Back to News

Back to News

Weekly recap: strong crypto market recovery touching the levels at the beginning of 2022

The Shiba Inu metaverse plans to sell plots of virtual land, CME Group launches micro-sized Bitcoin and Ether options, while Lionel Messi becomes the global brand ambassador of the digital fan token company, Socios.com. Meanwhile, Solana funds witness a record-breaking amount of weekly inflows. Read the Weekly recap to find out more about the main events of the crypto market that happened between 25th and 31st March 2022.

Crypto market in numbers

Over the past week, the crypto market capitalisation remained above the $2 trillion mark. The market grew by 11% to $2.16 trillion, according to CoinMarketCap. The current indicator level has not been observed since the beginning of January 2022. The main jump in the crypto market cap was recorded between 27th and 28th March, which coincides with the launch of micro-sized Bitcoin and Ether options by CME Group.

Crypto market activity is growing at the same pace. Over the past seven days, trading volumes have increased by 12.6% compared to the previous week. The average daily trading volume between 24th and 30th March was $99 billion, an $11 billion increase from the previous week.

Market sentiment improved significantly. On 28th March, the Cryptocurrency Fear & Greed Index jumped into the “Greed” zone, up to 60 points – a high since 17th November 2021. The indicator remained in this zone for another two days, but since 29th March 2022, a gradual downward movement was observed. On 31st March, the index value dropped to 52 points, which refers to the “Neutral Zone”. Two short-term rises have also been observed since February, but they ended with a return to the “Extreme Fear” zone. It seems that market participants do not see suitable conditions and factors for the further stable growth of cryptocurrencies yet.

Bitcoin’s volatility has dropped sharply amid its price increase. The 30-day volatility index dropped from 4.16% on 29th March 2022 to 3.27% on 30th March 2022. On Thursday, the index stood at 3.24%, the lowest level since early February 2022, according to CryptoCompare.

All-Time Highs

| Coin | Date | ATH on EXMO, $ |

| WAVES | 30.03.2022 | 62.08 |

Gainers of the week (25th – 31st March 2022)

| Coin | Opening price 25.03, $ |

Opening price 31.03, $ |

Change |

| WAVES | 32.20 | 52.60 | 63.4% |

| ZRX | 0.60 | 0.84 | 39.7% |

| CHZ | 0.23 | 0.32 | 35.9% |

| ONT | 0.58 | 0.70 | 21.2% |

| NEO | 25.17 | 29.12 | 15.7% |

Losers of the week (25th – 31st March 2022)

| Coin | Opening price 25.03, $ |

Opening price 31.03, $ |

Change |

| IQN | 2.77 | 2.22 | -20.1% |

| EXM | 0.04 | 0.03 | -8.7% |

| BTG | 46.34 | 44.50 | -4.0% |

| ZEC | 200.81 | 194.45 | -3.2% |

Easily track gainers and losers within the Simple trade section on EXMO. Check real-time updates in the last 24 hours, week and month.

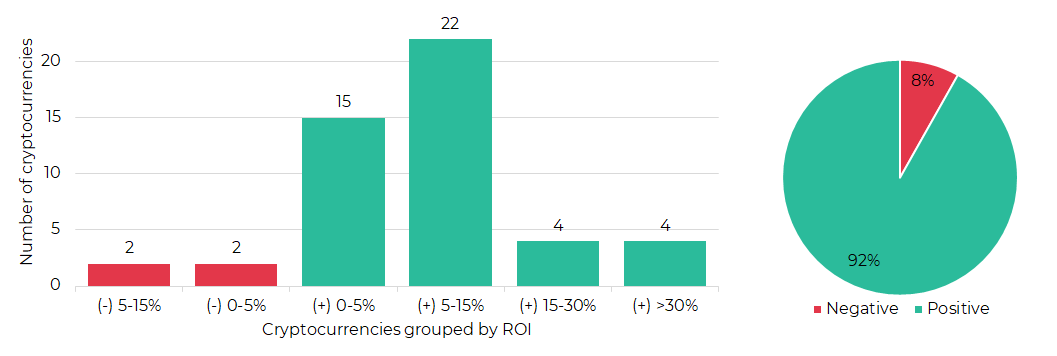

Segmentation of cryptocurrencies based on trading results

(25th – 31st March 2022)

Top crypto market driving factors

The overall crypto market

▲ 28.03.2022 – CoinShares: between 21st and 25th March, digital asset investment products saw inflows totaling $193 million, the largest since mid-December 2021. 76% of inflows came from Europe at $147 million.

