Back to Articles

Back to Articles

How to trade crypto in a bull market

To trade successfully in a bullish market, it’s crucial to be aware of certain nuances — especially if you’re new to the world of crypto. In this article, we’ll go over 6 tips for trading effectively when asset prices are on the rise.

A bull market occurs when asset prices rise. During this time, buyers have more power over sellers. Traders feel optimistic and confident and expect the good trend to continue.

Often, a bullish crypto market aligns with broader economic improvements: a surge in GDP, a decline in unemployment and a boost in corporate profits. During this period, there is an increased demand for assets, accompanied by growing trade volumes and liquidity. New, promising projects emerge and develop actively.

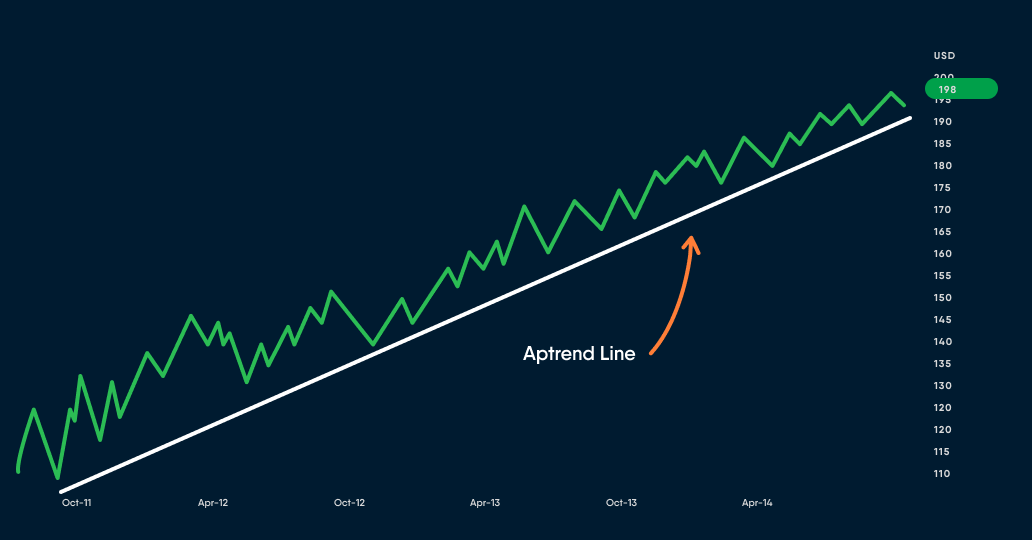

A key indicator of bullish sentiment on the chart is the upward-sloping trendline. This line connects two or more price lows of an asset, moving right and upward. Each subsequent low surpasses the previous one, signalling a bullish trend. As long as the lows remain above this line, an upward momentum persists.

The growing trend line is a basic indicator of bullish sentiments

The growing trend line is a basic indicator of bullish sentiments

Analysts and traders are largely in agreement: a robust bull market awaits us in 2024. Our 6 key tips will help you to trade effectively during this period and to choose right strategies for maximising gains.

6 key tips for trading in a bullish market

Hold and earn

The simplest and most widely used strategy during a bullish market is to buy and hold and, when prices rise further, sell.

It’s a good plan, but it can be refined. You can start to earn on assets even before selling. On EXMO.com, this option is available through the Earn program. It’s quite simple: you purchase assets, subscribe to Earn, and lock your assets for a specific period. After thirty days, when the subscription ends, you receive a crypto reward and can sell more assets than you initially bought. Alternatively, you can extend or start a new subscription.

Diversify your funds across multiple assets

Reduce risks by diversifying your funds among several assets. The foundation for every portfolio includes bitcoin and ethereum. These are the so-called ‘blue-chip’ coins – currencies with the highest market capitalisation, good liquidity and a reliable reputation.

However, during a bull market, assets that are priced lower and have lower capitalisation will likely experience faster growth. They can yield a higher profit, especially if they are undervalued – meaning they cost less than their fair value. The quantity and percentage of such coins in your portfolio depend on the level of risk you are willing to take.

In addition to the classic bitcoin and ethereum, it makes sense to pay attention to fundamental coins – those with a solid technical foundation and an established development team.

Follow the Dollar-Cost Averaging strategy

Use the Dollar-Cost Averaging strategy. It works well at the beginning of your crypto journey because it doesn’t require advanced strategic skills. All you need to do is invest a certain amount in crypto on a specified day every month. You should buy both “blue-chip” assets and growing assets.

This strategy is an excellent way to deal with price fluctuations, which often occur in the early stages of a bullish market. You simply ignore them and invest according to your schedule. If the market “drops,” you can buy additional coins and lower the average purchase price. If it rises, your assets become more valuable.

Moreover, this strategy helps investors to profit with crypto during inflation.

Gradually lock in profits

Establish target profit levels and consistently sell coins when their prices reach those goals.

You can never predict when the market will dip or rise again, or if the decline will persist. That’s why gradually locking in profits is a way to safeguard your money. You might not always manage to utilise the highest price before a downturn, but ultimately, your profit could end up being even better than those who “hold on” and don’t sell assets before a decline.

Stick to a long-term strategy

Stay disciplined in your investments, steer clear of impulsive decisions, don’t let emotions dictate your purchases, and keep your focus on the long-term perspective. While a bullish market might deliver impressive price surges at a particular moment, it’s crucial to recognise that investing is more of a marathon than a sprint. Adhering to your investment plan, making occasional adjustments and carefully evaluating the market are strategies that can yield better results than chasing quick gains “here and now”.

Avoid falling into the FOMO (Fear Of Missing Out) trap, and wait for a period of local consolidation (when the asset’s price isn’t significantly changing) to buy coins.

Effectively manage risks

One practical way to lock in profits or sell assets when their prices are on the decline is to set stop-loss and take-profit orders. This feature is available on every exchange, including EXMOcom.

A stop-loss order is designed to minimise losses as prices fall. It is set at a price below the current level, and when the asset’s value hits that, it is automatically sold.

This feature is optional in spot trading – where you trade solely with your funds, without borrowed money as in margin trading. For assets experiencing a drop in prices, you have the flexibility to hold onto them, anticipating a recovery.

On the other hand, take-profit operates differently – it is activated when the price reaches a point at which you aim to lock in a specific profit. In spot trading, having this order is a necessity, as highlighted in the advice regarding locking in profits.

These orders can be pre-set and executed automatically. This means you won’t be required to monitor the market around the clock, searching for the optimal moment to sell assets. Additionally, they allow you to establish anticipated limits for losses and profits in advance.