Back to Articles

Back to Articles

What is Proof of Stake (PoS): Review, Staking and Comparison with Proof of Work (PoW)

This article will explain how Proof of Stake algorithm works, who created it, and how it differs from Proof of Work.

On 04th August 2020, the Ethereum team launched the Medalla test network, which involved ensuring that the platform transitioned to the Proof of Stake or PoS algorithm.

What is Proof of Stake

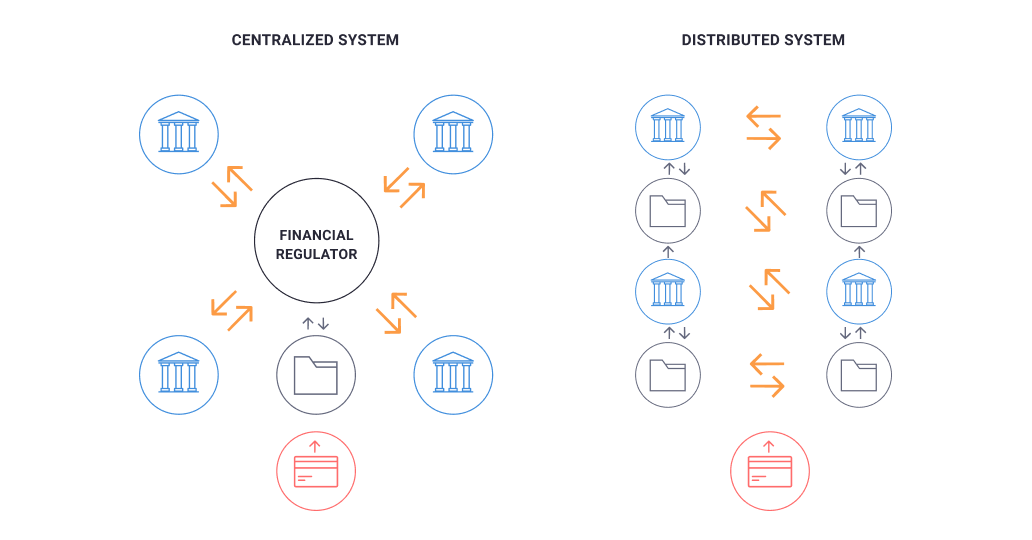

Unlike centralised systems, where a controlling entity is the determining authority, distributed systems rely on a large number of autonomous authorities and nodes that cooperate to maintain the system. A consensus algorithm is a mechanism by which nodes in distributed networks come to an agreement on updated and accurate data records. This includes verifying which transactions are legitimate.

Proof of Stake (PoS) is one such algorithm. Its essence is that special nodes check the legitimacy of transactions. Validators are selected based on a combination of several factors — the number of coins in the validator’s wallet (stake), the age of the stake, and randomisation.

A new block is checked as follows:

-

The validator makes a bid, blocks some of the coins in the wallet. Usually, the system sets a certain minimum threshold for such a bid.

-

When the system needs to generate a new block, it selects the validator who placed the bid and is online. The choice of validator may be either random (PoS), or be carried out at a time (DPoS).

-

The validator checks the block, adds it to the chain, and receives a reward. The process of forming a new block is called forging.

-

If the validator is caught carrying out fraud, for example, attempts to double spend, their bid is withdrawn in favor of the system.

The reward is not formed from generated coins, as in the PoW algorithm (for example, in the Bitcoin network), but from the total commissions that participants paid to validate their transactions. The amount of remuneration is determined by the specific PoS mechanism, cryptocurrency and other factors. The process of earning coins by validators is called staking.

How did Proof of Stake appear?

Proof of Stake (PoS) was first mentioned on the forum bitcointalk.org in 2011. A user under the nickname “QuantumMechanic” created the topic Proof of Stake instead of Proof of Work. The author wrote: “By Proof of Stake, I mean that your “vote” for the accepted transaction history that should be better weighted not by the share of computing resources you bring to the network, but by the number of bitcoins you own.” According to QuantumMechanic, this provided the following advantages:

-

Faster and more specific confirmation of transactions.

