Back to News

Back to News

Weekly recap: FIFA launches its NFT marketplace on Algorand

Ethereum activated the Bellatrix upgrade, Cardano announced the date of the Vasil hardfork, while the U.S. company is set to launch a stablecoin on Ripple XRP Ledger. Read the Weekly recap to learn more about the main crypto events that happened between 01st and 08th September 2022.

Crypto market in numbers

The crypto market capitalisation stood at about $975 billion for most of the week. There were also two unsuccessful attempts to reach $1 trillion, as well as a fall to $934 billion, after which the market managed to recover.

Weekly trading volumes fell to $439 billion, down 11% from the previous week. The daily average fell to $63 billion over the week. The largest recovery was observed on 7th September 2022, during the market downturn.

The Cryptocurrency Fear & Greed Index remained in the “Extreme Fear” zone for the third week in a row. On 08th September, it stood at 20 points.

Bitcoin continued to lose its dominance. Its market share plunged to a new four-year low of 37.7%. The market share of ether, on the contrary, managed to hold at above 20%. However, for a little over a year, the figure has not risen above 22%. Perhaps, the upcoming Ethereum Merge will change the situation. Over the past 12 weeks, though, ETH grew by 58% against BTC and continues to grow.

Bitcoin’s volatility remained relatively moderate. The 30-day volatility index stood at 2.76% on 8th September. The same level was observed for the last two weeks.

Gainers of the week (1st – 8th September 2022)

| Coin | Opening price 01.09, $ | Opening price 08.09, $ | Change |

| ROOBEE | 0.00067 | 0.00079 | 18.7% |

| TON | 1.64 | 1.87 | 13.9% |

| EOS | 1.54 | 1.66 | 8.0% |

| LINK | 6.63 | 7.08 | 6.8% |

| ETC | 36.24 | 37.26 | 2.8% |

Losers of the week (1st – 8th September 2022)

| Coin | Opening price 01.09, $ | Opening price 08.09, $ | Change |

| GNY | 0.015 | 0.012 | -22.3% |

| VLX | 0.046 | 0.036 | -22.1% |

| CHZ | 0.24 | 0.19 | -20.5% |

| SMART | 0.00059 | 0.00049 | -16.5% |

| CRON | 0.20 | 0.17 | -16.2% |

Easily track gainers and losers within the Simple trade section on EXMO. Check real-time updates in the last 24 hours, week and month.

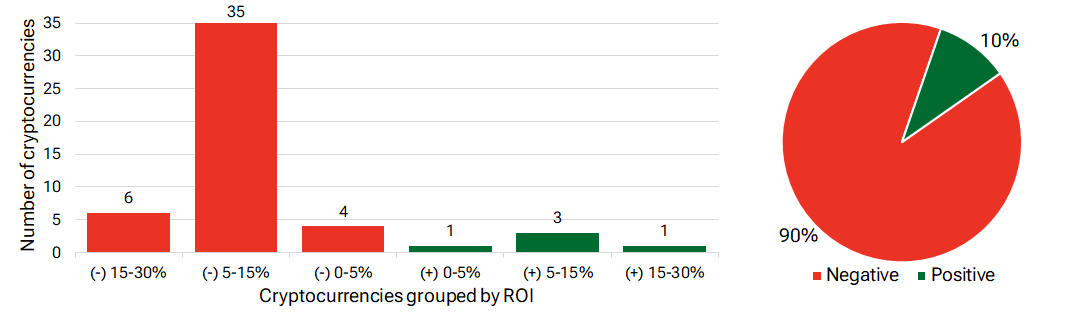

Segmentation of cryptocurrencies based on trading results

(1st – 8th September 2022)

Most traded coins (1st – 7th September 2022)

| Coin | Trading volumes, $ |

| BTC | 7,436,310 |

| ETH | 5,051,223 |

| ETC | 1,100,392 |

| TON | 841,768 |

| ROOBEE | 584,518 |

| XRP | 469,090 |

| DEBT | 412,731 |

| LTC | 287,171 |

| GMT | 231,565 |

| WAVES | 212,454 |

Top crypto market driving factors

Overall crypto market

▼ 01.09.2022 – Bank of America: crypto investors are switching to stablecoins, a type of cryptocurrency whose value is pegged to another asset like the U.S. dollar or gold, and out of more volatile assets because of uncertainty about the sustainability of the “bear market bounce” and the potential for a hard recession in the U.S.

▼ 04.09.2022 – The US Federal Reserve: with the enormous growth of the cryptocurrency industry, the DeFi ecosystem can possibly pose long-term financial stability risks.

▲ 05.09.2022 – Republican congressman Brad Sherman: there is just too much money and power behind crypto to ban it.

▼ 05.09.2022 – The Block Research: the adjusted transaction volume of stablecoins increased by about 33% in August, soaring to a new all-time high of over $866 billion.

