Back to News

Back to News

Weekly recap: Ethereum successfully completes the Merge

Following the Merge upgrade on Ethereum’s mainnet, the blockchain transitioned to PoS. MicroStrategy is to buy more BTC for almost $500 million, while Franklin Templeton and Fidelity Investments are to launch crypto services. Read the Weekly recap to learn more about the main crypto events that happened between 08th and 15th September 2022.

Crypto market in numbers

The crypto market capitalisation has returned to its previous level following short-term growth. For the week, the index rose by less than 1%. Between 09th and 13th September 2022, the market experienced a rally, with capitalisation reaching $1,076 trillion, according to CoinMarketCap. After the U.S. inflation data was updated, the market lost 5% in the first hour alone. As a result, capitalisation currently is once again holding just below $1 trillion.

Weekly trading volumes reached $587 billion, the highest since mid-June. Compared to the previous week, the indicator rose by almost 34%. The largest increase in trading volumes were observed simultaneously with the growth of crypto rates. After the drawdown, trading on the market remains above the lower levels that have been observed in recent months. The revival can partly be attributed to the end of the summer holiday season.

The Cryptocurrency Fear & Greed Index confirmed that the market believed in the return of the bull rally. On 13th September 2022, the index rose to 34 points for the first time in a month. For most of the week, the indicator stood above the “Extreme Fear” zone. Its median value for the week stood at 26 points.

Bitcoin’s market dominance hovered at 39% for most of the week. Between 08th and 13th September 2022, the indicator managed to rise by 1.6% to 40.3% at the time of the maximum increase in BTC’s rate. The share of ether decreased slightly from 20.4% to 19.6%.

Some altcoins have lost more than the two leading cryptocurrencies. This has been confirmed by the Altcoin Season Index, which has fallen from 96 to 73 points over the past four days. Therefore, the number of cryptocurrencies from the top 50, that have shown growth above BTC, decreased by 13%.

Gainers of the week (09th – 15th September 2022)

| Coin | Opening price 09.09, $ | Opening price 15.09, $ | Change |

| GNY | 0.013 | 0.016 | 19.2% |

| SMART | 0.00049 | 0.00058 | 18.6% |

| VLX | 0.04 | 0.05 | 5.8% |

| ETC | 40.63 | 43.00 | 5.8% |

| ONG | 0.38 | 0.40 | 5.0% |

Losers of the week (09th – 15th September 2022)

| Coin | Opening price 09.09, $ | Opening price 15.09, $ | Change |

| UNI | 6.83 | 6.19 | -9.4% |

| EOS | 1.77 | 1.61 | -8.6% |

| NEAR | 5.24 | 4.85 | -7.4% |

| WXT | 0.0055 | 0.0052 | -6.8% |

| HAI | 0.0173 | 0.0162 | -6.2% |

Easily track gainers and losers within the Simple trade section on EXMO. Check real-time updates in the last 24 hours, week and month.

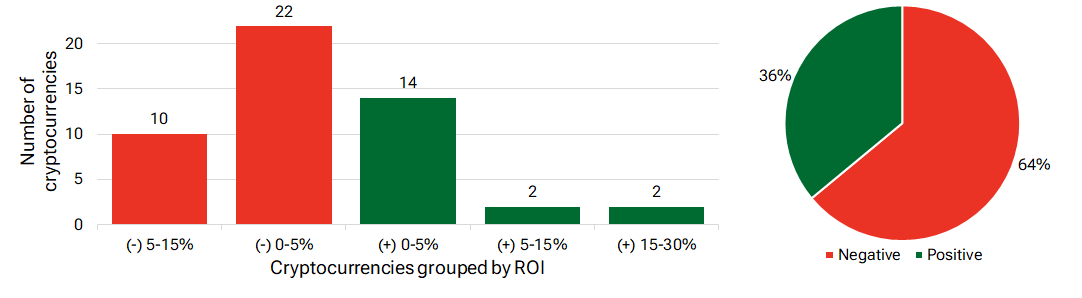

Segmentation of cryptocurrencies based on trading results

(09th – 15th September 2022)

Most traded coins (09th – 14th September 2022)

| Coin | Trading volumes, $ |

| BTC | 17,736,127 |

| ETH | 12,043,276 |

| DEBT | 3,140,036 |

| ROOBEE | 1,532,507 |

| XRP | 1,273,394 |

| LTC | 869,899 |

| DASH | 841,876 |

| ETC | 800,983 |

| BCH | 646,127 |

| GMT | 555,747 |

Top crypto market driving factors

Overall crypto market

▲ 08.09.2022 – Franklin Templeton, an investment company with $1.4 trillion in assets under management, is set to offer cryptocurrency-focused separately managed accounts to investment professionals.

▲ 11.09.2022 – The Securities and Exchange Commission (SEC) decided to set up two new crypto-focused offices this fall to address growing crypto issuer filings.

▼ 12.09.2022 – CoinShares: between 05th and 09th September, digital asset investment products saw outflows totaling $63 million, marking the fifth consecutive week of outflows. The outflows remain relatively small in size, totaling $99 million.

▼ 12.09.2022 – CoinShares: digital asset investment products’ trading volumes remain only 46% of this year’s average at $1 billion over the past week.

▼ 12.09.2022 – CoinShares: despite the uptick in prices on Friday, 9th September, it was the largest day of outflows.

