Back to Articles

Back to Articles

Sögur (SGR) project overview

Sögur (SGR) is a stablecoin aiming to become a global currency. Its exchange rate is pegged to a basket of fiat currencies, its governance system is based on democratic practices, and its Advisory Council members include a Nobel Prize winner in economics. Let’s take a look at the key features of this coin and its prospects.

Sögur (SGR) Price

What is Sögur (SGR) coin?

Sögur was created by the British company, Sogur Monetary Technologies Limited, for non-commercial purposes. All its profits are directed towards achieving the set goal and cannot be shared between the management. The objective of the organisation is to launch a global decentralised cryptocurrency that will be devoid of the main disadvantages of fiat and cryptocurrency assets.

Sogur Monetary Technologies considers shortcomings to be centralisation, non-transparency and non-accountability of fiat assets, high volatility, low level of trust and weak monetary policy in crypto. According to the creators of Sögur, they managed to eliminate these problems by creating a unique economic model for their payment system.

SGR Features

Peg to a basket of SDR currencies. A regular stablecoin is pegged to one asset, be it a local currency or another type of asset. Basically, it is a tokenized version of this asset, its blockchain-based replication. The cost of SGR is tied to SDRs (Special Drawing Rights). An artificial reserve and legal tender were issued by the International Monetary Fund, which have been used by central banks for more than 50 years to stabilise their reserves.

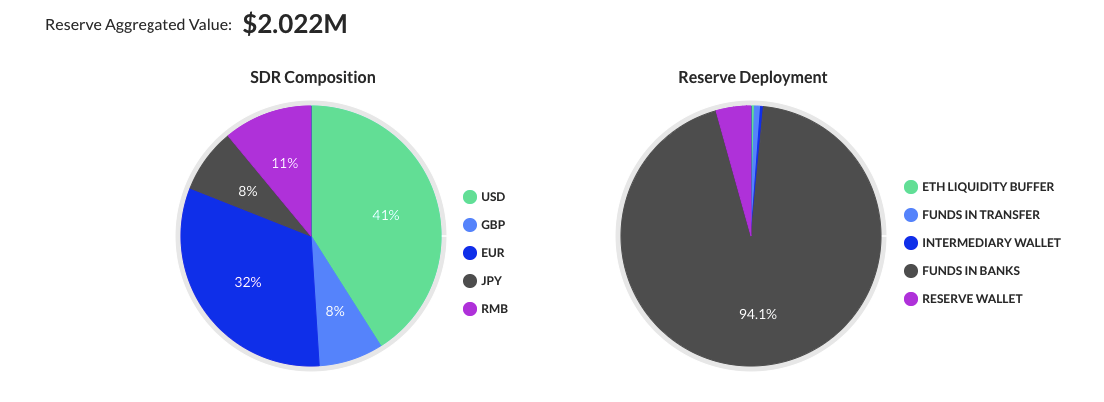

SGRs Sögur reservation structure. Source

The IMF’s SDRs are based on a basket of major international currencies, which is revised every five years. Now it includes the US dollar, Euro, Chinese Yuan, British Pound sterling and Japanese yen. The SGR coin is the tokenized equivalent of SDR, which inherits exchange rate stability and a high level of trust, since Sögur cryptocurrency tokens are supported by fiat money at a 1:1 ratio.

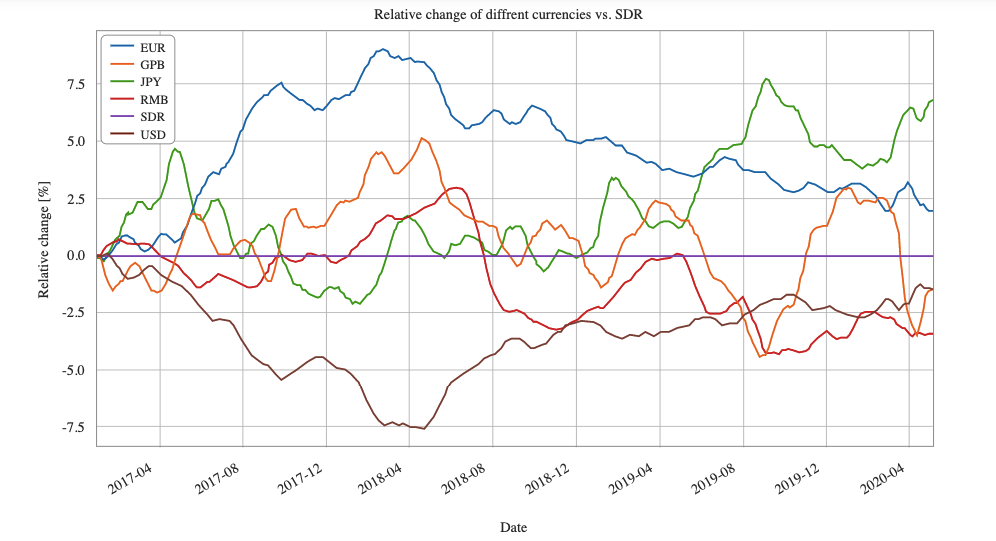

Consequently, the Sögur cryptocurrency (SGR) rate is much more stable than both crypto and fiat currencies. It makes the SGR token an excellent tool for all types of trading operations and, at the same time, a reliable means of preserving the value of capital: a so-called “safe haven”.

