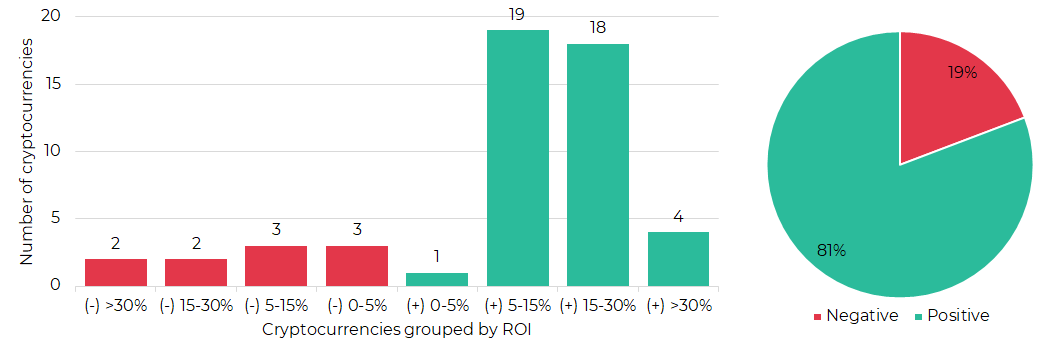

Segmentation of cryptocurrencies based on trading results

(3rd – 9th February 2022)

Most traded coins (2rd – 8th February 2022)

| Coin | Trading volumes, $ |

| BTC | 30,075,352 |

| ETH | 20,550,592 |

| XRP | 6,831,435 |

| IQN | 3,523,606 |

| TONCOIN | 2,407,216 |

| GMT | 1,785,100 |

| LTC | 1,612,963 |

| ROOBEE | 1,243,198 |

| ADA | 966,286 |

| DOGE | 798,151 |

Top crypto market driving factors

Overall crypto market

▲ 01.02.2022 – CB Insights: blockchain industry funding has increased by 713% in a year and grown to 4% of the global venture investment market. Investors were most willing to invest in projects related to cryptocurrencies and NFTs.

▲ 03.02.2022 – Following a meeting on 3rd February, the European Central Bank kept interest rates unchanged despite record inflation.

▼ 03.02.2022 – ForkLog: in January, total spot trading volume on large top-tier exchanges fell below $1 trillion for the first time since July 2021.

▲▼ 03.02.2022 – CryptoCompare: in January 2022, trading in futures and options accounted for 61% of the total trading volume of the crypto market.

▲ 07.02.2022 – CoinShares: digital asset investment products saw inflows of $85 million last week. The majority of investments have come from Brazil and Canada ($75 million). Over the past three weeks, digital asset investment products recorded inflows totaling $133 million.

▲ 07.02.2022 – CoinShares: between 31st January and 4th February, multi-asset funds entered their fourth consecutive week of inflows totaling $15.5 million.

Bitcoin (BTC)

▲▼ 02.02.2022 – IntoTheBlock: on 29th January, almost 64,000 BTC were withdrawn from exchanges, which is the largest outflow since 18th April 2021. On 31st January, 32,000 BTC were deposited to exchanges, which is the largest single-day increase since June 2019.

▲ 02.02.2022 – Glassnode: Purpose Bitcoin ETF saw one of its biggest inflows on 1st February. Such investments have not been observed since mid-December.

▲ 05.02.2022 – Coinglass: on 4th February, the volume of liquidations of short positions in perpetual bitcoin futures reached $57 million in just eight hours.

▲ 07.02.2022 – Valkyrie Capital’s Bitcoin Mining ETF, focused on renewable energy, has been approved by the U.S. Securities and Exchange Commission. It is set to go live on the Nasdaq exchange on 8th February.

▲ 07.02.2022 – CoinShares: between 31st January and 4th February, bitcoin continued to lead inflows – $71 million. At the same time, Purpose Bitcoin ETF accounted for most inflows – $61.7 million. This is the largest inflow to the fund since mid-December.

▼ 09.02.2022 – JPMorgan: bitcoin’s fair value is around $38,000 based on its volatility in comparison with gold. BTC is roughly four times as volatile as gold. Analysts noted that in a scenario where the volatility differential narrows to three times, the fair value rises to $50,000.