▼ 28.03.2022 – CoinShares: between 21st and 25th March, multi-asset investment products saw outflows for only the second time this year, totaling $5.5 million. However, year-to-date inflows total $125 million, the second-largest inflows after Bitcoin.

▲ 29.03.2022 – Tether issued an extra 1 billion USDT in four days.

Bitcoin (BTC)

▲▼ 25.03.2022 – Santiment: the number of Bitcoin addresses holding 1,000 to 10,000 BTC has jumped by 8.3% since the Russia-Ukraine war was made official. The number reached 2,203, which is a one-year high.

▲ 25.03.2022 – ForkLog: as BTC’s price rises, so does the Bitcoin futures’ open interest. The open interest in the Bitcoin futures market approached $20 billion – for the first time since December 2021.

▲▼ 27.03.2022 – CME Group announced the launch of micro-sized Bitcoin and Ether options.

▲ 28.03.2022 – CoinShares: between 21st and 25th March, investors focussed on Bitcoin, which saw inflows totaling $98 million. Year-to-date inflows amount to $162 million – a 2.6 times boost since the beginning of 2022.

▲ 29.03.2022 – MacroStrategy, a subsidiary of MicroStrategy, has taken on a loan of $205 million from Silvergate Bank to buy more Bitcoin.

▲ 30.03.2021 – Rumours: Apple can announce the support of Bitcoin payments at the Bitcoin conference in Miami. Apple has added the symbol of Bitcoin in its icon set update.

Ethereum (ETH)

▲▼ 26.03.2022 – According to Ethereum developers, the network difficulty “bomb” for Ethereum is expected to take effect in June 2022, which will make Ether mining much less rewarding.

▲▼ 27.03.2022 – CME Group announced the launch of micro-sized Bitcoin and Ether options.

▲ 28.03.2022 – On 25th March, Google searches for ‘Ethereum Merge’ hit an all-time high.

▲ 28.03.2022 – CoinShares: between 21st and 25th March, Ethereum saw inflows totaling $10 million. Year-to-date outflows now total $29 million.

▲ 28.03.2022 – Santiment: the number of Ethereum addresses with over 10,000 ETH has grown to the largest amount (1,329) since December 2021. Analysts suggest that there has been an evident correlation between the number of whale addresses and future price movement.

XRP (XRP)

▲ 28.03.2022 – In its recent report, Goldman Sachs’ Investment Banking Division has identified Ripple as an “opportunity in payments.”

▼ 28.03.2022 – CoinShares: between 21st and 25th March, Ripple recorded outflows of $1 million. Year-to-date flows remain positive, with inflows totaling $4 million.

▲▼ 29.03.2022 – Greenpeace, Ripple co-founder Chris Larsen, along with other climate groups, has launched the “change the code, not the climate” campaign aimed at changing Bitcoin to a more environmentally friendly consensus model.

Cardano (ADA)

▲ 28.03.2022 – CoinShares: between 21st and 25th March, Polkadot saw inflows of $1.8 million.

▲ 28.03.2022 – Milkomeda C1 Sidechain, which brings EVM compatibility to the Cardano network, went live.

▲ 29.03.2022 – Major U.S. ETF provider, WisdomTree, has announced the launch of new ETPs on Solana, Cardano and Polkadot.

