Back to Articles

Back to Articles

Solana (SOL): project overview and 2022 perspectives

Last year, Solana became one of the fastest-growing cryptocurrencies, having increased by a whopping 11,000%. Discover the key factors behind the project’s success and learn whether it has more steam left to strengthen its position.

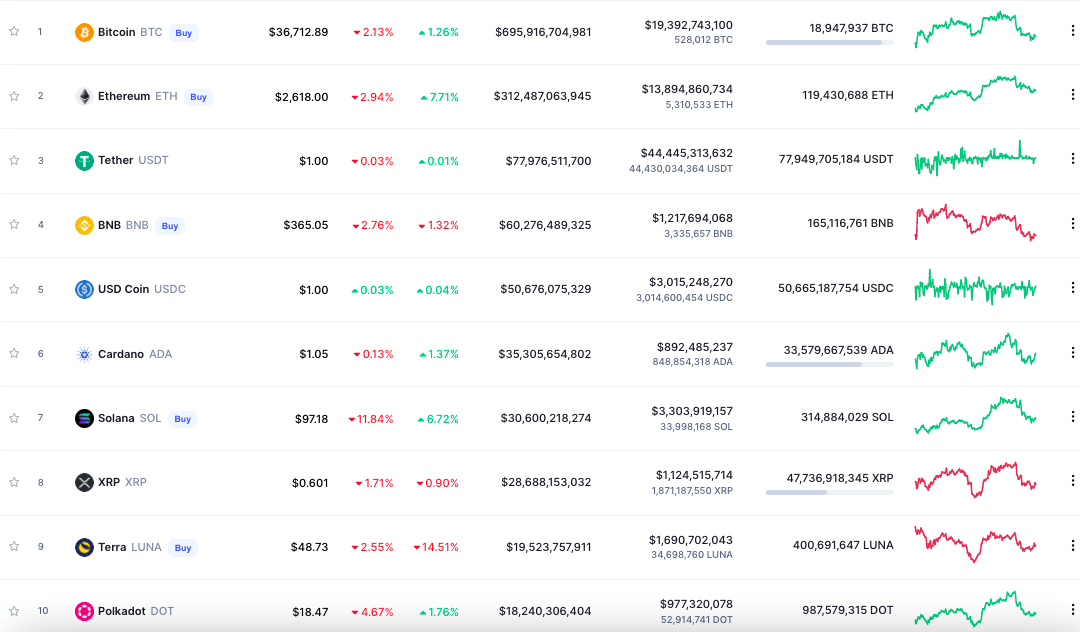

In 2021, Solana surged by over 11179.5%, which made it one of the best-performing digital currencies ever. Having hit another all-time high last summer, the project entered the top 10 cryptocurrencies in terms of market capitalisation. In November 2021, Solana’s native wallet Phantom reached over 1 million active users.

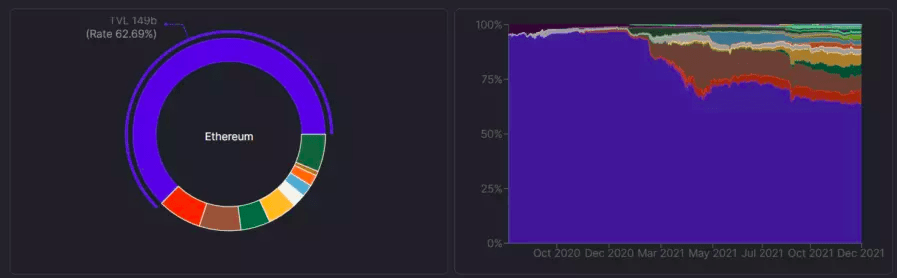

In October last year, the network also moved up to the third place, in terms of the amount of blocked funds in DeFi protocols.