Ethereum (ETH)

▲ 03.02.2022 – Santiment: Ethereum’s address activity ratio has risen to the highest level since August 2021, when ETH prices jumped by 51%.

▲ 03.02.2022 – ForkLog: in January, the total volume locked in DeF on Ethereum reached a record 43 million ETH amid a correction observed in the digital market.

▲▼ 07.02.2022 – Kaiko: Ethereum’s daily options trade volume broke all-time highs above $1.1 billion at the end of January and equaled that of Bitcoin for the first time last week.

▼ 07.02.2022 – CoinShares: between 31st January and 4th February, Ethereum investment products saw outflows of $8.5 million. Ethereum has recorded nine weeks of outflows, totaling $280 million, or 2.2% of all AUM.

XRP (XRP)

▲ 08.02.2022 – Santiment: XRP grew by 37% over the past four days as the network’s active addresses continued to look strong.

Cardano (ADA)

▲ 07.02.2022 – CoinShares: between 31st January and 04th February, Cardano saw inflows totaling $1.1 million.

Solana (SOL)

▲ 02.02.2022 –The Frankfurt Stock Exchange listed Solana Exchange Traded Product (ETP) from Valour, a subsidiary of crypto agency DeFi Technologies.

▲ 03.02.2022 – Neon Labs announced the release of the Neon EVM on the Solana mainnet. The tool aims to allow dApp developers to use Ethereum tooling to scale and get access to liquidity on Solana.

▲ 07.02.2022 – CoinShares: between 31st January and 4th February, Solana saw inflows totaling $2.4 million.

Polkadot (DOT)

▲ 04.02.2022 – Crypto Carbon Ratings Institute: Polkadot is currently the greenest major PoS blockchain on the market.

▲ 07.02.2022 – CoinShares: between 31st January and 4th February, Polkadot saw inflows totaling $2.1 million. However, outflows of $2 million have been recorded since the beginning of the year.

Shiba Inu (SHIB)

▲ 02.02.2022 – Shiba Inu has partnered with Welly’s, a Shiba Inu-themed Italian blockchain-based restaurant in Naples. The restaurant will be using Shiba Inu as their mascot and also accept SHIB tokens for payments. The partnership solidifies SHIB’s first step into IRL (in-real-life) projects.

▲ 04.02.2022 – Unification Foundation, a provider of blockchain solutions for enterprises, has announced that Shibarium, Shiba Inu layer 2 scaling solution, will launch very soon. Two private Shibarium testnets have already been launched.

▲ 08.02.2022 – Shiba Inu developers announced that the protocol will soon offer plots of virtual lands in an upcoming metaverse.

Cosmos (ATOM)

▲ 03.02.2022 – Cosmos developers announced the launch of the following projects in the first half of 2022: the Archway incentivised smart contract platform, the Celestia modular blockchain network, the Tgrade regulated DeFi platform and the Umee cross-chain borrowing and lending protocol.

Chainlink (LINK)

▲ 07.02.2022 – Santiment: Chainlink’s development activity, measured by significant daily github updates, is outpacing that of Ethereum.

Tron (TRX)

▼ 07.02.2022 –CoinShares: between 31st January and 4th February, Tron saw outflows totaling $0.5 million. Since the beginning of the year, outflows of $4 million have been recorded.

Tezos (XTZ)

▲ 04.02.2022 – Manchester United FC is set to unveil a new training kit sponsorship deal with blockchain platform Tezos, according to The Athletic. The multi-year agreement will be worth £20 million per season.

▲ 07.02.2022 – Swiss banking group Swissquote is planning to offer Tezos staking services.

Maker (MKR)

▲ 08.02.2022 –Total supply of MakerDAO’s decentralised stablecoin DAI exceeded $10 billion.

EXMO news

EXFI airdrop completed. All SGB holders who participated in the EXFI airdrop from Flare Finance have received their EXFI tokens.

SOLO airdrop completed. All XRP holders who participated in the Sologenic airdrop from the SOLO Core Team have received their SOLO tokens today.

That’s all for this week! Follow EXMO on YouTube, Twitter and Telegram to stay tuned to the main events and trends in the crypto market.