Back to News

Back to News

Weekly recap: institutional investors are being attracted to ether again

Valour Polkadot and Cardano ETPs debuted on the Frankfurt Stock Exchange, whales increased investments in bitcoin by almost $10 billion in a month and a half, while Bitcoin and Ethereum network hash rates hit new all-time highs. Read the Weekly recap to find out more about the main events of the crypto market that happened between 10th and 16th February 2022.

Crypto market in numbers

By the end of the week, the crypto market cap had almost returned to the levels observed on 9th February and today stands at about $2 trillion. However, during the week, the figure fell to $1.85 trillion, according to CoinMarketCap. The median value for the previous seven days also remained unchanged – $1.9 trillion.

Market trading activity remains relatively low, despite a slight recovery recorded for the second consecutive week. Trading volumes rose to $560 billion over the week – a 2% increase from a week earlier.

Between 09th and 15th February, average daily trading volumes amounted to $80 billion. The largest recovery was recorded on 10th and 11th February – $109 billion and $93 billion, respectively.

The Cryptocurrency Fear & Greed Index reflected more positive market sentiment over the past week. The indicator fluctuated between the “Fear” zone (from 44 points) and the “Neutral” zone (up to 51 points). Similar levels have not been observed since mid-November. On 16th February, the index value stood at 51 points.

Bitcoin’s dominance keeps strengthening. The indicator rose by 0.66% to 42.09% over the week and by 2.8% over the month. Therefore, its value returned to the levels recorded at the end of November, according to CoinMarketCap.

Ether’s share of the market remains almost unchanged and as of 16th February is 18.85%. Cardano’s and Solana’s dominance is gradually decreasing. Just a month ago it was estimated at 2.27% for each currency, but as of 16th February, it stands at 1.85% and 1.64%, respectively.

Bitcoin’s 30-day volatility index stays almost at the same level for the last two weeks and ranges from 3.42% to 3.54%, according to CryptoCompare. A slight index increase has been observed over the last two days. As of 16th February, it stands at 3.52%.

Gainers of the week (10th – 16th February 2022)

| Coin | Opening price 10.02, $ | Opening price 16.02, $ | Change |

| CRON | 0.86 | 1.08 | 25.5% |

| QTUM | 7.27 | 7.63 | 5.0% |

| ONT | 0.58 | 0.59 | 1.2% |

| WXT | 0.00448 | 0.00453 | 1.1% |

| ROOBEE | 0.00358 | 0.00362 | 1.1% |

Losers of the week (10th – 16th February 2022)

| Coin | Opening price 10.02, $ | Opening price 16.02, $ | Change |

| BTT | 0.0027 | 0.0023 | -15.8% |

| ONE | 0.22 | 0.19 | -15.3% |

| WAVES | 11.93 | 10.53 | -11.8% |

| VLX | 0.32 | 0.29 | -11.3% |

| ZRX | 0.71 | 0.65 | -8.9% |

Easily track gainers and losers within the Simple trade section on EXMO. Check real-time updates in the last 24 hours, week and month.

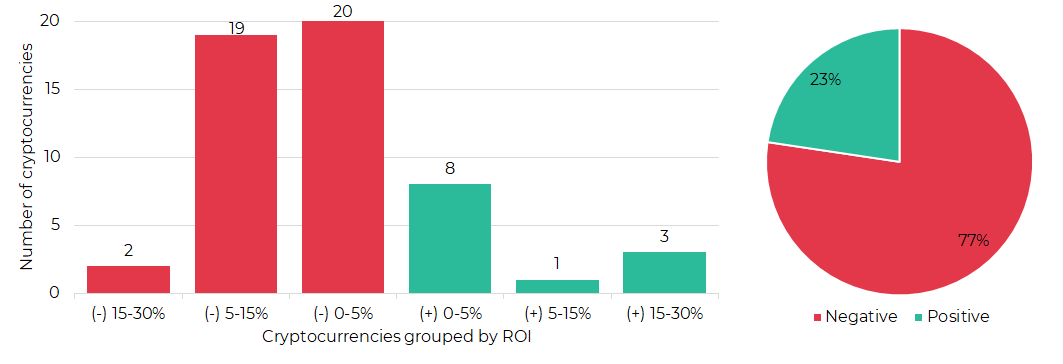

Segmentation of cryptocurrencies based on trading results

(10th – 16th February 2022)