What is Solana (SOL)

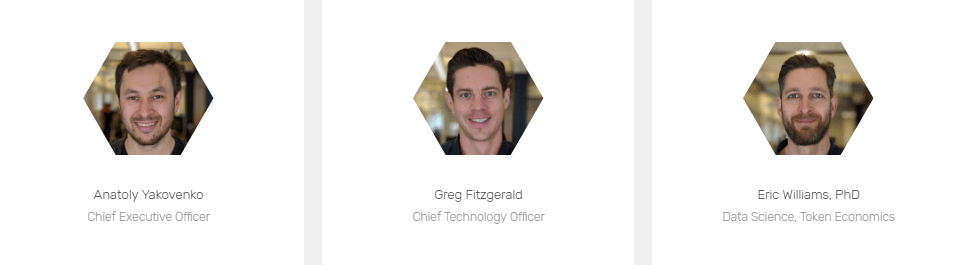

Solana is a project aimed at creating a fast and scalable blockchain protocol for building decentralised applications (dApps) and smart contracts. Among the project’s founders are scientists and professionals who have previously worked at established technology companies, including two former Qualcomm colleagues, Anatoly Yakovenko and Greg Fitzgerald, as well as particle physicist Ph.D. Eric Williams.

Back in 2017, Anatoly Yakovenko published a draft whitepaper where a new Proof-of-History (PoH) algorithm was introduced. Later, when Solana was launched it combined the benchmark PoH algorithm with the traditional Proof of Stake (PoS) consensus mechanism.

In February 2018, Yakovenko and Fitzgerald published the official white paper of the Solana project and launched the first internal testnet. In the same year, they founded the project development company now known as Solana Labs. Solana was named after a small beach town called Solana Beach, where Anatoly and his teammates lived for three years when they worked for Qualcomm. In addition to specialists from this company, the project’s team includes former programmers from Google, Microsoft, Apple, Intel and Dropbox.

In just a year since the release of the white paper, Solana raised more than $20 million in venture capital investments, as a part of several private token sales. In February 2020, the public testnet of the Tour de SOL project went live. A month later, developers launched the beta version of the mainnet, and in June 2020, the Solana Foundation, a non-profit organisation aimed at growing the Solana ecosystem and adopting decentralised technologies, was created. Subsequently, Solana transferred all intellectual property and 160 million native SOL tokens to this foundation.

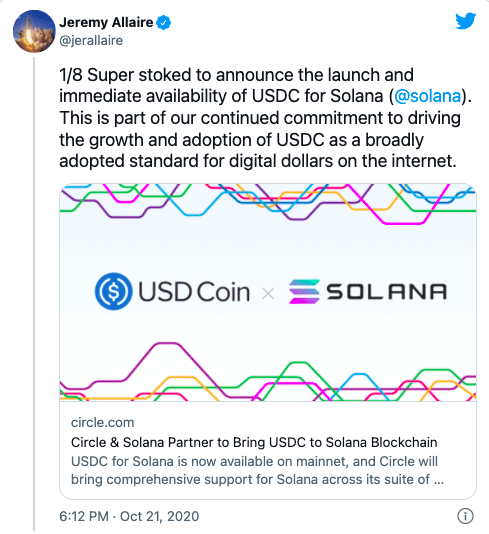

In August 2020, the Serum decentralised exchange was launched on the Solana blockchain. In the same month, stablecoin issuer Tether launched its USDT coin on Solana. Following this, in October 2021, the USDC stablecoin established by the CENTRE consortium was also launched on the blockchain.

In May 2021, Solana launched five investment funds with $100 million to drive Solana growth and development in China. A month later, Solana Labs raised over $300 million in a private token sale round. The funding round was led by major venture capital firms, Andreessen Horowitz and Polychain Capital.

How Solana works and its consensus mechanism

The Solana network combines two algorithms: Proof-of-Stake, which allows validators to validate transactions depending on how many coins they hold, and the new Proof-of-History synchronisation algorithm. The latter has an internal clock that shows the same time on all nodes. Since these nodes work on a schedule, and thanks to synchronisation, they can verify the time between transactions in the blockchain. Therefore, the algorithm solves one of the main problems of other crypto projects – the problem of node synchronisation. To execute transactions, nodes must write a block to the blockchain. To do this, they communicate and reach a consensus that is to comply with the rules of the protocol and ensure the reliability of all transactions. This is a rather time-consuming process that reduces the throughput of the blockchain. For example, Bitcoin can process 4 transactions per second (TPS), Ethereum – 13 and EOS – less than 50. At the same time, the Visa payment system handles 65,000 TPS. During tests, Solana showed 60,000 TPS. According to developers, the theoretical Solana network bandwidth can reach over 700,000 TPS.

