Back to Articles

Back to Articles

Stablecoins: Definition, Features, Security and Advantages

Most cryptocurrencies were created to become a means of payment. The problem is that because of their small capitalisation, even the most popular cryptocurrencies often experience a great deal of price fluctuations. That is why, for example, a cup of coffee can cost 10 conventional coins, tomorrow it may cost 20, and the day after tomorrow, only 5. Stablecoins were created to solve such problems.

What Are Stablecoins?

Stablecoins are cryptocurrencies that maintain a stable cost based on external assets, in the form of fiat currencies (dollar and euro), exchange commodities (gold or oil), another cryptocurrency (Bitcoin or Ethereum), or a set of smart contract protocols.

They aim to solve the problem of high volatility, faced by the majority of traditional cryptocurrencies, while preserving all their advantages, including decentralisation, security, low commissions, confidentiality, and transparency.

The most famous example is the platform, Tether, which issued the coins based on the US Dollar (USDT), Euro (EURT), and Chinese Yuan (CNYT). In the summer of 2020, USDT capitalisation exceeded USD $13.5 billion, which allowed it to become the world’s third largest coin by capitalisation.

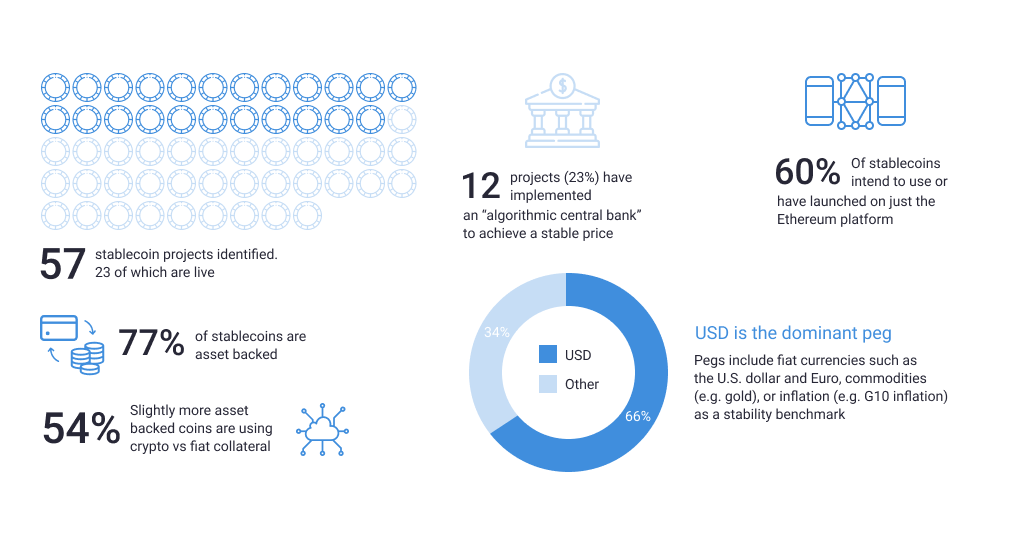

Stablecoin market overview. Source: blockchain.com

How Stablecoins Work

There are many stablecoins in the cryptocurrency market. Based on the type of security, they are usually divided into four types. Each has its own working principle, advantages and disadvantages. We will tell you more about each of them.

Fiat-backed Stablecoins

This type includes all cryptocurrencies, the rate of which is backed by fiat money: Dollar, Ruble, Yen, etc. The idea is to support the cost of cryptocurrency with real money in bank accounts in a 1:1 ratio, due to which the holder of stablecoins can change them for real money at any moment and the rate remains unaffected.