Comparison of the dynamics of the Sögur (SGR) exchange rate with the main fiat currencies. Source

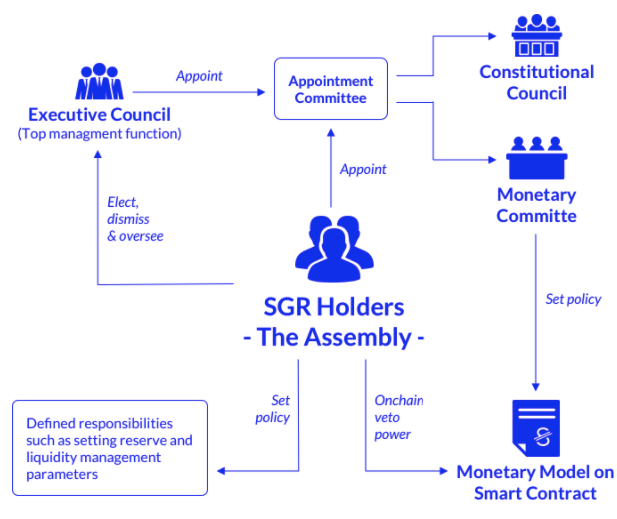

Decentralised governance model. The creators of Sögur (SGR) have implemented a fairly sophisticated payment management system that leaves control of the coin in the hands of its holders (ordinary users) instead of Sogur Monetary Technologies Limited, as the issuer, or its sponsors.

Sögur Coin Management Structure Diagram (SGR). Source

The main elements of the Sögur ecosystem governance model are as follows:

- Participants. These are all holders of the Sögur cryptocurrency. They are entitled to participate in the elections to the Executive Council and Assembly.

- Executive Board. The main executive body responsible for managing the ecosystem and operations of Sögur. The board makes changes to smart contracts that are responsible for the ecosystem’s monetary policy. Consists of 5-7 members who are elected by coin holders for 5 years.

- Assembly. An advisory body in which Sögur members can express their opinions and make collective decisions — election of members and dissolution of the Executive Board, drawing up its agenda and monitoring. In addition, the Assembly has the right to veto any decisions of both the Executive Council and the developer company. Any member of the system can make proposals and vote, either directly or by delegating their vote to another member.

Furthermore, Sögur also has the Monetary Committee, which is responsible for the long-term stability of SGR. There is also the Constitutional Council that arbitrates disputes between ecosystem participants.

Autonomous monetary policy. According to the Whitepaper, Sögur’s monetary policy is based on a variable reserve ratio. It remains at 100% for the first 2 million SGR tokens sold. As more tokens are issued, the ratio will gradually decrease to 10% when the capitalisation of Sögur reaches 3 trillion SDRs.

The dynamics of Sögur reserves as new coins are issued. Source

In this case, several rules apply:

- If the popularity of the coin falls (when people sell off the SGR), then the reserve ratio will increase up to 100%.

- All money obtained through the issue of coins will be automatically added to the cryptocurrency reserves that are stored in bank accounts.

- Interest earned from holding reserves in banks will also be added to cryptocurrency reserves.

Development prospects

Sögur Cryptocurrency Development Roadmap (SGR). Source

According to the project roadmap, in the coming year, the SGR value will remain at the current level, since the money supply of the cryptocurrency is almost 2 million coins. Therefore, the monetary policy of the site ties the cryptocurrency rate to the value of SDRs.

The situation will change by December 2021, when there will be an additional issue of coins in an amount equivalent to 100 million IMF SDRs. After that, the site will be able to develop freely and in accordance with the law of supply and demand and a variable reserve ratio.

At the same time, the SGR rate is likely to grow gradually, since:

- Sögur is, in theory, the most reliable stablecoin on the market.

- Capable and professional consultants are working on the project, including Myron Scholes, Nobel laureate in economics (1997) and professor at Stanford University; and Yaakov Frenkel, chairman of JPMorgan Chase International and former Governor of the Bank of Israel.

- The cryptocurrency is managed by and is accountable to coin holders.

Conclusion

The Sögur cryptocurrency (SGR) is an excellent tool for preserving the value of capital, which in the future can also become a promising non-risk investment asset. At the same time, the coin is not suitable for speculation, because even if its market capitalisation grows by USD $1 billion overnight, the price of SGR will not even double. The monetary policy will not allow this to occur.