Why is Solana called the ‘Ethereum Killer’

In addition to high throughput, Solana can compete with Ethereum and other blockchains for several reasons:

- Solana is not only many times faster but also hundreds of thousands of times cheaper than many of its competitors. According to BitInfoCharts, at the beginning of March 2022, Ethereum’s average transaction fee was around $32, while average transactions on Solana cost around $0.00025. Solana is also a great choice for NFT collectors since it is necessary to use a smart contract to process non-fungible tokens, which further increases the gas fee on the Ethereum network.

- Solana is a perfect platform for creating smart contracts, decentralised applications and NFT solutions since it uses the Rust programming language and LLVM System, which allows developers to easily and quickly migrate their protocols and applications from other major blockchains to Solana.

- The ecosystem of the project is growing much faster than that of Ethereum. While more projects are still being launched on Ethereum, they experience difficulties due to poor scalability, low bandwidth and expensive transactions. That is why, in just a year of full-fledged operation, Solana became the third-largest blockchain in terms of locked stake funds, totaling more than $14 billion USD in value locked. According to DefiLlama, at the beginning of February 2022, the total amount of money invested in DeFi projects based on the Solana blockchain reached $7.5 billion.

- Solana is more stable and uses fewer resources. All blockchain networks have the same task — share and exchange data (assets). When the number of users in the network exceeds several hundred million active participants, the network becomes overloaded, which can slow it down or even cease its operation. Solana solved this problem with the help of the Turbine protocol. It breaks all blocks into many pieces, which are then downloaded piece by piece by each node and then transferred to other members of the network. Solana thus reduces bandwidth usage, dependence on peer-to-peer messages, as well as provides data redundancy, which makes the entire network more economical and resilient to failure.

- High environmental efficiency of the blockchain. Ethereum currently uses a consensus protocol called Proof-of-Work. It depends on the computing power of the mining devices, which is why maintaining the network results in high power consumption. This ultimately has a range of negative impacts on the environment. Solana uses the Proof of Stake mechanism, which is much more energy-efficient than the competitor’s algorithm. This means that Solana is much more environmentally friendly than PoW blockchains like Bitcoin, Ethereum, Dogecoin, etc.

SOL price

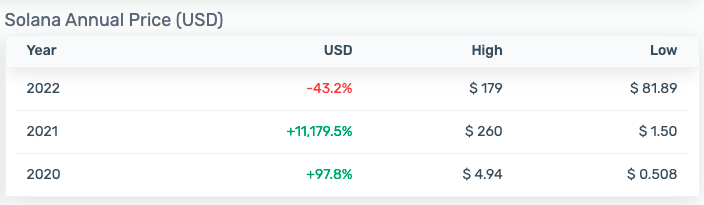

In 2020, SOL price was just below $5, but already in 2021, the coin set an all-time high of $260. In just a year, SOL grew by more than 11,000%!

As of 08th February 2022, there were 317.3 million SOL tokens in circulation, which represents 62.44% of the total coin supply, according to Cryptorank.

Solana’s Phantom wallet hit one million active users in November 2021, just a couple of months after its launch.

A growing number of large cryptocurrency exchanges are listing SOL. In 2021, the SOL token was also listed on EXMO.

You can see the current SOL/USDT rate on the interactive chart.

How to buy SOL

You can buy Solana with fiat money or with other cryptocurrencies on crypto exchanges. On the EXMO platform, SOL is traded in pairs with BTC and USDT:

Solana problems

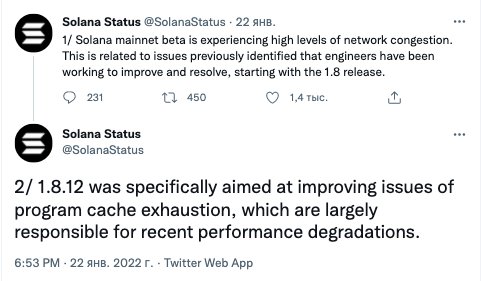

Intermittent network instability is what can prevent Solana from outperforming its major competitor. Since the beginning of 2022 alone, the project has experienced several technical failures due to network congestion caused by increased transaction volumes and hacker attacks. In the first half of January 2022, the Solana blockchain network went offline twice due to overload. Solana developers have announced on Twitter about the release of the new upgrade that will improve issues of program cache exhaustion and make Solana a more scalable blockchain.