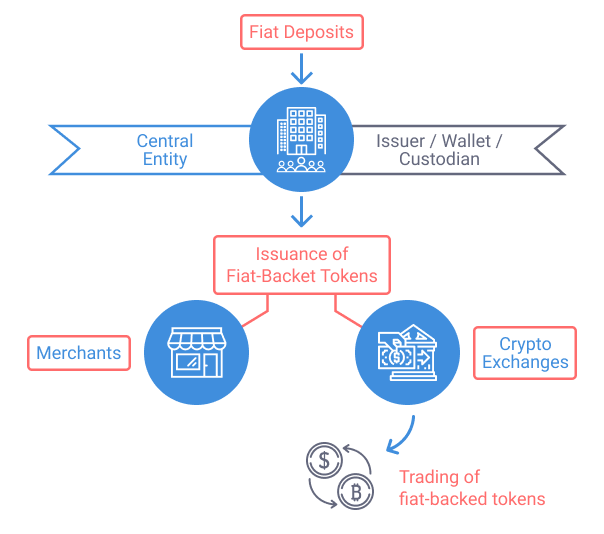

The illustration below shows how it works:

As you can see, the scheme is quite simple: the issuer first makes a deposit to a bank account and then issues tokens for the amount deposited. Whenever the tokens’ owner exchanges them for fiat, the equivalent amount of tokens is taken out of circulation or destroyed. If the issuer needs to increase the money supply of stablecoins, they simply replenish the balance of the deposit for the necessary amount.

Advantages:

- Simplicity: The algorithm of the fiat rate support is simple and straightforward.

- Stability: The fiat rate is much more stable than traditional crypto assets due to the Central Bank’s monetary policy. The value of fiat money is also guaranteed by the Central Bank.

Disadvantages:

- Regulation: Fiat security requires stricter regulation and supervision, which can complicate both the creation and operation of stablecoins.

- Centralization: The organisation that controls fiat deposit in a bank and token emission are, in fact, the same Central Bank.

- Requires Trust: An external auditor needs review deposits made in a bank, that will confirm that the issuer can really buy back every stablecoin coin at any moment.

- Risks of arbitration: If there is at least some time interval between the fluctuation of the token rate and the base currency on the exchanges, traders can use it for speculation. This process is described in the following article «First Mover: How a DeFi Trader made an 89% profit in minutes slinging Stablecoins».

A good example of the fiat-backed token is USDT — the most popular cryptocurrency equivalent to a US Dollar with a rate of 1 USDT = 1 USD. Another example is TUSD, launched by specialists from Google, Palantir, Berkeley, and even Stanford University.

We should also recall the project “Libra” by Facebook, which changed the vector of development from the global cryptocurrency to the platform for launching fiat-backed stablecoins because of disagreement with the American regulator.

Commodity-collateralised Stablecoins

These are cryptocurrencies whose rate is tied to the value of commodities. The most common being gold and precious stones, since these are considered a safe haven. If the collateral is gold, then one coin is the equivalent of a certain weight of gold (for example, 1 token is equal to 1g of gold or 1 carat for diamonds).

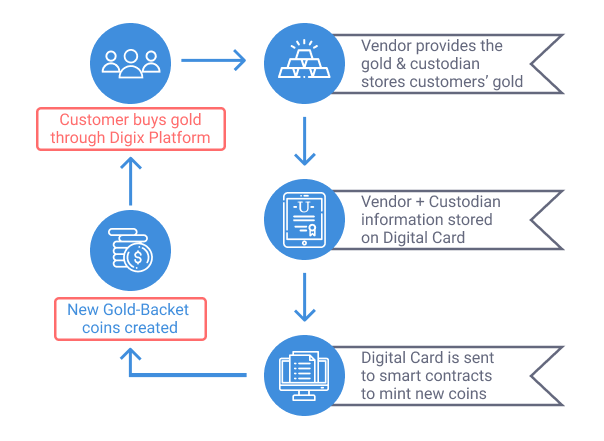

The figure below shows how it this works on an exchange called “Digix”:

As with fiat, the issuer can only issue tokens after buying the investment – gold coins and/or bars from the dealer’s banks. The amount of security must also be equivalent to the money supply of tokens.

Advantages:

- Liquidity: Increases the liquidity of assets, used as collateral.