▲▼ 29.03.2022 – IntoTheBlock: the volume of on-chain transactions of over 100,000 has increased by 50 times in 2022. On 28th March, a total of 69 billion ADA were moved in these large transactions, representing 99% of the total on-chain volume. This indicates that Cardano is experiencing increasing institutional demand.

▲ 30.03.2021 – The Los Angeles-based firm that manages more than $1 billion in property, Wave Financial, launched a $100 million fund to boost liquidity for Cardano DeFi platforms.

Solana (SOL)

▲ 28.03.2022 – CoinShares: between 21st and 25th March, Solana saw the largest single week of inflows on record totaling $87 million, which represents 36% of AuM.

▲ 29.03.2022 – Major U.S. ETF provider, WisdomTree, has announced the launch of new ETPs on Solana, Cardano and Polkadot.

▲ 30.03.2022 – The largest non-fungible token (NFT) marketplace Opensea has plans to add Solana support in April.

▲ 30.03.2022 – Opera takes a giant leap into Web3, integrating 9 blockchains, including Solana, Polygon, StarkEx, Ronin, Celo, Nervos, IXO and Bitcoin.

▲ 30.03.2022 – Dune Analytics: on March 29th, the Solana NFT market transaction count reached 57,100, and the transaction volume reached 136,000 SOL, both hitting new highs in the month.

Polkadot (DOT)

▲ 28.03.2022 – CoinShares: between 21st and 25th March, Polkadot saw inflows totaling $1.2 million. As a result, year-to-date outflows have almost zeroed.

▲ 29.03.2022 – Major U.S. ETF provider, WisdomTree, has announced the launch of new ETPs on Solana, Cardano and Polkadot.

Dogecoin (DOGE)

▲ 28.03.2022 – Elon Musk is “giving serious thought to” creating a new social media platform that is open source and supports cryptocurrencies like Dogecoin.

Shiba Inu (SHIB)

▼ 28.03.2022 – Coinmarketcap: during the last 10 days, the meme coin, Shiba Inu, has lost almost 55,000 holders, or 5% of the total number of holders.

▲ 28.03.2022 – WhaleStats: over the past 5 days, large investors acquired 3 trillion SHIB worth around $60 million.

▲ 29.03.2022 – CoinMarketCap: the number of on-chain addresses holding SHIB has declined by over 60,000 within the last two weeks.

▲ 30.03.2021 – Shiba Inu announces SHIB, its own new Metaverse, and the imminent start of the sale of virtual lands.

Cosmos (ATOM)

▲ 28.03.2022 – CoinShares: between 21st and 25th March, relative newcomer ATOM saw inflows totaling $0.8 million.

NEAR (NEAR)

▲ 29.03.2022 – NEAR’s first native lending protocol, Burrow, went live beta on the NEAR mainnet.

Chainlink (LINK)

▲ 30.03.2022 – Glassnode: Link outflows from exchanges hit a new high since the summer of 2021.

Stellar (XLM)

▲ 25.03.2022 – Stellar developers announced the launch of Starbridge, a project that allows users to transfer assets between Stellar Network (XLM) and the Ethereum network.

Waves (WAVES)

▲ 29.03.2022 – DefiLlama: Waves’ total value locked reached $4 billion and hit a new high, with an increase of almost 39% in the past 24 hours.

EOS (EOS)

▲ 27.03.2022 – Billionaire Brock Pierce revealed trading all his Block.one shares (including 240,000 BTC) for EOS tokens.

Maker (MKR)

▲ 29.03.2022 – An application to onboard loans originated by Huntingdon Valley Bank, for use as collateral in MakerDAO, has gone live on the platform’s forum.

Chiliz (CHZ)

▲ 29.03.2022 – Football icon Lionel Messi has signed a $20 million deal with digital fan token company, Socios.com, to become its global brand ambassador.

EXMO news

EXM quarterly burn. The quarterly burn of EXMO Coin – one of the most profitable exchange tokens – will take place this week, on 01st April 2022.

That’s all for this week! Follow EXMO on YouTube, Twitter and Telegram to stay tuned to the main events and trends in the crypto market.