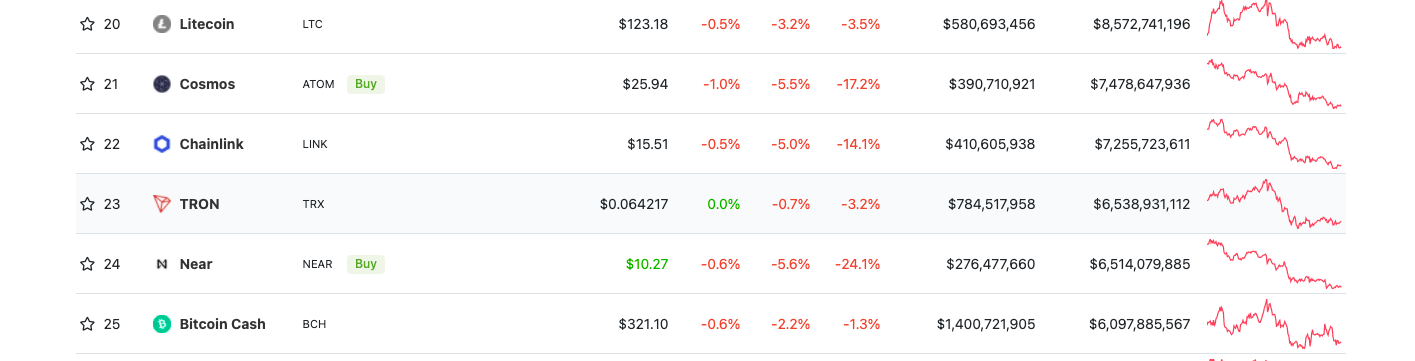

In the second half of January, when the market kept falling under bearish pressure, Solana was unavailable to users for two days due to a network outage. As a result of this failure, which became the sixth one within the last few months, the rival coin XRP surpassed SOL in terms of market capitalisation.

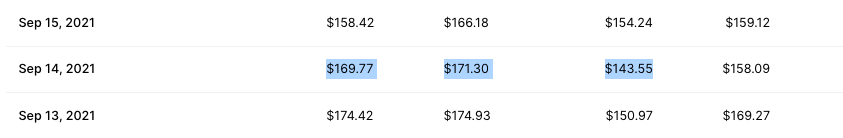

This was not the first time that network issues have had a negative impact on Solana’s price. In September 2021, a surge in transactions caused the Solana network to crash. New blocks were not released for more than 16 hours, and a restart was required to resume the operation of the blockchain. The developers stated that the incident was caused by a DDoS attack. Amid the failure, the price of the SOL token fell from $171.3 to $143.5. However, it later recovered to previous levels.

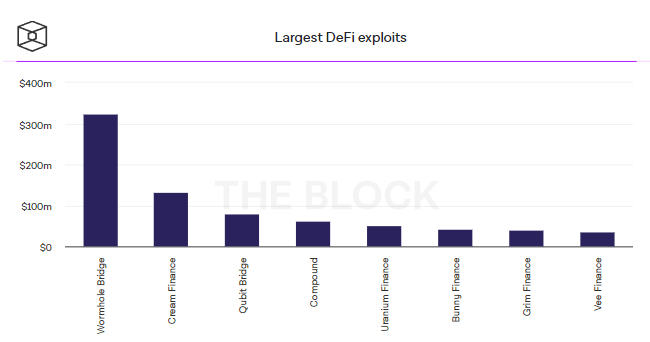

The project experienced another attack in early February 2022 when hackers took advantage of a smart contract bug and stole 120,000 wETH worth $320 million from the Wormhole DeFi project. At that time, this was the largest hack in DeFi history. As a result, the coin’s price fell by 8% in 24 hours.

Wormhole developers announced that the vulnerability would be eliminated in the near future and the necessary amount of ETH would be added to the network to ensure wETH is backed.

Solana prospects: predictions for 2022

After a breakthrough rally in 2021, experts predict further growth of the Solana token. Specialized media has identified three reasons why Solana’s (SOL) price could see additional upside in 2022.