- Stability: The cost of precious metals and stones is usually more stable than fiat rates.

- Support with real assets: Token holders can change them for material assets, which have real value on the market.

Disadvantages:

- Centralisation: Token emission and collateral control are provided by one organisation, which creates the risk of data and money supply manipulation.

- Long and complex audit: Count and control of physical assets in bank vaults is a long and time-consuming process.

- More intermediaries: Several additional parties are involved in the assurance process: supplier, custodian and an auditor.

A good example of a commodity-collateralised stablecoin is the DGX token, backed by real gold stored in a “Safe House” vault located in Singapore. To ensure transparency and increase confidence in DGX, this repository is reviewed every three months.

Crypto-backed Stablecoins

These are cryptocurrencies backed by other virtual assets, usually with the largest market capitalisation (Bitcoin or Ethereum). As a rule, several coins act as collateral in order to distribute risks better. Such stablecoins are mainly used on decentralised P2P lending platforms.

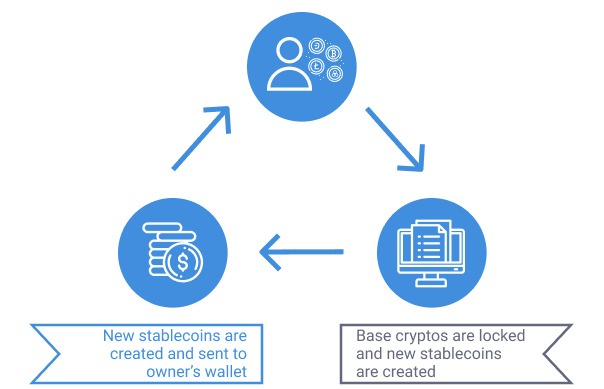

This is how it works:

Almost all stablecoins work based on smart contracts that block a certain amount of currency (security) in the smart contract, and then create a fixed amount of new coins.

Advantages:

- Transparency: Smart contracts and every transaction are set out in the blockchain, making the process fully accountable and transparent.

- Efficiency: Due to smart contracts, the conversion of one cryptocurrency to another is very fast.

- Decentralisation: It is possible to create a decentralised platform for launching crypto-backed coins quickly and easily.

Disadvantages:

- Risks of arbitration: There may be a time lag between the change in the main currency rate and the stablecoin rate.

- Deceptive stability: In practice, this approach doesn’t make sense, since the value of altcoins always follows bitcoin. The only exception is fiat or commodity-backed coins.

The platform “Wrapped Bitcoin” (WBTC) uses the support of cryptocurrency, the rate of which is backed by bitcoins in the ratio 1:1.

Seigniorage-style Stablecoins

Such coins use an algorithmic approach to increase/decrease the cryptocurrency money supply in the same way as the Central Bank prints or destroys money to address the problem of inflation. The main purpose of these coins is to maintain the rate at the same level (for example, $1).

Advantages:

- Transparency: All transactions and smart contracts are set out in the blockchain.

- Decentralisation: Since all transactions, smart contracts, and adjustments are made in the blockchain, you can create a system without a central regulator.

Disadvantages:

- Difficulty: Provision of a stable rate requires the implementation of complex mathematical logic.

- Goal-setting: If the purpose of such stablecoins is to equal the rate of $1 in fiat (or another level), wouldn’t it be easier to create a fiat-backed coin?

Stablecoins on EXMO

EXMO follows the trends of stable coins and can offer two stable cost assets: USDT and USDC. By the way, we offer a special deal for our users who trade USDT — 0% commission for all pairs with USDT. The only exception is the USDC/USDT pair. You can exchange USDT and USDC tokens with more than a dozen currencies on the platform!

Conclusion

According to Marco Di Maggio, Associate Professor of Harvard Business School, stablecoins are the next stage of development of e-commerce. They are more convenient and less expensive than other cryptocurrencies and fiat money. Everybody will create them: startups, large marketplaces, as well as states. And it will happen soon enough.