▲ 12.09.2022 – The Wall Street Journal: Fidelity is set to launch bitcoin trading for retail investors through its brokerage customers.

▲ 12.09.2022 – State Street Head of Digital: Institutional investors have maintained their interest in blockchain and cryptocurrencies despite the bear market. The bank itself plans to launch new crypto products in the Asia-Pacific region.

▼ 13.09.2022 – Annual growth of consumer prices in the U.S. in August slowed down from 8.5% to 8.3%, but turned out to be higher than forecasted at 8.1%. New data increased the likelihood that the U.S. Federal Reserve will raise the base rate by 1% this September.

Bitcoin (BTC)

▲ 10.09.2022 – MicroStrategy has filed a new filing with the US Securities and Exchange Commission that will essentially allow it to sell up to $500 million worth of its stock for “general corporate purposes, including the acquisition of bitcoin”.

▼ 12.09.2022 – CoinShares: Bitcoin saw outflows totaling $13 million, while short-bitcoin investment products recorded inflows totaling $11 million, indicating continued negative sentiment.

▼ 12.09.2022 – Stone Ridge Asset Management, an 11.4-billion dollar asset manager, filed to liquidate its bitcoin strategy fund with the Securities and Exchange Commission (SEC).

▲ 14.09.2022 – Bitcoin’s mining difficulty hits a new all-time high of 32.05T.

Ethereum (ETH)

▲ 12.09.2022 – Chicago Mercantile Exchange (CME Group) announced the launch of ether options.

▼ 12.09.2022 – CoinShares: between 05th and 09th September, Ethereum was the primary focus of the outflows, totaling $62 million.

▲ 13.09.2022 – Opera Software integrated MetaMask into its crypto browser ahead of Ethereum’s the Merge upgrade.

▲ 15.09.2022 – On 15th September 2022, the developers executed a massive upgrade, The Merge, on Ethereum’s mainnet. The blockchain successfully transitioned to the Proof of Stake (PoS) consensus algorithm.

▼ 15.09.2022 – CryptoQuant: ETH’s inflow to exchanges has reached a record high over the past 45 months.

▲ 15.09.2022 – Glassnode: the number of addresses holding more than 10 ETH has reached an all-time high. The number of addresses holding more than 1,000 ETH hit a 16-month high.

XRP (XRP)

▲ 14.09.2022 – The U.S. SEC has filed the under seal for the Motion for Summary Judgment against the Ripple defendants.

Cardano (ADA)

▲ 08.09.2022 – Cardano Daily: there are almost 7,000 NFT projects and 15 marketplaces on the Cardano network.

Solana (SOL)

▲ 11.09.2022 – The Block: activity on the Solana blockchain has seen a significant jump. The number of new NFTs created on Solana surged to a high of 312,000 on 07th September 2022. At the same time, Solana-based NFT volumes have risen, hitting the highest level since May. These successful results are mainly related to Solana’s low barrier to entry.

Dogecoin (DOGE)

▲ 13.09.2022 – Elon Musk has posted a link to a piece of Cybertruck-themed merch on Twitter, adding a comment to “blow the whistle” and “pay in DOGE”. The main post was a troll of a recent Twitter case against whistleblower, Peiter Zatko.

Shiba Inu (SHIB)

▲ 09.09.2022 – Brandie Konopasek, a Netflix film producer and post-production manager, has joined Shiba Inu’s Metaverse team.

Uniswap (UNI)

▲ 13.09.2022 – Uniswap proposed to deploy Uniswap v3 on Aurora and has asked the community to discuss the proposal. Aurora is an Ethereum Layer-2 built on top of the NEAR Protocol.

Near (NEAR)

▲ 12.09.2022 – Tether is set to launch its USDT stablecoin on the NEAR Protocol.

▲ 12.09.2022 – NEAR Foundation has launched a $100 million venture capital fund and venture lab for web3.

▲ 12.09.2022 – NEAR Protocol slashed the price for stakers and kicked off Phase 1 or its “Nightshade” playbook facilitated by NEAR contributor, Pagoda. The changes could lead to 100-300 additional validators joining the 100-strong network and increasing decentralisation on NEAR.

▲ 12.09.2022 – The NEAR Protocol is forming a working group called the NEAR Digital Collective to set standards for self-governance.

▲ 13.09.2022 – Uniswap proposed to deploy Uniswap v3 on Aurora and has asked the community to discuss the proposal. Aurora is an Ethereum Layer-2 built on top of the NEAR Protocol.

Algorand (ALGO)

▼ 11.09.2022 – The Algorand Foundation said that it has a $35 million exposure in USDC to Hodlnaut, a bankrupt Singapore-based crypto lender.

EOS (EOS)

▲ 14.09.2022 – On 21st September 2022, the EOS Network project will upgrade to the Leap 3.1 release, as a result of which the previously inattentive EOSIO developers will be replaced with the EOS Network Foundation (ENF) core development team.

Maker (MKR)

▲ 13.09.2022 – Crypto lending platform, Maker, doubled its ether storage debt ceiling on staking in an effort to reduce its reliance on centralised stablecoins. As a result, users can issue new DAI stablecoins without a fee.

EXMO news

PLC Ultima (PLCU) has been listed on EXMO. The coin is now available for deposits and trades with USDT.