Most traded coins (9th – 15th February 2022)

| Coin | Trading volumes, $ |

| BTC | 25,172,200 |

| ETH | 20,250,568 |

| XRP | 8,012,964 |

| IQN | 3,315,885 |

| GMT | 1,873,263 |

| LTC | 1,579,553 |

| ROOBEE | 1,334,221 |

| TON | 1,009,798 |

| ZEC | 695,652 |

| ADA | 670,881 |

Top crypto market driving factors

Overall crypto market

▲ 09.02.2022 – The U.S. Congress did not support the tightening of stablecoin regulation.

▼ 10.02.2022 – In the USA, the consumer price index for all items rose by 0.6% in January, driving up annual inflation by 7.5%.

▲ 10.02.2022 – KPMG: in 2021, total global fintech funding reached $210 billion – a five-time increase from the previous year.

▲ 10.02.2022 – PwC: the total value of crypto M&A grew by almost 5,000% in 2022, with crypto fundraising deals rising by 645%.

▲ 10.02.2022 – Apple announced plans to launch Tap to Pay for iPhone, a new feature that effectively turns the smartphone into a point of sale (POS) device for businesses and merchants. Unless Apple places a direct barrier for crypto payments, customers will be able to use their cryptocurrency cards to make payments via Tap to Pay.

▼ 11.02.2022 – The Fed is holding an expedited closed meeting on 14th February to review and determine discount rates.

▲ 11.02.2022 – Intel, one of the world’s largest chip makers, is likely to unveil a specialised crypto-mining chip in 2022.

▲ 14.02.2022 – The U.S. Treasury confirmed the exemption of miners and stakers from collecting data for the Internal Revenue Service.

▲ 14.02.2022 – CoinShares: digital asset investment products saw inflows totaling $75 million last week. Inflows were recorded for the fourth consecutive week but they remain relatively minor compared with those observed during the fourth quarter of 2021.

▲ 14.02.2022 – CoinShares: multi-asset (coin) investment products remain popular, with inflows totaling almost $19 million last week.

▲ 14.02.2022 – The US Federal Reserve did not raise interest rates following an expedited closed meeting. The next meeting is scheduled for 16th March 2022.

Bitcoin (BTC)

▲ 09.02.2022 – Santiment: addresses with 1,000 BTC or more have added a total of 220,000 bitcoins (almost $10 billion) to their combined wallets. This is the most rapid accumulation since September 2019.

▲ 09.02.2022 – Santiment: Tether’s amount of daily active address on its network has quietly fallen to two-year lows. Such drops have historically coincided with BTC price rises.

▼ 09.02.2022 – Glassnode: Canadian spot BTC ETF suffered the largest outflows ever – 2,128 BTC.

▲ 09.02.2022 – Salvadoran Finance Minister, Alejandro Celaya: $1 billion bitcoin bond issue will take place between 15th and 20th March.

▼ 09.02.2022 – Glassnode: Bitcoin miners sold part of their holdings over the past 30 days after an accumulation period observed since mid-November.

▲ 13.02.2022 – Glassnode: on 12th February, the Bitcoin network hash rate jumped by over 30%, reaching a new all-time high of 248.11 million (TH/s).

▲▼ 14.02.2022 – CoinShares: Bitcoin saw inflows totaling $25 million last week. At the same time, the majority of outflows came from the Americas.

▲ 14.02.2022 – Santiment: the highest number of active addresses on the Bitcoin network since 2022 was recorded on 12th February.

▲ 14.02.2022 – Glassnode: Bitcoin outflows from exchange wallets increased and reached 43,000 BTC in 30 days. In September last year, outflows reached 100,000 BTC.

▲ 15.02.2022 – The Fidelity physical Bitcoin ETP was listed on the Deutsche Börse Xetra and SIX Swiss Exchange.

Ethereum (ETH)

▲ 09.02.2022 – Ethereum co-founder Vitalik Buterin shared the project’s plans for the coming year.