▼ 05.09.2022 – CoinShares: between 29th August and 2nd September, digital asset investment products saw minor inflows totaling $9.2 million although the predominant inflow was observed for short investment products. In a similar fashion to the previous week, weekly trading volumes stood at a multi-year low, totaling only $915 million.

▲ 05.09.2022 – CoinShares: multi-asset products continued to see inflows totaling $3.3 million, while altcoins saw minor inflows totaling $0.5 million.

▼ 05.09.2022 – The Sydney Morning Herald: Netflix has decided to reject all advertising campaigns related to cryptocurrency on its new subscription tier.

▲▼ 06.09.2022 – IMF: Crypto assets are no longer niche, and regulators need to keep pace.

▲ 06.09.2022 – Financial Times: Singapore’s largest bank, DBS, plans to grow its cryptocurrency and digital assets business despite the crypto bear market.

▲▼ 07.09.2022 – KPMG: venture capital firms poured $14.2 billion into crypto across 725 deals in the first half of 2022, but investments will likely slow for the remainder of the year. The figures highlight the growing maturity of the market, despite global and ecosystem problems.

Bitcoin (BTC)

▲ 05.09.2022 – MicroStrategy conducts some Research and Development (R&D) projects relating to Lightning Network, the layer-2 solution for Bitcoin. The team is working on the enterprise Lightning wallet, servers and authentication.

▼ 05.09.2022 – CoinShares: between 29th August and 2nd September, Bitcoin recorded outflows totaling $11 million, representing the fourth consecutive week of outflows. Short-bitcoin investment products saw inflows of $18 million, bringing total AuM to a record $158 million.

▼ 05.09.2022 – Glassnode: Bitcoin’s price stability above the June low of $17,600 has fallen on the shoulders of speculators who could face another wave of capitulation.

Ethereum (ETH)

▲ 02.09.2022 – The Block Research: for the first time, the volume of Ethereum futures was larger than that of Bitcoin futures.

▲ 06.09.2022 – The Bellatrix hardfork, the last major upgrade before Ethereum’s move to Proof-of-Stake, was successfully activated.

▲ 07.09.2022 – Swiss-regulated cryptocurrency company, SEBA Bank, launched Ethereum staking for institutional investors.

▼ 07.09.2022 – Whale Alert: ETH whales are moving their holdings to crypto exchanges.

▲ 08.09.2022 – Chainalysis: following the upcoming shift to PoS, Ethereum will attract more institutional investors since it will introduce them to staking yields, similar to bonds and commodities. Also, the price of Ether could decouple from other crypto assets.

XRP (XRP)

▲ 01.09.2022 – Design consulting service, btrax, partnered with Ripple to build a Web3 design lab centred around the XRP Ledger. The new service is supposed to assist Japanese-based companies in accelerating their Web3 business development.

▲ 02.09.2022 – Web3 payment infrastructure provider, Stably, struck a partnership with Ripple to launch its USD-pegged stablecoin on the XRP Ledger blockchain.

▲ 02.09.2022 – Ripple’s developer arm, RippleX, has changed the design of XRP Ledger’s sidechains to solve problems such as price escalation and transition throughput.

▲ 07.09.2022 – Ripple CBDC adviser, Antony Welfare: Ripple may soon unveil positive developments in its central bank digital currency (CBDC) projects.

Cardano (ADA)

▲ 01.09.2022 – Cardano developer, Input Output (IOHK), released a new test version of the Daedalus wallet as part of the final milestone towards implementing the Vasil upgrade.

▲ 02.09.2022 – IOHK announced that the highly anticipated Vasil upgrade will take place on 22 September 2022.

Tron (TRX)

▲ 02.09.2022 – TronScan: the total transfer value on the Tron network has surpassed $5 trillion.

Ethereum Classic (ETC)

▲ 01.09.2022 – Ethereum Classic’s hashrate reached another all-time high, surpassing 40 terahash per second (TH/s).

▲ 05.09.2022 – The Ethereum Classic’s hashrate reached over 46 terahash per second (TH/s).

Chainlink (LINK)

▲ 02.09.2022 – Testlabs, the world’s most experienced private independent gaming certification lab, announced that Chainlink VRF, the industry-leading oracle network and blockchain standard for verifiable randomness in Web3 gaming and NFTs, has acquired the first GLI-19 compliance certification.

Algorand (ALGO)

▲ 02.09.2022 – Soccer’s governing body, FIFA, will launch an NFT platform for soccer-themed digital collectibles on the Algorand blockchain ahead of the 2022 Qatar World Cup.

▲ 07.09.2022 – Algorand developers have reported the last upgrade brought a 5-fold increase in blockchain performance to 6,000 transactions per second, as well as new tools to streamline development and introduce on-chain randomness capabilities for dApps.

That’s all for this week! Follow EXMO on YouTube, Twitter and Telegram to stay tuned to the main events and trends in the crypto market.