- Steady ecosystem growth

- An exciting array of institutional investments

- Healthy derivatives market

Pantera Capital partner, Paul Veradittakit, also predicts the coin’s growth and suggests that Solana will take a massive market share away from Ethereum this year. At the very beginning of 2021, the brainchild of Vitalik Buterin led the way, in terms of value locked in DeFi, with $21 billion locked in DeFi that accounted for 97% of the multi-chain ecosystem. At the end of December, this figure decreased to 63%. At the same time, according to Defillama, in less than a year, Solana’s share grew 16 times – from 0.2% to 3.2%.

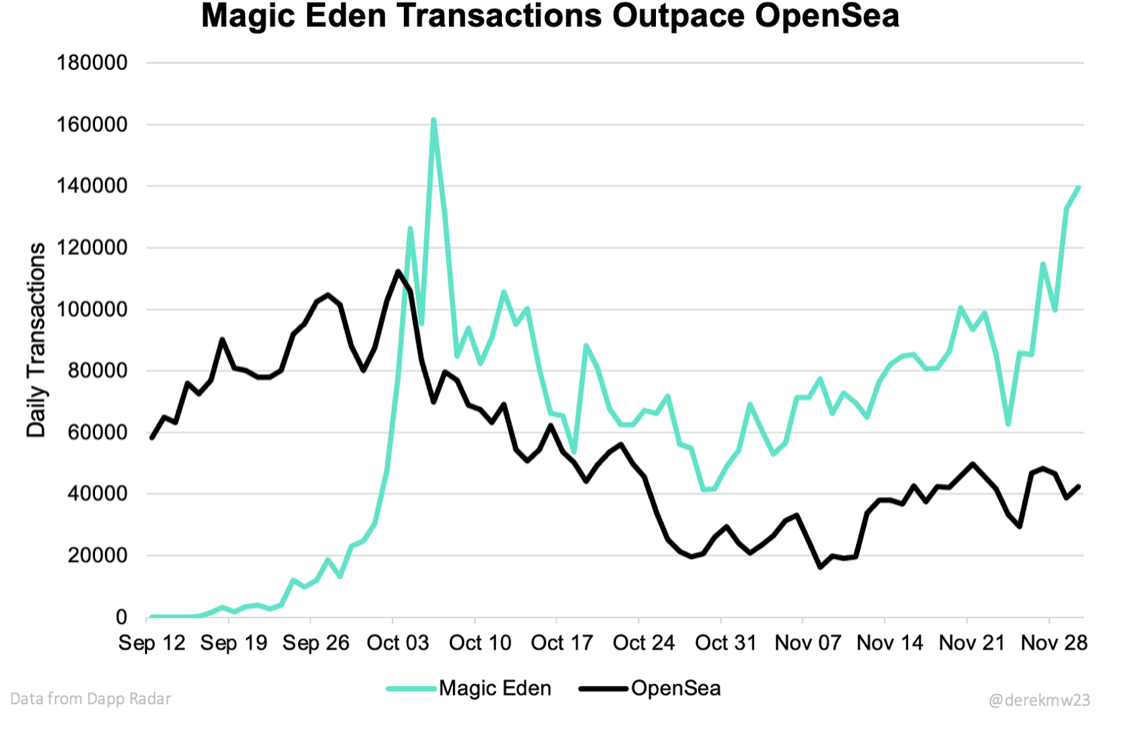

In addition to smart contracts, the demand for SOL is fueled by the rapidly growing non-fungible token market. In December 2021, Magic Eden, the leading NFT Marketplace on Solana, managed to surpass the giant, OpenSea, in terms of the number of transactions, despite having half the number of OpenSea’s users.

JPMorgan analysts also noted that Solana is one of the main competitors of Ethereum – the largest altcoin in this segment in terms of market capitalisation: “similar to DeFi apps, congestion and high gas fees have been inducing NFT applications to use other blockchains.”

According to CryptoSlam, Solana’s share of the NFT market has grown from 2.1% to 4.3% since mid-August 2021. At the end of January 2022, the weekly NFT trading volume on the Solana network stood at over $36 million and at the same time, Ethereum’s share of the NFT market was about 92.2%.