-

You don’t need to buy mining equipment that can be confiscated (at that time, the status of cryptocurrencies was still semi-legal).

-

A more reliable system of “voting rights” that is formed from the bottom up, and not as it is now — arbitrarily and/or centrally.

-

PoS will grant “voting rights” to all participants by delegating their coins (i.e., votes) to trusted delegate nodes.

The idea of QuantumMechanic was greatly appreciated by the Bitcointalk community, who accepted it and developed it. Besides, over time, Proof of Stake saw several other advantages, such as reduced power consumption and greater benefits in blockchain networks, where all coins are already generated.

The first practical implementation of PoS took place in 2012 in the Peercoin blockchain, which used a hybrid PoW/PoS algorithm, where PoW was only needed for issuing coins, while PoS was used for validating transactions. This consensus model is described in detail in Sunny King and Scott Nadal’s work PPCoin: Peer-to-Peer Crypto-Currency with Proof-of-Stake.

In 2014, Daniel Lumiere refined the algorithm by creating the Delegated Proof of Stake (DPoS) mechanism. It was first implemented in the Bitshares network and proved to be so effective that other cryptocurrencies gradually switched to it. In addition to Bitshares, Lumiere later created the Steem and EOS blockchains, which also use DPoS.

The main types of PoS

|

PoS |

DpoS |

LPoS |

PoI |

DBFT |

|

Dash, Stratis, BlackCoin, Cardano, NAVCoin |

Bitshares, Nano, NEOGAS, Steem, EOS |

Waves, Tezos |

NEM |

Neo |

Currently, there are many variations of the PoS algorithm. The most popular is Delegated Proof of Stake (DPoS), the essence of which is that network users can delegate their coins to other participants, master nodes, thus voting for validators in exchange for a share of their profits. The income of a voter usually depends on their contribution to the total votes of master nodes — the larger the contribution, the higher the income.

Other popular variations of the PoS algorithm include the following:

-

Leased PoS (LPoS). Participants can lease their tokens to other participants. Leased coins increase the node’s value, giving it a better chance of generating a new block and earning a reward. The tenant node shares its reward with them in exchange for the tokens of the landlord nodes.

-

Delegated Byzantine Fault Tolerance (DBFT). Byzantine Fault Tolerance protocols are used when the holders of coins choose the “keepers” responsible for generating new blocks and consensus.

-

Proof of Importance (PoI). When selecting validators, a mechanism considers the number of coins in the account, the time when the validator node is online, and its activity, i.e., the number of recent transactions.

-

Casper. Hybrid Ethereum algorithm, which transfers the network from PoW to PoS with minor modifications. For example, if the validator supports an empty fork chain of the blockchain, it will respond with its bid but also with an amount equal to double the transaction cost.

-

Proof of Stake Velocity (PoSV). It is the consensus mechanism of the Reddcoin blockchain, where the validator’s reward depends not only on the share of ownership of coins but also on the speed of work.

Proof of Stake (PoS) vs Proof of Work (PoW)

|

Proof of Stake (PoS) |

Proof of Work (PoW) |

|

The transaction of validators depends on the number of coins bet, age a stake, and activity of participants. |

Mining is required in the form of performing complex calculations using powerful computing devices. |

|

There is no reward per block. Transaction validators only receive a transaction fee. In DPoS and LPoS, validators share the reward with those who supported them with coins (votes). |

There is a reward for a new block in the form of new coins. These are given to the first miner who solves a mathematical puzzle. There is a reward for checking transactions in the form of commissions. |

|

PoS is very cost-effective for investors, since you do not need to buy powerful computing devices such as ASICS. |

PoW is profitable only with very large investments that allow you to get an advantage over other miners. This occurs only if the rate of the mined coin is high. |

Conclusion

Although Proof of Stake (PoS) has several disadvantages, this algorithm has proven to be superior compared to Proof of Work (PoW) in terms of ease of mining and energy efficiency. As a result, we can expect further growth in the interest of PoS. However, it can become a prevalent trend only by showing the algorithm’s effectiveness in a large, established project, for example, Ethereum 2.0. Users will have to wait for the results of Medalla testing and the transition of Ether to PoS.