▼ 13.02.2022 – Blockchair: Ethereum’s transaction fees slipped to the levels observed in September 2021. Now, users pay an average of $14.47 per transaction, with the median fee staying at $5.67. The drop was mainly caused by ETH’s price falls as well as a decrease in the daily number of transactions on the network from 36 million to 14.5 million.

▲ 13.02.2022 – BitInfoCharts: Ethereum network hashrate hits a new all-time high of over 1 petahash/sec.

▲ 14.02.2022 – CoinShares: between 7th and 11th February, Ethereum recorded inflows of $21 million, breaking its nine-week spell of outflows.

XRP (XRP)

▲▼ 09.02.2022 – Two memos termed as a piece of key evidence in the Ripple case have to be released by 17th February, according to the court ruling.

▲ 11.02.2022 – Ripple has joined the Frankfurt-based think-tank, Digital Euro Association (DEA), to assist it in its work on a CBDC pilot.

▲ 14.02.2022 – CoinShares: between 7th and 11th February, XRP recorded inflows totaling $2 million.

Cardano (ADA)

▲ 11.02.2022 – IOHK, the developer of the Cardano network, has unveiled the CIP-35 proposal for Plutus smart contracts to speed up transactions on the network.

▲ 13.02.2022 – Messari: Cardano’s transaction volume surpasses that of Bitcoin and Ether combined – $17.56 billion, $10.55 billion and $5.77 billion, respectively.

▲ 14.02.2022 – Valour Polkadot and Cardano ETPs debuted on the Frankfurt Stock Exchange.

▲ 14.02.2022 – The Cardano project team announced that they are doubling the reward for “whitehat hackers” for finding vulnerabilities on the network.

Solana (SOL)

▲ 10.02.2022 – Ledger hardware wallet is testing Solana support.

▲ 14.02.2022 – CoinShares: between 7th and 11th February, Solana recorded inflows totaling $3.1 million.

Polkadot (DOT)

▲ 14.02.2022 – Valour Polkadot and Cardano ETPs debuted on the Frankfurt Stock Exchange.

Dogecoin (DOGE)

▲ 14.02.2022 – ElonMusk responded with a wink emoji when a Twitter user proposed an idea of SpaceX merch store and Starlink accepting DOGE payments.

Shiba Inu (SHIB)

▲ 13.02.2022 – Bigger Entertainment, the music publishing group associated with the first crypto-based record label, announced that it will burn 1 billion SHIB within a week. Of these, 240 million tokens will be sent to the “dead wallet” on 14th February.

Tron (TRX)

▲ 10.02.2022 – TRON DAO launches the TRON Grand Hackathon 2022 in partnership with BitTorrent Chain. Submission of the first season of the Hackathon will begin on 14th February and will end on 7th March 2022.

Algorand (ALGO)

▲ 11.02.2022 –The Algorand Foundation announced the appointment of Staci Warden as its Chief Executive. She previously served as the Chief Executive at JPMorgan.

Tezos (XTZ)

▲ 10.02.2022 – Manchester United have confirmed a multi-year sponsorship deal for their training kit with blockchain platform Tezos.

Waves (WAVES)

▲ 11.02.2022 – The Waves team has unveiled an updated roadmap that includes support for the Ethereum Virtual Machine (EVM), decentralised governance, cross-chain bridges, and the metaverse.

yearn.finance (YFI)

▲ 11.02.2022 – Yearn has paid a $200,000 bounty to a whitehat who has responsibly disclosed a vulnerability via Immunefi.

EOS (EOS)

▲▼ 10.02.2022 – The non-profit organization, EOS Network Foundation, is seeking $4.1 billion in damages from Block.one, which launched the EOS project.

Wirex (WXT)

▲ 14.02.2022 – British processing service, Wirex, raised $15 million from strategic investors. The funds received are an intermediate stage of financing before the next $60-80 million Series B round scheduled for 2022.

EXMO news

Results of Valentine’s Day contest. We are pleased to announce the names of the three traders who won an EXMO Gift Card worth $100.

That’s all for this week! Follow EXMO on YouTube, Twitter and Telegram to stay tuned to the main events and trends in the crypto market.